March 31, 2023

Article

Since 1 April 2015 this has been an easy question to answer. From this date, differential rates depending on the level of a company’s taxable profits disappeared for most companies. Life was simple and the rate was 19%.

It has been well publicised that the rate is increasing to 25% from 1 April 2023 but there are a number of added complications which will result in many companies paying a different rate, at least until 2024. These arise from:

- Different rates for companies with taxable profits of less than £250K

- Blended rates for companies that have something other than a March year end

- Special rules for the splitting of tax bands for companies that are associated with other companies

The first two of these are straightforward mathematical exercises, but the third is more complicated and requires an element of judgement.

Small company and marginal rates

Despite the announced rise in the rate of corporation tax, a standalone company with taxable profits below £50K will continue to pay tax at 19%.

For those with profits in excess of £250K, the full amount will be subject to tax at the new rate of 25%.

The complication arises for those companies with profits above £50K but below £250K. Marginal relief will apply to profits within this range to smooth the transition between the 19% and 25% rates. The tax due is calculated by applying a complex formula and despite the ‘smoothing’ it has the effect of increasing the tax due on profits within this range to 26.5%.

For a single company with a March 2024 year end and profits of £100K, assuming it receives no dividend income from non-group members, its tax charge for the year will be £22,750 (£50K at 19%, plus the balance of £50K at 26.5%).

The full 25% rate will also apply to all profits made by a “Close Investment Holding Company” and those not resident in the UK, irrespective of the level of profits earned. A company is deemed to be a Close Investment Holding Company unless it either carries on a trade on a commercial basis or invests in property for the purposes of letting to unconnected third parties. The most obvious example is a company whose only activity is the making of stock market investments.

Blended rates for non-March year ends

Corporation tax rates apply for fiscal years which run from 1 April to 31 March. If a company’s accounting year falls into two fiscal years then its profits are time apportioned between the two (there is no need to try and calculate the actual profit arising in each period).

HMRC have released an online tool to help companies calculate their expected tax liability, including any marginal relief that may be due.

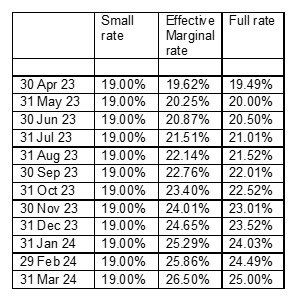

The rates applying for standalone companies with year ends between 30 April 2023 and 31 March 2024 are:

Care needs to be taken where an accounting period is less than 12 months. The limits and effective rates will need to be adjusted accordingly.

Associated companies

The biggest complication is for companies that are associated with other companies. In these cases, it becomes necessary to split the limits based on the number of companies involved. If there are two active companies (including the company in question) divide each limit by two, if there are three divides by three, and so on.

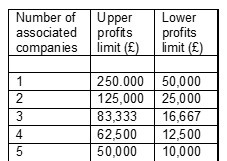

In a simple example of two affected companies (a parent and a wholly owned subsidiary) with a March 2024 year end, the small (19%) limit applies up to profits of £25K (£50K/2), the main (25%) rate from profits of £125K (£250K/2) and the marginal (26.5%) rate in between.

The table below shows how the upper and lower limits change where there are up to five associated companies:

What is an associated company?

It can be difficult to decide if two companies are associated. If one company has control of the other, or if both are under “common control” then they will be associated. The count includes worldwide companies but excludes dormant and "passive" entities. A company is associated if it meets the definition at any time in an accounting period.

For group companies this should be straightforward to determine. The difficulty comes when determining whether two companies are under common control.

Common control is determined by:

- Share ownership;

- Shareholder voting power;

- Rights to distributable income: or

- Entitlement to assets on a winding up (excluding trading balances).

So, if one person owns 100% of the share capital in each of two companies those companies will be associated whether they have any other relationship between them or not.

In some cases, it is necessary to aggregate the shares (or other rights) held by individuals and their associates. This should only be considered where there is “Substantial Commercial Interdependence” between the two companies which may be:

- Financial e.g., loans

- Economic e.g., same economic objective, one’s activities benefit the other's, common customers

- Organisational e.g., common management/employees/premises/equipment

This is where judgement comes in. Unhelpfully, “Substantial” is not defined but will require an assessment of each set of circumstances with the onus on each company to determine its own position. Our view is that such an assessment will take into account the number of factors involved and for how long within an accounting period they are in place. In some cases, a number of smaller factors may aggregate to make companies associated whereas in others one substantial factor may be relevant.

If it is established that such interdependence exists the next step is to aggregate the interests of the associated persons and for this purpose, an associate includes:

- Spouses

- Civil partners

- Business partners

- Blood relatives (parent, child, sibling)

- Trustees of a settlement created by the individual or a relative of theirs.

As an example, suppose that two spouses each own 100% of their respective companies. If the two companies share the same employees, customers, and business premises there is substantial commercial interdependence and the spouses’ interests will be aggregated. The two companies will therefore be associated. If the same two companies were entirely unconnected in their activities there would be no aggregation of interests and they would not be associated.

Planning opportunities

Companies may wish to plan and consider reducing profits below the marginal rate limit where this is likely to apply. For example, this could be achieved through employer pension contributions or by bringing forward the purchase of plant and machinery.

Where different companies have been set up over the years to house different divisions or trades, thought should be given as to whether this is still a commercial need. It may be possible for the activities of different entities be transferred into one, to reduce the number of companies in operation. Where this is not possible, consideration should be given to the matching of profits between the associated companies to ensure one does not end up taxable at the marginal rate.

If the company is a member of a group, a review should be given to the use of any group losses. These would normally be used in priority by those companies with profits falling between the lower and upper limits, to ensure the tax cost to the group is mitigated as far as possible.

Companies should start identifying the number of associated companies now. They can then plan for any impact this may have on the corporation tax that will be payable, with cash flow forecasts and budgets updated accordingly.