July 30, 2024

Article

The VAT return process, typically at the end of the month or quarter, is a good opportunity to ensure that your Xero is up to date and reconciled before pressing the button to submit.

As with most things, everyone will have their preferred way of doing this but here are a few of my top tips for ensuring correctness of the return before submitting to HMRC:

- Inputting all expenses and sales invoices. This may be by including manually, using Xero files, or add-ons such as Hubdoc.

- Reconciling the bank – sometimes a step skipped for those on an accruals basis but doing it at this point can make it easier as the transactions are fresh in your mind. It is often a good time to notice missing invoices or duplicated entries too.

- Check the bank balance once reconciled using the Xero bank reconciliation report (Reports > Bank Reconciliation). If everything is reconciled correctly then this should agree to your statement balance. By doing this on a monthly or quarterly basis makes it a lot easier to spot any differences, rather than leaving until your year end.

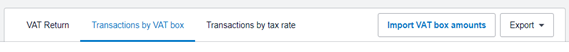

Use the ‘review’ VAT return screen. Reviewing either the ‘transactions by VAT box’ or ‘transactions by VAT rate’ options allow you to see the detail of transactions making up your VAT payable or reclaimable figure. This is a crucial step, especially if the figure showing is higher or lower than expected. By spotting an error here, you can click on the transaction to edit, meaning you are not having to pay or reclaim VAT at a later date to correct.

Please note, you can correct VAT errors by adjusting the entry in Xero for errors where they are within the 4 year time limit and either:

- The net VAT adjustment does not exceed £10,000; or

- The errors are of a net value between £10,000 and £50,000 but do not exceed 1% of your Box 6 figure (net Outputs) on the VAT return for the period in which the errors are to be corrected.

This will get picked up on your next VAT return submission.

However, for errors where the VAT errors exceed £10,000 and 1% of your net Outputs for the relevant return period, you must notify HMRC by using an error correction form (VAT652).