May 19, 2020

Article

In the last newsletter, I highlighted the key benefits of Systematic Investing and how this can lead to better investment outcomes. There are many factors that make up a Systematic Investment approach, however, one of the key principles is ‘cost control’ and understanding the costs of investing.

Although most investors know that they are paying something for their investments and pensions, very few are aware of the actual costs that are being applied. This is a key area of discussion as management fees, expenses and transaction costs incurred in the management of a portfolio have a direct impact on returns. Therefore, managing costs is just as important as managing investments because good investment performance can be wiped out by high costs.

There can be number of literal costs of investing because there are several parties involved in helping manage your money. Typically, an investment portfolio will have three layers of costs:

• Investment Platform Costs* - The investment platform holds your investment portfolio and allows you to access a wide range of fund managers and investment funds.

• Fund Manager Costs* - Typically, a fund will apply an Ongoing Charge Figure (OCF) which covers administration, operating costs, investment

management and independent oversight. These fund manager costs can vary hugely and are dependant on the type of investment fund. They typically range from 0.30% - 1.60%.

• Financial Adviser Costs - These are the charges applied by your Financial Adviser to provide ongoing advice in relation to your investment portfolio and wider financial planning needs.

*Please note that some investment and pension providers combine the costs into one figure.

It is important to keep a lid on these costs as much as possible, to ensure that you, as the investor, are getting the maximum amount of net return possible.

Case Study

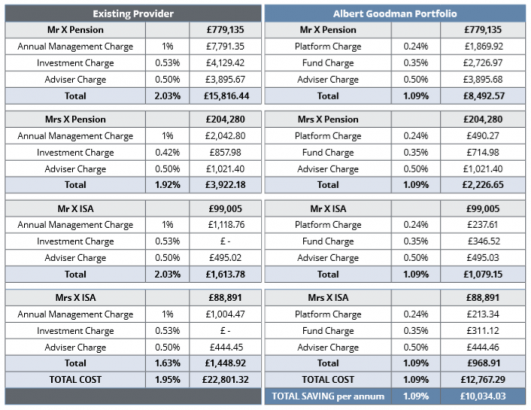

In order to bring this theory to life, here is a real life case study of a client that came to Albert Goodman Chartered Financial Planners within the last six months. The clients contact our office as they had concerns over the advice they were getting from their existing financial adviser and wanted an independent review of their investments and pensions in relation to the cost of investing.

Summary

• Mr & Mrs X had a combined wealth of £1.1 million

• This £1.1 million is split between both pension & ISAs As part of a detailed review of their existing assets, we completed an extensive cost comparison which confirmed that by adopting a Systematic Investment approach, with a focus on controlling costs, we were able to save the clients more than £10,000 per annum in charges:

If we assume that both investment portfolios provided a gross return of 5% over a year, the net return for the existing portfolio would reduce down to 3.05%. Although, there is still a reduction in return from the Systematic Investment approach, the loss of return in charges is much lower and leads to a net return of 3.91%.

Summary Whilst there was a significant cost saving to be had in the case study above, it is also important to consider the wider portfolio position and your investment objectives and needs when analysing any investment portfolio. Our independent financial advisers will analyse every aspect of your existing investment or pension portfolio, and consider the underlying performance and risk before making any recommendations.

If you would like to discuss your existing investment or pension portfolio with one of our advisers, please get in touch and we will be happy to discuss this in more detail.