May 22, 2019

Article

The automatic enrolment of the UK workforce into a formal pension arrangement has introduced over 10 million people to retirement saving. Taking that statistic on face value – it’s been a phenomenal success.

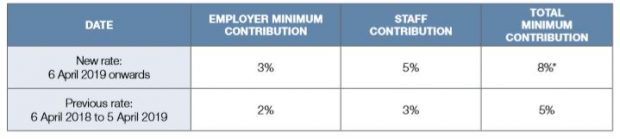

The minimum contributions that employers and employees have to pay increased on 6 April 2019, as shown in the table below:

* Please note that contribution levels with a 7% and 9% definition are also available.

Many employers will have regarded complying with the regulations as the end of their involvement with the process, but as is very often the case, the devil is in the detail.

Like pretty much everything in life, pensions do not respond well to neglect, so the regulations require that employers have in place a monitoring and review process, to ensure the pension arrangement they’ve provided, delivers good outcomes for their employees. The vast majority of employers are completely unaware of this, and if their pension arrangement delivers poor results, they’re not going to know, until perhaps a very unhappy employee points it out and claims recompense from the employer.

There’s also the attention focussing announcement by the Government recently, that company directors who are found guilty of neglecting their scheme, can be sentenced to up to 7 years imprisonment.

To assist employers and deliver peace of mind, we have developed a specific service to meet these requirements. The ‘MOT test’ like report is clear evidence of proper due diligence on the scheme by the employer and is the basis of the 3 yearly re-registration and re-certification of the scheme with the regulator. It also flags up any operational or logistical errors or failings with the scheme and delivers comprehensive investment performance analysis.

Please get in contact for more details and an initial discussion.