April 25, 2024

Article

The latest income tax changes in respect to the change in basis periods could significantly impact cashflow for those who did not have a 31 March or 5 April year-end.

Please note, these changes do not affect sole traders or partnerships that already have a 31st March/5th April year-end or if you trade through a limited company.

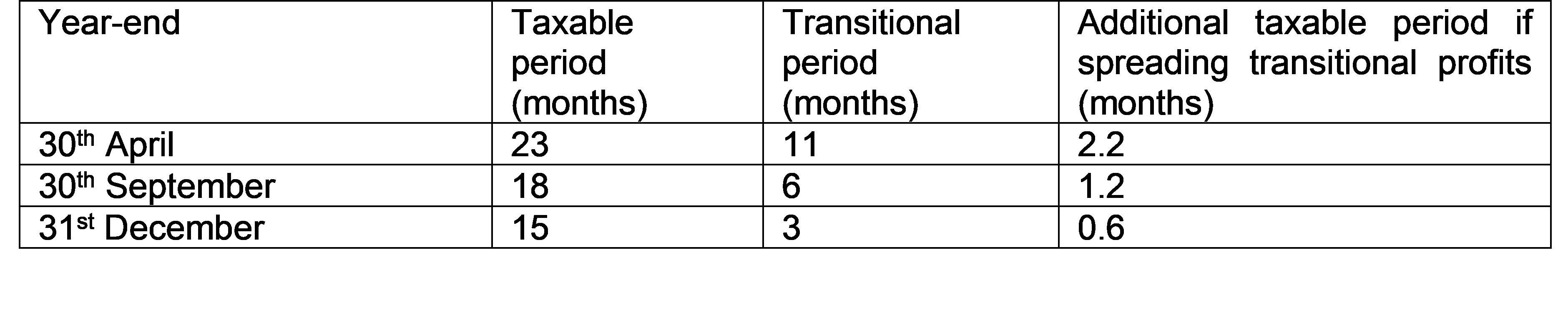

Whether or not you have decided to change your year-end, individuals will still be taxed to 31 March/5 April, providing a longer taxable period as shown below.

Also shown here is the ‘Transitional period’, being the additional period to bring you in line with 31 March/5 April. While the transitional profits are excluded when considering farmers averaging, these trading profits can be spread out over five years to help reduce the tax impact.

It is easy to see here that the increased period being taxed this year could result in a spike in your 31st January 2025 tax payment.

When planning for these basis periods changes, some of the things that should therefore be considered are:

- Overlap profits – these being the profits that were taxed twice when you joined the partnership

- Future profits and whether you expect them to increase or decrease

- Whether you consider trading for more than 5 years

- Opting to suffer the tax on all the transitional profits up front as it may be taxed at a lower rate

- Future cash flow and whether cash is available now.

The key starting point is to understand your individual tax position and then plan your cashflow. You can aid this by:

- Saving early to build your tax reserves.

- Consider new schemes, such as SFI, that provide quarterly payments to support cashflow.

- Forecast your performance, increasing cash through trading.

- Plan capital investments for the next 5 years.

- Speak to HMRC to discuss payment plans.

Please do contact us if you would like to discuss this in more detail.