January 30, 2024

Article

A common query I receive is how to enter hire purchase transactions as there are a couple of ways around it and often include added complications of part exchanges. Usually the deposit paid will cover the VAT liability (or net VAT) reclaimable and sometimes includes the signing fee.

In the example below, we have a John Deere tractor purchased for £100,000 and an older one part exchanged for £50,000. This leaves the balance financed of £50,000. There is a signing fee of £100, an option to purchase fee of £70 and total interest payable of £4,000. There are 36 monthly repayments of £1,500.

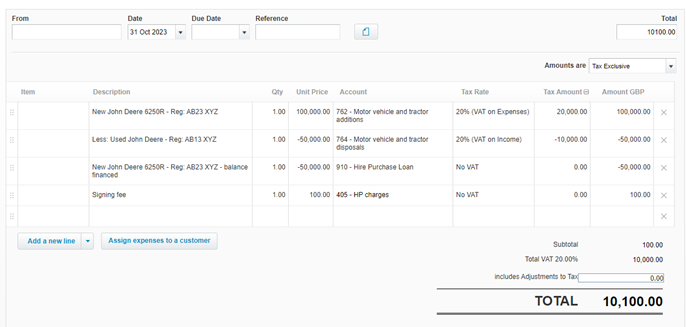

We therefore lay the bill out as follows:

- The new tractor is posted to our additions code with input VAT charged on this

- The part exchanged tractor is then a negative line going to the disposals code with output VAT charged on this.

- There is then the balance financed line which is also negative and goes to the hire purchase loan account with No VAT selected.

- The signing fee is expensed to the profit and loss account hire purchase charges with No VAT on this (unless specified otherwise).

This provides the net amount payable of £10,100, being the cash deposit (which equals the net VAT above) plus the signing fee, which should then agree to the payment made on the bank reconciliation screen.

Going forwards, the £1,500 monthly repayments need to be reconciled with No VAT to the Hire Purchase loan account. As there is interest included in these repayments, this element can either be left for us to split out when completing the year end accounts or this can be split on a straight-line basis on each repayment by you (tip - you could even set up a bank rule for this!).

CAPITAL ALLOWANCES

Plant, machinery and motor vehicles provide you with tax relief via capital allowances (calculated as part of your taxable profits). HMRC states that to be qualifying expenditure for capital allowances purposes, the asset must be owned. However, assets bought under hire purchase are not owned until the final payment is made (usually with a nominal amount called the option to purchase fee). This has been recognised by HMRC and so you are therefore considered to be the owner as soon as soon as the asset is brought into use – not just when it is brought into the yard.

This is therefore important to take into consideration for tax planning purposes as lead times are still significantly longer than a few years ago to get assets on farm.

In addition, it’s important to note that this isn’t just when it’s in the yard. For example, if you bought a new combine now and took delivery of it in February but you’re a March year end, then it would be difficult to argue it has been used in the trade before your year end and so the capital allowances can’t be claimed on the full amount in that year.

Extra Tip – Why not add a picture/ PDF of the hire purchase agreement to this transaction? To do this click on the paper icon

Other items that you wish to attach generally in Xero that aren’t specific to a particular transaction (such as bank or loan statements) can be uploaded by clicking on the entity name in the top left and then selecting Files.