May 22, 2019

Article

A FOLLOW UP ON POINTS COVERED AT OUR RECENT CONSTRUCTION INDUSTRY BREAKFASTS

In February and March, we ran seminars focusing on one of our specialist sectors, construction.

In Yeovil, this was in conjunction with South Somerset District Council and their Chief Executive, Alex Parmley discussed development plans in the council and explained some opportunities to work alongside the council and their plans to support construction businesses. He also answered questions from locals and outlined the current changes to the council’s organisational structure.

In Taunton, we were joined by special guest Rebecca Pow, local MP for Taunton Deane. She discussed development plans in Taunton, whilst some of our own experts covered a few key topics relating to changes and opportunities relevant to those within the construction industry.

A summary of some key topics are outlined below:

VAT CHANGES FOR CONSTRUCTION SERVICES

HMRC have announced changes to the way VAT is accounted for, on supplies of construction services, which is due to take effect from 1 October 2019. The rules impact on contractors and subcontractors in the construction industry scheme.

This is a significant change in the industry and will move the VAT responsibility away from the supplier of the service and give it to the recipient of the service. This means the recipient will have to account for the VAT on the qualifying transactions by declaring the output tax on the supply at the appropriate rate and claiming the input tax subject to the usual rules (the reverse charge method).

HMRC have described the reason for this as an attempt to reduce the “missing trader fraud” where a supplier charges VAT on supplies but never pays this over to HMRC.

For more details about this change, contact Andy Branson, VAT Director - andy.branson@albertgoodman.co.uk

RESEARCH & DEVELOPMENT (R&D) TAX CREDITS:

Ensuring tax relief opportunities are utilised where possible

In the 2016/17 tax year, R&D claims made by the construction industry sector made up just under 3.5% of all R&D claims. Meanwhile, over 50% of the total claims made were from the IT and manufacturing sectors.

Given the nature of the industry, many would expect the R&D relief for construction industry companies to be much higher. Kelly Di Notaro, Tax Manager, gave a presentation and explained the R&D position in much more detail and following discussions after the breakfast, many felt that their companies were missing out on this valuable relief.

For example, if your company worked on a project where you did something different to the ordinary and sought to advance science or technology by solving a problem in a new way and you were not sure this was going to work, then the company may be able to claim the relief.

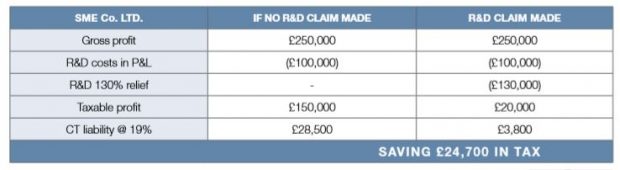

The rate of tax relief depends on the size of a company. For small or medium sized entities (SME’s), the tax relief works by taking 130% of the qualifying R&D costs and allowing this as an additional deduction against company profits, meaning a lower profit is used for calculating the corporation tax liability.

The numerical example below demonstrates how the SME relief works:

To find out more or if you think you may be able to benefit from the relief, please get in contact with our Tax Manager, Kelly Di Notaro.

In addition to the R&D presentation, Michael Evans, our Payroll Manager summarised the relevant 2019/20 employee and employer tax rates and allowances and Joseph Doggrell, Partner and construction specialist, ran through some information on HMRC’s implementation of Making Tax Digital.

If you missed our construction breakfasts please get in contact to ensure you are notified about events in the future.