November 05, 2024

News

A new scam is targeting businesses by sending fake letters that request taxpayers "verify" their financial information via email. Scammers frequently impersonate HMRC through calls, texts, emails, and letters to access money or personal data. If successful, this scam could lead to identity theft, allowing criminals to secure loans or withdraw funds from directors’ accounts in the company’s name.

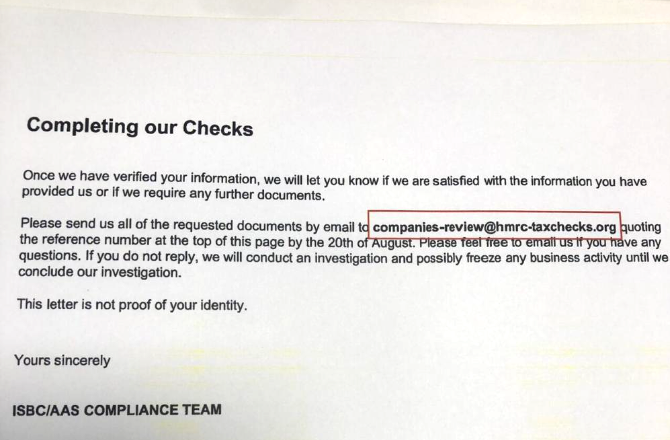

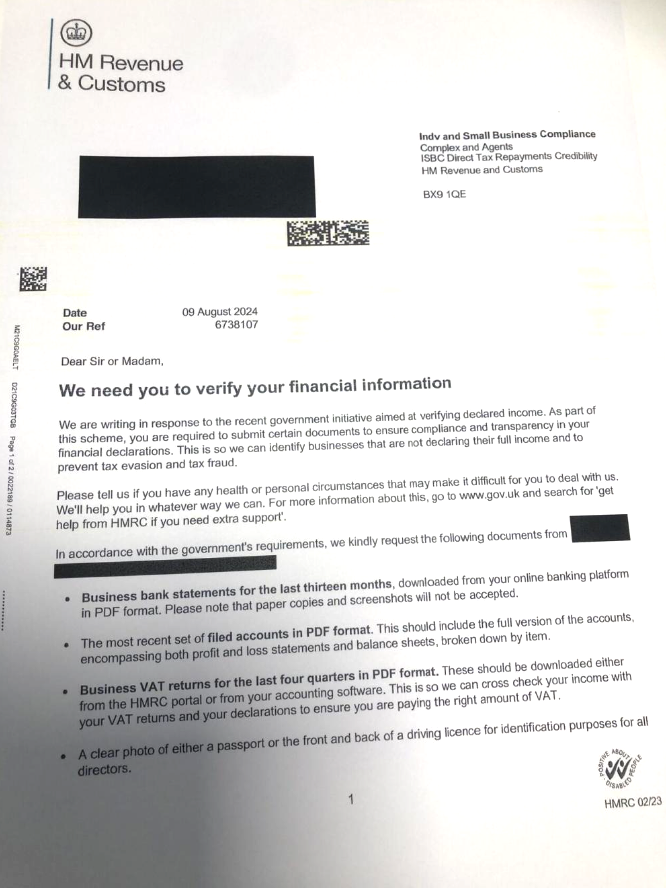

The letter is carefully designed to mimic official HMRC correspondence, using similar fonts, layout, and even a link to the government website. Unlike many scam letters, this one is free of spelling and formatting errors, making it harder to identify as fraudulent.

Key Features of the Scam Letter:

- Shows the postcode BX9 1QE (an HMRC sorting office) at the top of the page.

- Claims to be from HMRC’s "Individuals and Small Business Compliance Team," referencing a "recent government initiative aimed at verifying declared income."

- Requests specific business documents (such as 13 months of bank statements, recent profit and loss statements, balance sheets, and VAT returns) be emailed in PDF format to hmrc-taxchecks.org and include a reference number from the letter.

- Asks for a copy of directors’ IDs (passport or driver’s license) for "identification purposes."

- Warns that failure to respond may lead to a business freeze and investigation.

The scam’s biggest indicators are the fake email address [email protected] and an incorrect tax reference.

Official HMRC Guidance on Handling Tax Scams:

An HMRC spokesperson warns: “Scams may promise a rebate, warn of outdated tax details, or threaten arrest for unpaid taxes. Never rush if contacted with urgent demands for payment or information. HMRC will not threaten arrest. Unexpected requests should raise red flags—verify details on gov.uk for scams advice.”

How to Handle Suspected Scam Communications:

- Visit the official government website to see if the communication matches recent HMRC notifications or reported scams.

- Avoid clicking on any links in emails or messages.

- Independently look up and verify contact information (postal address, email, phone number).

- Report scam letters posing as HMRC to the tax compliance team. For other fraudulent mail, send it to Freepost Royal Mail Customer Services or use the online reporting form.

If you’ve lost money to a scam, contact your bank immediately using the number on the back of your card.