September 02, 2024

Article

The Annual Tax on Enveloped Dwellings (“ATED”) is a tax charge on non-natural persons (“NNP”) with an interest in UK residential property. An NNP can be a company, a partnership with a corporate partner, or a collective investment scheme. The tax charge is based on the property’s value.

ATED is not just “annual” and needs to be kept under constant review throughout the year. Any changes made to interests held, any conversions, alterations, disposals, reclassifications or changes in use or occupation of the residential property may mean further filings are necessary to amend or update the charge or claim for relief.

ATED is complex, so if you are in doubt that the charge applies or any changes need to be notified, please do get in touch.

Revaluations of Properties

Last year was of particular importance as all residential properties were revalued for ATED purposes. A return was needed if an NNP holds all or part of an interest in a residential property, where the property is valued at more than £500,000 as at 1 April 2022 or, if acquired after this date, cost more than £500,000.

Chargeable Periods and Valuations

Chargeable periods for ATED run from 1 April to 31 March, so the next return due will be for the year ended 31 March 2025. However, the main return for the period has to be filed by 30 April 2024, so only 30 days after the start of the chargeable period.

The charge is based on the property’s open market value (“OMV”) at 1 April 2022, or the acquisition cost of property if acquired after this date. Whilst there was no requirement to get a professional valuation done, if HMRC disagree with your own valuation, they may charge you penalties and interest, as well as the additional tax due, if they disagree.

This valuation will stay in place until 1 April 2027, unless the property is disposed of in the meantime or there is a substantial addition or disposal to the property or the interest held, or alteration to the number of dwellings.

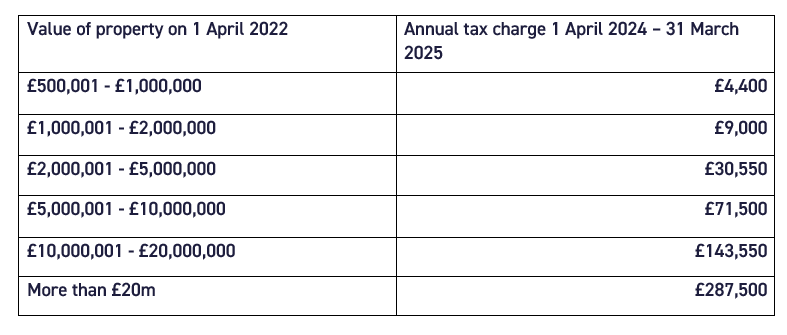

The charge will depend on where the valuation/cost sits within prescribed bandings, as set out below.

Property Interest

The NNP has to hold all or part of the beneficial interest in the property, which may be a freehold or leasehold interest. The charge payable by the NNP is based on the entire residential property’s value, not just the percentage interest held by it.

For example, an NNP owning 50% of a freehold property valued at £2.5m is liable to pay ATED based on a 100% interest, so on the £2m - £5m band and not the £1m - £2m band. £30,550 would therefore be payable for the 2023/24 year.

Single Dwelling Interests

The charge is based on a “single dwelling interest”, so if the property includes more than one possible dwelling, you will need to determine that they all qualify as “single” qualifying dwellings or not. If they do, the valuation bands are applied to each interest.

The charge will also apply if the property is suitable for use as a dwelling although, typically, current use at the date acquired generally overrides any past or intended use.

Certain buildings are never dwellings, such as hotels, care homes, hospitals or accommodation provided for school children or students lets.

Available Reliefs

Whilst there are many reliefs available which may reduce the charge to nil, the relief rules are complex. In some cases, you will need to look back to the preceding chargeable period to revise the charge calculation, as well as considering any changes needed to the current period’s charge, as circumstances change.

The most common reliefs are where the property is used in a commercially run property letting business or is held as part of the trading stock by a property development, or property trading business. Relief is also available for qualifying properties open to the general public in certain circumstances or properties occupied by certain employees/partners, as well as farmhouses/cottages occupied by qualifying farm workers.

If an NNP wants to claim one of the reliefs, it has to file a return to do so.

Non-Qualifying Individual

Most of the reliefs are not available when there is, or has been, a “non-qualifying individual” (“NQI”) in occupation. An NQI is broadly anyone connected with the NNP and so will include most shareholders or partners, their spouses/civil partners, relatives and their spouses/civil partners, and then the relatives and spouses/civil partners of those individuals. Relatives are siblings, lineal descendants or ancestors. NQIs also apply to settlors and trustees of a trust and connected parties.

Again, the rules are complex and, if incorrectly applied, can easily result in interest and penalty charges being levied.

Payments and Penalties

Any ATED charges must be paid at the same time as the returns are filed. The filing deadlines are tight and for those NNPs already in the regime, the filing deadline for the chargeable period 1 April 2024 to 31 March 2025 is within 30 days after the start of the period, so by 30 April 2024.

Where new properties or interests are acquired during the period, the filing and payment deadlines are within 30 days of completion or substantial performance of the contracts, and for new builds or conversions, the earlier of either 90 days from when the property is registered for Council Tax or from the date of first occupation (for new builds) or completion (for conversions).

Different time limits also apply to amendments or submission of new returns to revise or add to the charges, again, all of which are narrow time limits.

Failure to file correctly or on time, or to pay on time will lead to penalties and interest charges, even where there is no tax due. For example, if a return should have been filed by 30 April 2024 and is not filed until 1 May 2025, a penalty of up to £1,600 could be charged, even if there was no tax to pay.

Action Required

If you are concerned that your company (NNP) may be subject to the ATED regime and would like more information, then please contact us.