August 01, 2022

Article

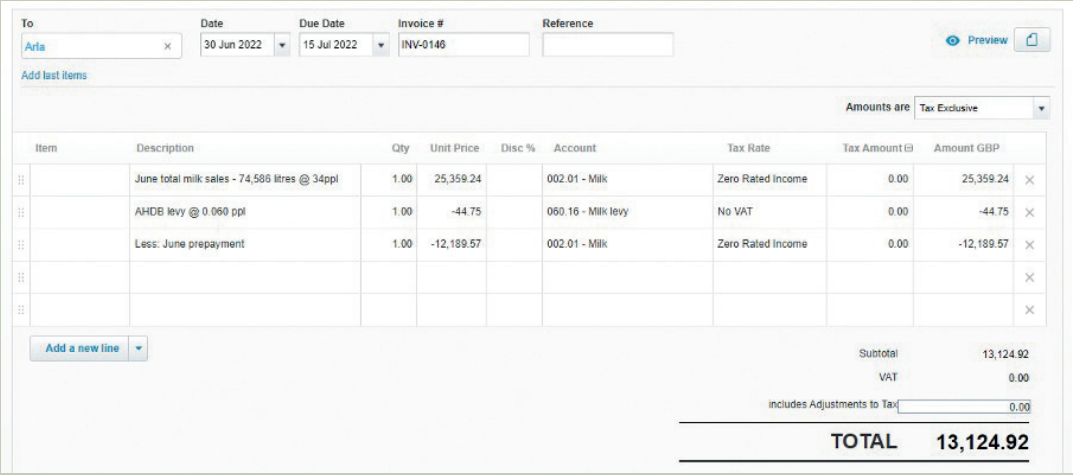

With livestock, crop and milk sales there will usually be either commission and tolls or a levy, such as an AHDB levy, deducted from your total gross sales. This means that the amount you receive into your bank is slightly lower than the total sales you have made. To complicate things further, some suppliers, such as Arla, make their monthly payments for milk sales in two amounts. This is excellent for cashflow purposes but it does add an extra step to the reconciliation process.

The following steps will enable you to record the total gross sales of milk (or corn or livestock) and show that there have been deductions too. (If you are not with Arla then skip steps 1 & 2c).

1. When you receive the prepayment remittance advice and the first payment into the bank, enter this as a sales invoice as you have been doing and code it up to ‘milk sales’. The description can just be the month it relates to and detail that it is a prepayment (eg June prepayment).

2. Then, when the final payment arrives into the bank and you have received the sales invoice, you need to create a new sales invoice with 3 lines:

a. The total sales in that month per the invoice

b. A negative line with the AHDB levy or commission

c. A negative line including the prepayment amount detailed in Point 1. This should be coded to ‘milk sales’

In the below example we have total milk sales in June of £25,359.24 with the prepayment receipt of £12,189.57 and the AHDB levy at 0.060 pence per litre with a balancing receipt in the bank of £13,124.92.

From our point of view it is really useful to have the quantities recorded in the description as we produce pence per litre schedules for our dairy clients. Uploading a scan/ copy of the invoice is also gratefully received and is done by clicking the icon to the right of ‘Preview’ in the top right hand corner.

Please note: as of 1st April 2022 any AHDB levy will now be Outside the Scope for VAT (this needs to be recorded as No VAT in Xero). Your milk, market or crop sales invoice should state if there is any input VAT on deductions and how much this is.