April 25, 2024

Article

One quick and simple question that clients ask is “Should I incorporate?”. As always with questions such as this, the simple answer is “it depends”. For many clients the main driver for asking the question is the level of tax that they have to pay on an annual basis. Will this “annual tax” be less or more if the business was operated through a limited company?

Tax for the Sole Trader

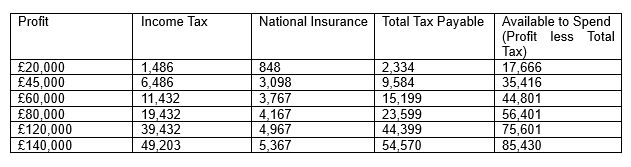

The Sole Trader pays two types of tax on their trading profits. Income Tax and National Insurance. The amount of Income Tax and National Insurance that is paid at different levels of profit is shown in Table 1. Please note, the figures in the table don’t take into account whether the individual has any children or whether they have to make any student loan repayments.

Table 1: Income Tax and National Insurance paid by a Sole Trader at different levels of profit.

What Rates of Tax does a Limited Company pay?

Limited companies pay corporation tax. The rates that apply depend on the level of profit being generated. For example, if a company generates profit of less than £50,000, then the rate of corporation tax is 19% whereas profits generated in excess of £250,000, are taxed at 25%. Confusingly, profits generated between £50,000 and £250,000 are taxed at 26.5%.

The immediate reaction of many clients is to say, “Surely the answer is obvious – I need to be a limited company? ”However, it costs money to take money out of a limited company. That “cost” is personal taxation – and this tax is of course in addition to the corporation tax that the company is paying.

As such, before any decision is made to incorporate, we need to consider how much of the “post-corporation tax profit” is going to be extracted from the company.

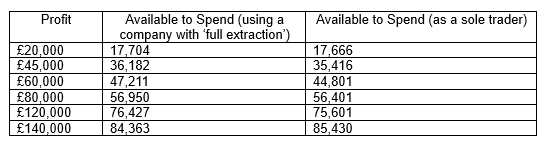

If we assume all of the profit is to be extracted – perhaps to fund an extravagant lifestyle, then a combination of personal tax and corporation tax will have to be paid. Assuming the owner shareholder takes a small salary and pays the remaining available profits as dividends, then the total taxpaid and funds available are as shown in Table 2 below. The amounts shown in Table 2 are shown alongside the amounts available to the sole trader from Table 1.

Table 2: A comparison of the after-tax amounts available to a sole trader and a company shareholder using full extraction

As can be seen above, any benefit from incorporating - where all monies are extracted - is negligible at best. Of course, this assumes that all profits are being extracted. If profits are instead retained in the company – perhaps to invest in working capital or to pay down debt – this would mean savings over and above those highlighted above.

Of course, with any business decision there are many different factors in play, as highlighted in Sarah Cleaves’ article – so, when your accountant answers “it depends” be patient... they are thinking!