December 05, 2024

Article

Capital gains tax (CGT) is the tax due on the increase in value of an asset on the disposal of that asset. Most commonly this is on the sale of an asset, however gifting an asset to another person, company or trust would also constitute a disposal for CGT purposes.

CGT is due on the gain made on an asset. The gain is calculated by deducting the base cost from the proceeds or market value of the asset at the date of the disposal. Individuals have an annual exempt amount of £3,000 which can be deducted from the gain to reduce the amount liable to CGT.

The rate at which CGT is payable depends on the asset being disposed, the income levels of the individual making the disposal and, following the recent Labour budget, the date of the disposal. Depending on the amount of basic rate band available after calculating the individual’s income tax liability, part of the gain will be taxed at a lower rate and any remaining gain thereafter will be taxed at a higher rate.

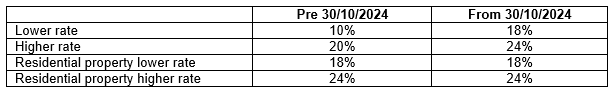

The CGT rates for the current tax year (2024/25) prior to the budget on 30 October 2024 and following the budget are summarised in the table below:

As the table shows, it was announced in the recent Labour budget that the standard lower and higher rates of CGT have been increased to align with the residential property rates. This means the disposal of assets such as shares or land are now taxable at these increased rates. It is also worth noting that the CGT rate for carried interest is increasing from April 2025. This was previously taxed in line with the residential property rates but will increase to 32%.

Another announcement to come from the Labour budget was that the rate of CGT where business asset disposal relief (BADR) is being claimed will increase. BADR is available where there has been a material disposal of a business asset, such as shares in a personal trading company. Historically, where BADR has been claimed, the whole gain would be taxed at the lower rate of 10% up to the utilisation of the lifetime limit of £1million. From 6 April 2025, the rate of BADR will increase to 14%, with a further increase to 18% from 6 April 2026.

The CGT rates for residential property have not changed following the budget, however there have been updates to the stamp duty land tax (SDLT) rules. The 3% SDLT surcharge for owners of multiple residential properties has increased to 5% with effect from 31 October 2024.

The point at which buyers of residential properties start paying SDLT is also changing. Previously the first £250k of a residential property was not liable to SDLT and between £250k and £925k SDLT is due at a rate of 5%. A new band will come into force from 1 April 2025 whereby SDLT will be due at a rate of 2% between £125k to £250k.

These recent changes may have an impact on how people choose to invest in their assets going forwards. If you would like to discuss how the recent changes could impact you, please get in touch with your usual point of contact.