November 27, 2020

Article

Ok, so I needed something to draw you in, but now I’ve got your attention I’ll explain just how cheap a fully electric car can be as a company car, due to the very generous allowances afforded to them whilst they’re in favour with the Chancellor.

The Employee

When an employer company, or business provides an employee/director with a company car, the employee will be taxed on the benefit in kind (BIK) value of that vehicle. The BIK is calculated taking a multiplier based on CO2 emissions and multiplying this by the list price of the vehicle including options to give the BIK value. This is the amount that the employee/director will be taxed on.

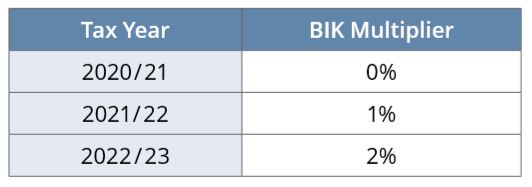

Electric vehicles have zero CO2 emissions (officially at least) and the BIK multiplier is as follows;

As you can see, the multiplier for the current tax year is 0% and therefore even if you did purchase the new £140K Porsche Taycan Turbo S and provide this to an employee, or yourself as a director of your business, you would not pay any income tax on the benefit in 2020/21. There would then be small BIK for the following tax years.

Obviously we are currently facing very difficult times, so buying £140K cars isn’t going to appeal to many, but it is just an extreme example of how the advantages of providing an electric car can be very tax efficient.

Maybe it is something to consider for your next change of company car with Teslas starting from roughly £40K which is not too far away from the former company car favourite; the BMW 320d. There are also much cheaper electric cars available so this is something that can benefit many.

The Employer

Employers pay Class 1A national insurance at 13.8% on the BIK of employees so electric cars can help to reduce Class 1A bills for company cars significantly due to the lower BIKs.

In addition, for any electric cars purchased up to 31 March 2021, the cost of the car is 100% allowable for a first year allowance, generating corporation tax relief on the entire cost of the car in year one. The same goes for the cost of installing vehicle charging points at places of work, up to 31 March 2023.

If this is something that you are considering for your next company car or for providing your employees with new cars, then please get in touch to discuss the practicalities