May 23, 2019

Article

In recent years HMRC have reduced the amount of interest that is available for relief at an individual’s marginal rate of tax. Holding property personally has therefore become less efficient than in previous years for certain individuals.

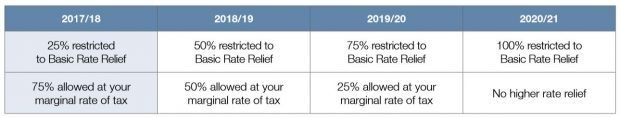

This provision is being phased in and started in the 2017/18 tax year and will be fully in place from the 2020/2021 tax year. With careful, planning it may now be the time to look at a corporate structure to hold residential property to protect assets and provide a tax efficient investment.

Owning a property personally was historically a very good way of investing your money as it had a dual income stream. If invested correctly, the property would create an income source from rent receipts while the property rises in capital value.

With the new initiative, it has been a misconception that you will no longer be able to get relief for the interest element of mortgage payments. Mortgage interest will still attract tax relief but only within the basic rate band of tax meaning that this initiative will only affect those that are higher rate tax payers. As a recap the interest amounts relievable are as follows:

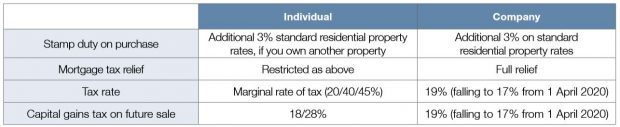

With the restriction it may now be time to look at a corporate structure to help with tax planning for future property holdings. If personal properties are transferred to a limited company, there could be adverse tax effects initially as large capital gains tax and stamp duty taxes could be due.

Currently, in addition to the above restriction of interest deduction, an individual is liable to tax on the rental profit made whether or not they access the money. While a company pays corporation tax on the profits, an individual will not pay tax personally until the funds are extracted.

Comparisons of the main differences are therefore as follows:

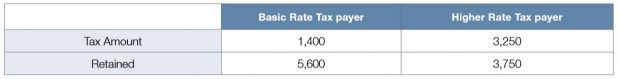

Looking at some numbers is likely to help with this. On the basis that rental income was £10,000 before an interest amount of £3,000, the tax payable would be as follows (based on the 2019/20 tax year):

Held personally

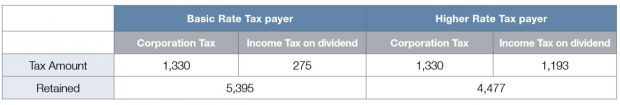

If the property is held within a limited company and the balance after corporation tax is taken as a dividend, the amounts retained would be as follows on the basis that the individual has no other dividend income:

As you can see, if the income is fully extracted this structure could be beneficial for higher rate tax payers. However, if the income is not required personally this can be retained in the company with no further tax consequences until you want to extract it.

ANNUAL TAX ON ENVELOPED DWELLINGS (ATED)

In addition to the income tax amount, corporate entities also have to consider another tax on residential property when it is held in a Limited Company. This is called Annual Tax on Enveloped Dwellings (ATED) which applies to properties valued at over £500,000.

There are certain exemptions from this including if the property is let out to third parties at a commercial rate of rent, but there is still a requirement to submit a return and claim your exemption on an annual basis.

If an exemption does not apply, the charges can be significant depending on the value of the property. This is also an annual charge which means that this structure does not work in all situations.

As you can see there are a number of considerations around the tax charges on holding residential properties. These need to be considered on a case by case basis as this is not a ‘one size fits all solution’.

If you would like to discuss further, please contact us.