August 01, 2023

Article

For VAT returns starting on or after 1 January 2023, the old default surcharge penalty system has been replaced. Under the new system, more businesses are likely to incur a penalty or pay interest, particularly for late payments. However, the new system should avoid the circumstance where very large penalties were imposed for minor infringements, for example paying one day late.

A summary of the basics of the new system, with some tips on how to avoid or minimise penalties and interest, is set out below.

Late submission penalties

Late submission penalties work on a points-based system. For each return submitted late a penalty point is issued.

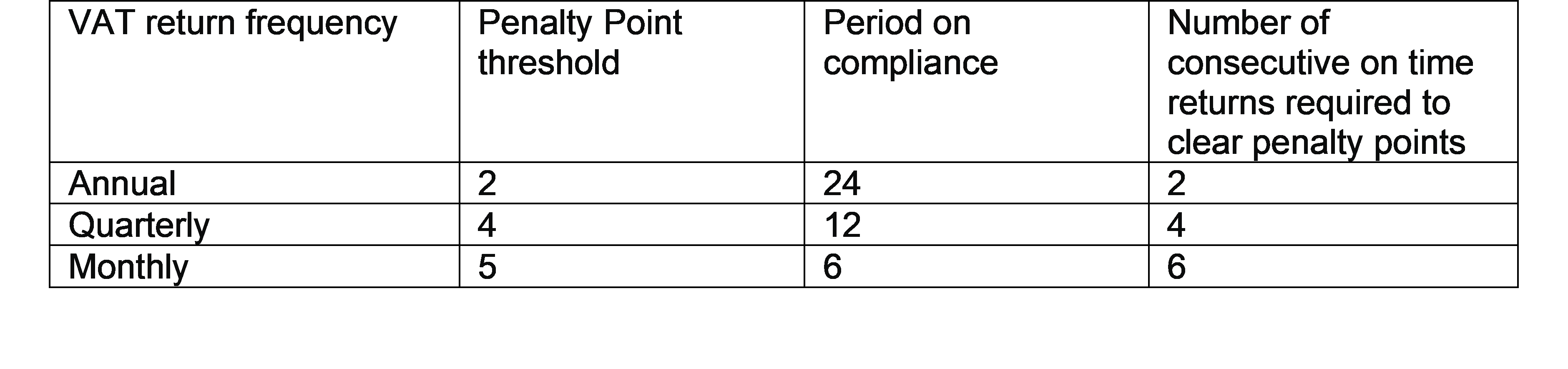

If a penalty point threshold (see table below) is reached a £200 penalty is issued. Once the threshold is reached a £200 penalty will be issued for all subsequent late returns.

A very important change is that points and penalties will apply to nil returns or returns claiming a repayment.

The late submission penalty rules do not apply to first or final VAT returns or one-off-returns that cover a period other than a month, quarter, or year.

Removal of points

If a business does not reach the penalty point threshold penalty points will expire after a certain period of time.

Where the deadline for payment was not the last day of the month a point will expire 24 months after the end of the month in which the late return was due. For example, if a return was due on 7 April 2023 the late submission point will expire on 30 April 2025.

If the due date is the last day of the month the point will expire on the last day of the month 25 months after the due date. For a return due on 30 April 2023 the penalty point will expire on 31 May 2025.

Provided the threshold for a penalty is not reached penalty points will disappear on a rolling basis.

Once the penalty point threshold is reached the only way penalty points can be removed is if:

- All outstanding returns for the previous 24 months have been submitted, and

- All returns are submitted on time for a specified period of compliance. The specified period of compliance varies depending on the VAT return type. The start date for the period of compliance is calculated by adding one day to the return deadline and is the first day of the next month.

For a return due on 7 July the compliance period starts on 1 August and if the due date is 31 March the period of compliance starts on 1 May.

Penalty points will be reset to zero on the first day when conditions are met.

Points can also be appealed. There is a new online process for appealing penalty points. This can be accessed via the business's VAT online account (or an agent’s Agent Services Account). This new process is relatively user-friendly.

The table below summarises the penalty point threshold and period of compliance:

Late Payment Penalties

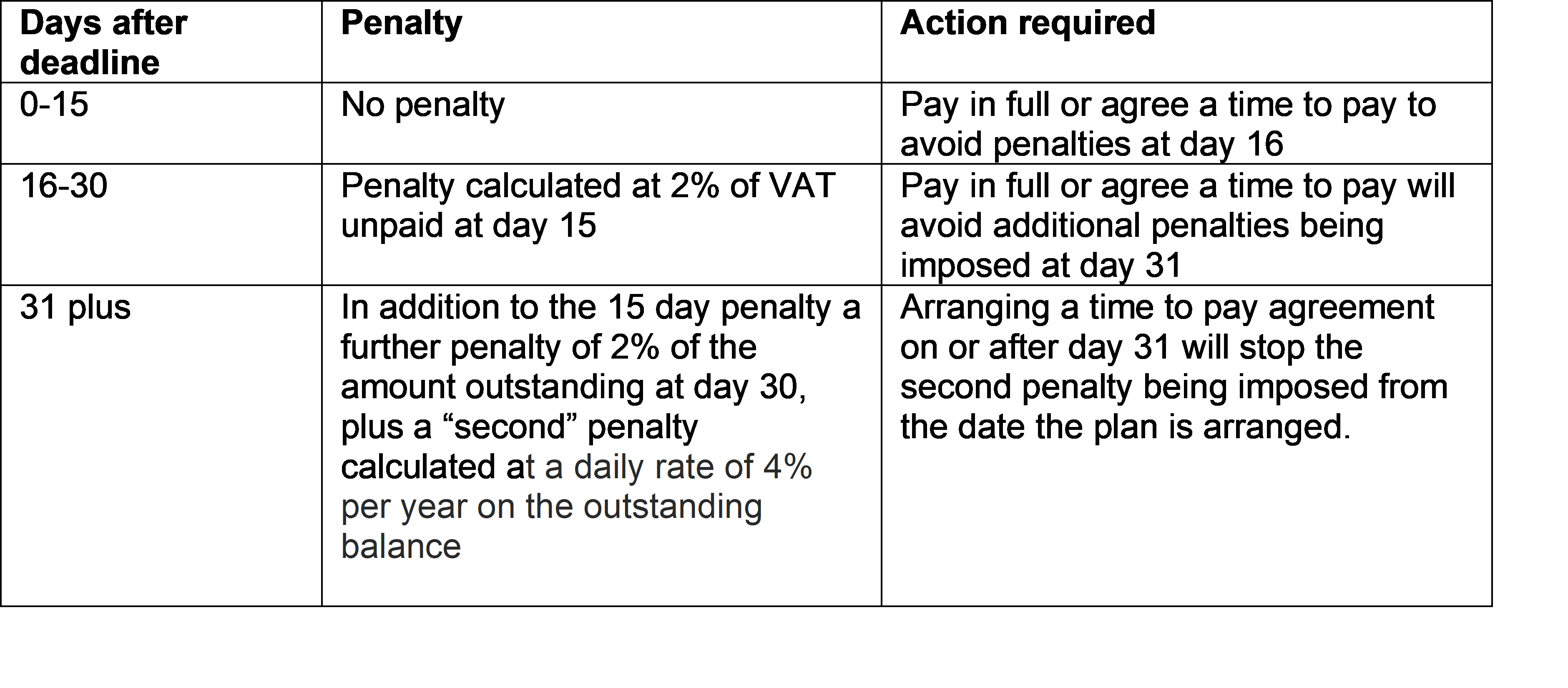

The penalty imposed for late payment will depend on how late the payment is made.

If time to pay agreements are not complied with penalties will be imposed.

Again points can be appealed.

Interest

Late payment interest is charged from the day after the customer's VAT payment is due until the day it is paid in full. It is calculated at the Bank of England base rate plus 2.5%

A time to pay agreement will not stop interest being charged.

Agreeing a time to pay with HMRC

Some businesses can now set up a VAT payment plan online.

VAT-registered businesses can now set up a payment plan online if the business:

- has filed its latest VAT return;

- owes £20,000 or less;

- is within 28 days of the payment deadline;

- does not have any other payment plans or debts with HMRC; and

- plans to pay off its debt within the next six months.

Some businesses are not eligible to use the online service. This includes businesses that use the VAT cash accounting or annual accounting schemes. Businesses that make VAT payments on account also cannot set up a payment plan online.

Businesses not eligible to use the self-serve time to pay service should call the HMRC Payment Support Service on 0300 200 3835 to agree a payment plan.

Ways to avoid or minimise penalties

Where possible submit VAT returns on time, even if payment cannot be made. This should avoid a late submission penalty.

If payment cannot be made by the due date agreeing time to pay with HMRC may reduce or prevent late payment penalties being imposed.

Contacting HMRC as soon as possible to try and agree a time to pay plan may avoid a late payment penalty.

Paying as much of the VAT due as soon as possible will minimise late payment penalties and interest.