April 10, 2024

Article

Switching back to the old invoicing style in Xero

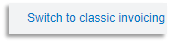

We have received some feedback from our staff and clients that the new Xero sales invoice screen can be hard to navigate. You can still access the old style of invoice in you click this link at the bottom of the Xero invoicing screen:

Troubleshooting live link to HMRC VAT filing from within Xero

As you most likely know, Xero links to your HMRC VAT filing portal to enable you to submit new returns and view your submission history.

However, this link will need to be re-instated every 18 months and occasionally it can disconnect before that point.

Reconnecting it is super easy, but sometimes it can go wrong – so here are the instructions to reinstate the link and common problems that prevent re-connection.

Reconnect Xero to HMRC

- Go to Accounting>VAT Return and click on ‘Connect to HMRC’

- When prompted click the green ‘Continue’ button, then Sign into Government Gateway

- From here you will be prompted to enter your government gateway ID and password

- Now select the ‘allow access’ button

This should now return you to the VAT dashboard and you should be reconnected. However, if this does not work the most common issue is that you have tried to connect Xero to the wrong Government Gateway ID.

The following steps will help you check that you have the correct Government Gateway ID to enable Xero to link to your MTD VAT dashboard.

Verify your Government Gateway ID

- Sign into your government gateway using the following address:

- HMRC online services: sign in or set up an account: Sign in to HMRC online services - GOV.UK (www.gov.uk)

- Click the ‘Sign in’ button and enter the credentials that you used to connect Xero above.

- This will take you to your business tax dashboard and should show a list of services that you can access.

If VAT is not listed on your Government Gateway dashboard check any other gateway ID’s that you have until you find the one that VAT is connected to. Once you have found the correct ID, go back to Xero and follow the steps to ‘Reconnect Xero to HMRC’ above.

In most cases, this will resolve the problem – if not please feel free to contact us for further help.

Bank accounts - statement balance versus balance in Xero

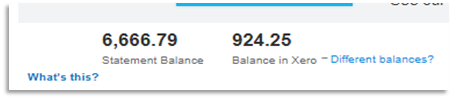

You may have seen this at the top of your bank reconciliation or banking dashboard within Xero:

So, what exactly is the difference and should we worry if the balances do not match?

Balance in Xero – this is the running total of all the transactions that have ever been entered into your bank account from within your accounts. Ideally, these transactions will be identical to the transactions that appear on your statements provided by your bank.

Statement Balance – this is the balance that Xero calculates as your bank balance based on the bank feed, imported statements and accounting transactions that have been marked as reconciled.

It is important to regularly check if your calculated Statement Balance in Xero accurately reflects the balance provided by your bank as this will be one of the key starting points for the production of your financial accounts.

Starting Bank Balance

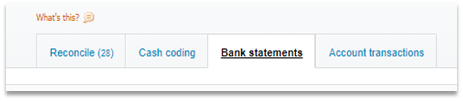

The first item to consider is how the bank feed was set up. Did the bank account in question have a balance in it when the feed was started and was this included in Xero? Navigate to the bank account and click on the bank statement tab as shown here:

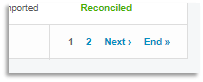

If you then scroll to the bottom right-hand side of this page and click the link to end it will take you to the very first transactions that were entered.

Look through the transactions of the first day to see if there is an item that imports the

balance from your bank account at that point. If this is missing, your contact at Albert Goodman will be able to assist you in adding the starting balance for your bank account.

Duplicated or missing items in the bank feed

Once you have made sure the starting point is right, scroll through the bank statements tab as above and check the balance at regular intervals – perhaps quarterly to start with – to ascertain where the error developed.

The items on the Bank Statements tab in Xero should mirror your statements supplied by your bank. If they don’t there could be 2 issues:

Missing items – if the bank feed has lapsed it may be that there is a period of time where there were no transactions imported from your bank. Your contact at Albert Goodman can give you further advice on how to import these or you can refer to the online Xero help guides that can be accessed by clicking the help button in the top right of the blue bar in Xero.

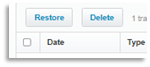

Duplicated items – occasionally the bank will import duplicated items. If you have not already reconciled these items, you can simply tick the box at the left-hand side of the duplicated item and then click the ‘Delete’ button. Contact us for advice if you are not sure!

If you have any top Xero tips, please do let us know and we can feature them here for others to benefit from! Alternatively, if you need any help with Xero matters, please email the cloud team [email protected].