September 18, 2019

Article

Another way to build wealth in your own name is through the use of certain tax free investments. The most well known of these are ISAs.

Whilst cash ISAs have become less interesting in recent years due to low interest rates, stocks and shares ISAs could still be a great way to build your wealth, whilst sheltering the income and capital gains arising on those investments from income and capital gains tax (CGT) respectively.

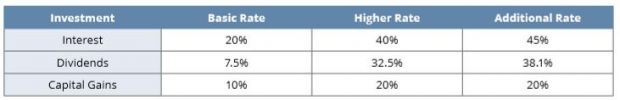

This is particularly valuable if you are a higher rate or addition rate taxpayer due to the rates of tax payable on interest and dividend income, as well as CGT. The tax rates for the different types of income and gains are as follows:

The annual ISA allowance is £20,000. Therefore, if you are investing each year and not currently using your ISA allowance, it would make sense from an income and CGT perspective to invest funds in an ISA to avoid suffering income tax and CGT on the income and gains that the investments produce. Again, this is most valuable if you are a higher or additional rate taxpayer.

As well as not being subject to income tax and CGT, ISA income and gains does not need reporting on a personal tax return.

The use of ISAs might be even more attractive if you are a shareholder in an unquoted (Limited) company, in which case you might be using the dividend allowance and basic rate band as part of the company remuneration strategy. You may even be taking income from your company up to the £100,000 threshold and, therefore any other investment income could actually result in you losing your personal allowance.

If you have any investment income, particularly if you are a higher or additional rate taxpayer, please give me a call to see if you could benefit from using ISAs to reduce the tax paid. Equally, to consider your overall investment return and financial position, please get in touch with our Financial Planning Team to discuss ISAs and other investments.

To read the Prosperity newsletter in full, please click here.