February 06, 2025

Article

While the budget is supposed to be a budget for growth, the extra tax on employment may affect the ability for an employer to invest in the business which therefore could prevent growth. This article considers remuneration planning following these changes, rather than the general affect across the wider business sector.

It has been traditional practice of owner managed businesses, run as companies, for directors to take a small wage and a larger dividend (to utilise their basic rate band for income tax purposes) to both remunerate the owner-manager tax efficiently and to claim a qualifying year for state pension purposes.

The changes in the budget both increases the employer’s NI (to 15%) and decreases the limit from which you start paying NI.

Where the director’s tax efficient salary was set at £9,100 for 2024/25, if the salary remains the same for next year, there will now be a £615 year NI charge for the company. This is on the basis the employment allowance (EA) was not available. Unfortunately, it is no longer possible to reduce the salary so that no NI is due and for it to be a qualifying year for state pension purposes.

While the EA has increased, which could reduce the overall liability, a sole director cannot claim the EA. Further, should wages be paid of more that £70,000, the business may not have the EA available to offset the additional cost.

Therefore, we need to consider the other remuneration options, which are not subject to NI – these being rent and interest.

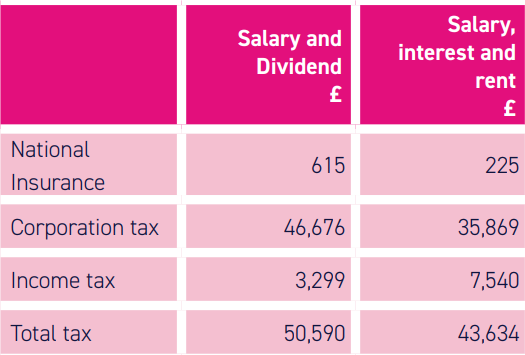

The following example provides a total remuneration of £50,270 to utilise the directors basic rate band, comparing the previously traditional remuneration package of salary and dividends with a mix of salary, dividends and rent as follows:

1. A salary of £9,100 and dividends of £41,170, compared to:

2. A salary of £6,500, to claim a qualifying state pension year, interest of £15,000 and rent of £28,770.

In each case, company profits are £200,000 before remuneration and there is no EA available.

This shows that the salary and dividend option is not the most tax efficient, which it hasn’t been for several years, but the change in NI has further emphasised this.

However, not everyone will be able to utilise the interest and rent option and each remuneration scenario now therefore needs to be individually tailored.

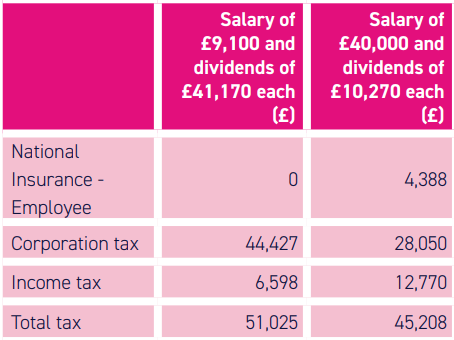

To illustrate this, let’s take the example of husband and wife tenant farmers in a limited company. They have no other employees, so the full EA is accessible.

On the basis there is no option available to charge rent and interest, let’s compare the traditional remuneration method of a low salary of £9,100 and a high dividend, with a salary of £40,000 each and low dividends:

This shows that every scenario is different, as the number of directors, or family members who work for the company can change the outcome. Care should be taken, but with the changes in NI, if family members are doing some work on the farm, it may become more tax efficient to employ them.

While certain options can give substantial tax savings, I should note that the cash flow will change for the different options. For example, with a high salary, PAYE tax will be payable by 19 April – if paid in March, whereas tax on dividends, interest and rent is not payable until the following 31 January. If the cash can be put to better use, then this could outweigh the tax saving.

If you would like to discuss the options or are concerned that you may not be remunerated most tax efficiently, please do get in touch.