May 17, 2022

Article

Certain national insurance contributions (NICs) paid by both employed and self-employed workers will rise by 1.25% from April 2022. The move, announced by Boris Johnson in September 2021 is in a bid to help fund health and social care costs.

What this means to you-

Most UK workers currently pay NICs to fund different parts of the state benefits system – from state pension to health and social care and unemployment benefits. The amount of NICs you pay depends on your salary and type of employment. This increase will apply to class 1 NICs paid by employees and class 4 NICs paid by self-employed workers. It will be administered by HM Revenue & Customs and will be collected via the current channels for NICs – pay-as-you-earn and income tax self-assessment.

Downing Street says this means an employed basic rate taxpayer earning the median basic rate taxpayer’s income of £24,100 per year in 2022/23 would contribute £180 per year, whilst a higher rate taxpayer earning the median higher rate taxpayer’s income of £67,100 per year in 2022/23 would pay £715 per year.

This will be offset with the threshold rises announced in the Budget, but these don’t come into effect until July 2022. For employers, the Budget also gave an increased Employers Allowance, which will help reduce the cost to the employer of the NIC increases.

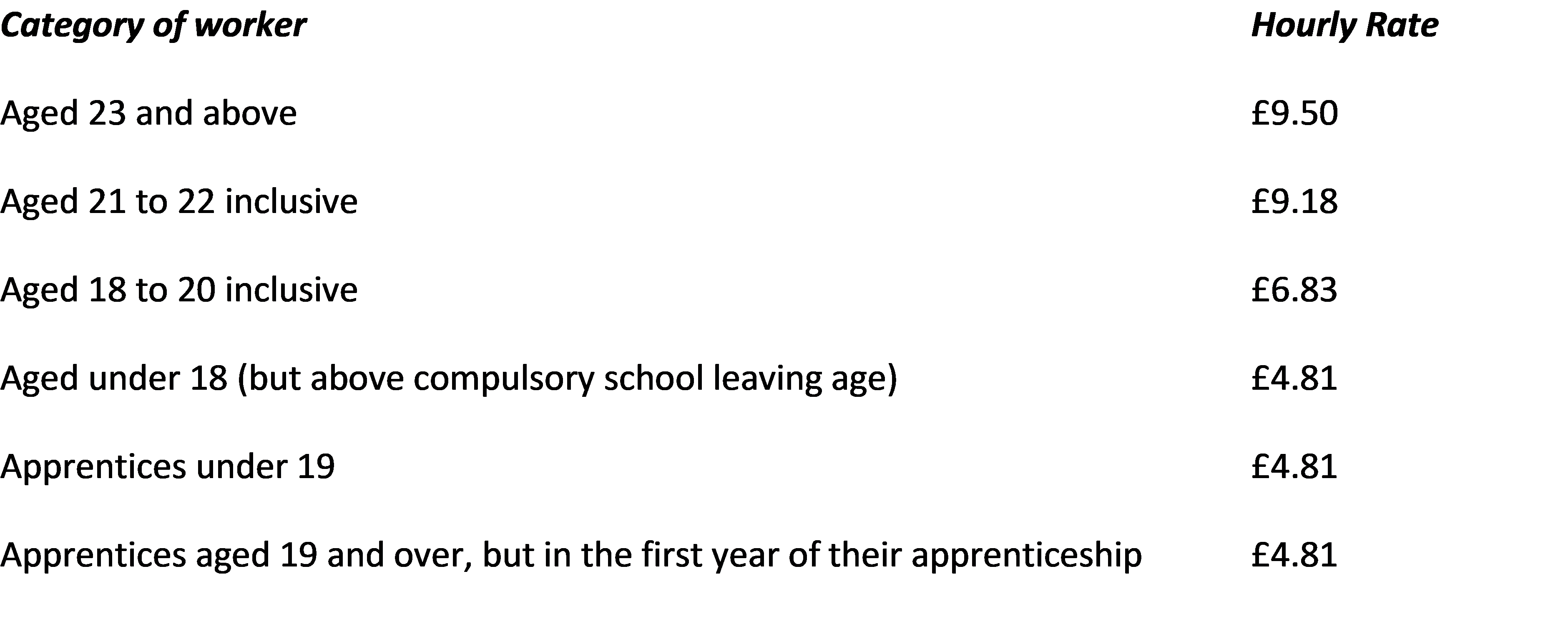

National Minimum Wage increases with effect from April 2022

Following advice from the Low Pay Commission, the government has announced that the National Minimum Wage rates will increase with effect from 1st April 2022. See below for the rates being introduced from April 2022:

What this means to you-

As an Employer, you must ensure that your staff receive the minimum rate applicable to their age group and that any salary sacrifice schemes that you operate do not reduce an employee’s cash earnings below the National Minimum Wage rates.

How Albert Goodman can help you-

Whilst we don’t have a magic wand meaning you don’t have to pay the increased NICs or wage rates, we can help with your Payroll requirements and make sure all these changes are dealt with correctly. We offer a bespoke Payroll Outsourcing service; our dedicated Payroll Team looks after over 700 clients taking the stress of legislative compliance away from Employers meaning you can get on with what you do best – running your business.

If you are interested in receiving a no-obligation quote for our services, tailored to the specific needs of your business get in touch with us today at payrollteam@albertgoodman.co.uk