February 06, 2025

Article

On 30 October Rachel Reeves announced proposals that will impact family businesses across the country, particularly those businesses intended to be handed down to the next generation to run.

Currently, trading businesses can qualify for up to 100% relief from inheritance tax (IHT) with business property relief (BPR). Further, property occupied for the purposes of agriculture can qualify for up to 100% agricultural property relief (APR). This means most businesses can be handed to the next generation to run, largely without a tax liability. This enables the business to continue in the hands of the next generation, without the need to sell assets, and provides certainty and confidence and therefore the ability to continue to invest in that business for long term growth. Without the reliefs, IHT would be payable on death at 40% on the value of assets in the deceased’s estate.

The measures announced in Rachel Reeves’ Budget mean that from April 2026 the reliefs will be subject to a combined cap of £1M for 100% relief per estate. Value over £1M will only benefit from 50% relief - effectively a 20% tax charge on business and agricultural property values in excess of £1M.

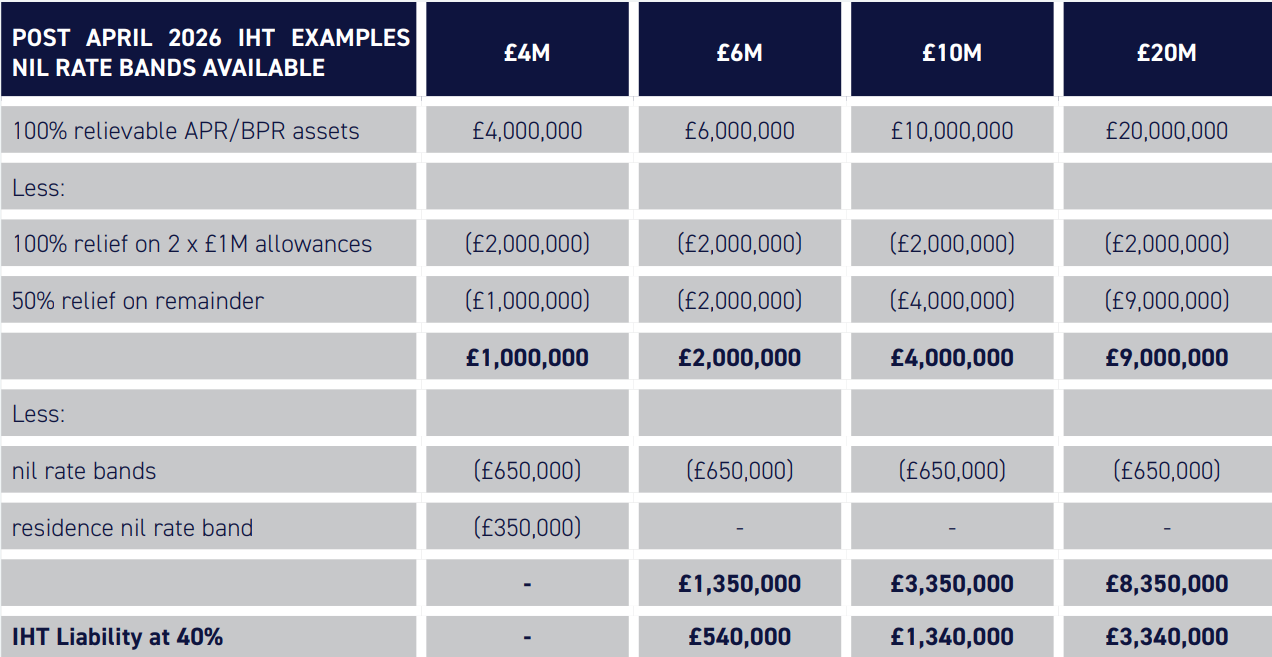

The Chancellor claimed that the £1M allowance would protect a small farm or business. There has been much commentary in the press about what this means. As an example, if we assume a husband and wife own the business, and business assets, jointly, have no other assets outside the business and have tax efficient wills in place, the potential value chargeable to IHT based on the value of the business could be as outlined below:

This suggests a small business on this basis could be worth up to £4M. However, clearly in real life, most businesses will not fit within the above scenarios exactly. Therefore it is important that all business owners consider the potential impact of the proposed measures.

Consider the impact

Over the next few months it is important that all business owners consider the potential impact of the proposed measures and whether the tax is affordable.

As assets qualifying for APR and BPR tend to be illiquid, there is much concern over how the IHT would be funded without a sale of the business or assets used in the business.

There is the option to fund the IHT in instalments over ten years with the first instalment due 6 months after death. Interest is generally charged over the ten-year period, with the interest rate increasing from 6 April 2025 to 8.75% (assuming no Bank of England base rate changes before then).

However, where the IHT relates to certain assets qualifying for APR and BPR, if the instalments are paid on time no interest would be charged. This does not include non-agricultural assets used in the business but held outside the business. Therefore, it is important to consider whether the descendants can meet the deadline for each ten-year instalment and that the ownership and structure of the assets and business can result in no interest charges.

To enable the instalments to be funded on time, without an interest charge, there would need to be sufficient profits generated in the business over the ten-year period. If this is not possible then alternative planning will need to be considered.

How can the IHT be funded?

If the potential IHT cannot be funded over the ten-year period, alternative planning should be considered which might include:

- Borrowing from the bank over a longer term but with interest chargeable over that term.

- Funding life insurace which will pay out a sum on death to help fund the IHT.

- The potential sale of assets if they are not needed for the future of the business.

- Starting the succession plan early through passing assets on to the next generation in lifetime.

Starting the succession plan earlier

It remains the case that often gifts of business and agricultural assets can be made in lifetime without any capital gains tax (CGT) or IHT payable. Holdover relief remains available for most trading and agricultural assets to defer CGT on a gift to the recipient of the gifted asset – so they pay the CGT if and when they dispose of it in the future. The asset will also be outside the estate of the person giving it away if they survive seven years from the date of gift and they do not reserve a benefit in the asset, or continue to receive an income from the asset.

The latter point is important – if the person giving away the asset reserves a benefit in it, such as remaining in occupation of a house which they had gifted or by continuing to receive an income from the asset gifted, then those assets would remain chargeable in their estates, even if they survive seven years. Therefore, careful consideration needs to be given to whether there is sufficient income to continue to fund the living requirements from the assets retained after the gift.

Based on the above, business owners need to consider whether they can afford to start the succession plan earlier and, assuming the next generation are ready to receive the assets and take part in running the business, the CGT and IHT planning should be considered.

It should be noted that any gifts made from budget day (30 October 2024) will be subject to anti-forestalling rules such that, if death occurs within seven years of the gift, and after April 2026, the value of the gift comes back into charge under the terms of the proposed new measures. As such, the gift will be subject to the same £1M allowance of the donor. Therefore, it is advisable to consider whether life insurance for the seven year period is affordable to cover such possible eventualities.

Key assets to prioritise for gifting

Where gifting is affordable, there are certain assets which should be considered for gifting earlier rather than later, these include:

1. Assets expected to increase in value

If there are assets expected to increase in value, such as a barn which could obtain planning for conversion, potential development land or land with an option for lease for solar, if the income and capital value is not required from these assets, considering gifting them sooner rather than later is advisable. This is because, whilst the assets are used in a trading or agricultural business, CGT holdover relief should be available. Once that use has changed, holdover relief may no longer be available. Further, if the assets are gifted and death occurs in seven years, it is the value at the date of gift which comes back into charge, not the value at the date of death, which may be significantly higher.

2. Furnished holiday lets

Please see Kate Hardy’s article regarding the abolition of the furnished holiday let (FHL) rules from April 2025. Currently, FHL’s qualify for CGT holdover relief. Once the rules have been abolished they no longer will, therefore there is a window of opportunity before April 2025 to make gifts of FHL if the income and capital is not required in the future.

Trusts

Trusts will also be caught by the new IHT regime from April 2026. Ruth Powell summarises the potential new rules and the planning to consider in her article What the Autumn Budget 2024 means for UK trusts.

Will Planning

The draft proposed measures confirm that the £1M allowance is not transferable between spouses. Therefore, it is important that business owners consider the ownership of the business and business assets as well as their wills and partnership agreements to ensure maximum use is made of the £1M allowance. However, it is important to take advice to ensure that the existing reliefs continue and that where assets are transferred between spouses there is no gap in relief. For example, if all the assets are in one spouse’s name but both spouses are in business together, if half are transferred to the other spouse, that spouse may not qualify for any relief for two years.

Death Bed Planning

It may be the case that there has been a death in the last two years and the estate of the deceased included agricultural or business assets. If those assets passed to the surviving spouse, it may be advisable to consider whether a deed of variation should be done to bank the existing reliefs under the current rules, rather than risk IHT payable under the proposed measures, if death of the surviving spouse occurs after April 2026.

Continued Lobbying

Between now and April 2026, membership organisations will continue to lobby on behalf of business and land owners so that government understand the impact of these measures on family businesses and the economy. As a firm we are doing the same. Please see our report to government Albert-Goodman-RAG-Report-Final.pdf (albertgoodman.co.uk).

Whilst this lobbying continues, and until we have draft legislation, we will not know the true impact of these measures. Therefore, we recommend that each business owner considers their own potential IHT liability, based on the proposals, and how the business might fund the liability as well as the options available to plan for the measures. Once we have draft legislation, families should be in a position to take action over the next year through joined up advice from their accountant, solicitor and land agent.