Tax efficient investments can be achieved in farm plant and machinery at present due to the Government’s

Annual Investment Allowance (AIA), but this is about to change.

The AIA means that an investment in plant and machinery of up to £1 million is fully tax deductible in year one. For

example, if you change a combine for a net £150,000, then the full £150,000 is deducted from your profit, before we

calculate your tax bill.

As there was no autumn budget this year, the AIA is expected to fall from £1 million to £200,000 from 1 January 2021.

Whilst this level of AIA covers the annual plant and machinery investment made by most farming businesses, there

are pitfalls.

Where your accounting year end straddles the period of change then the timing of your purchase can be critical to

receiving tax relief. For example, if a farm has a 31 March 2021 year end they will have total AIA available of £800,000 (9 months at £1 million plus 3 months at £200,000).

The problem is that no more than £50,000 of the business’s actual expenditure from 1 January to 31 March 2021 will

qualify for the AIA.

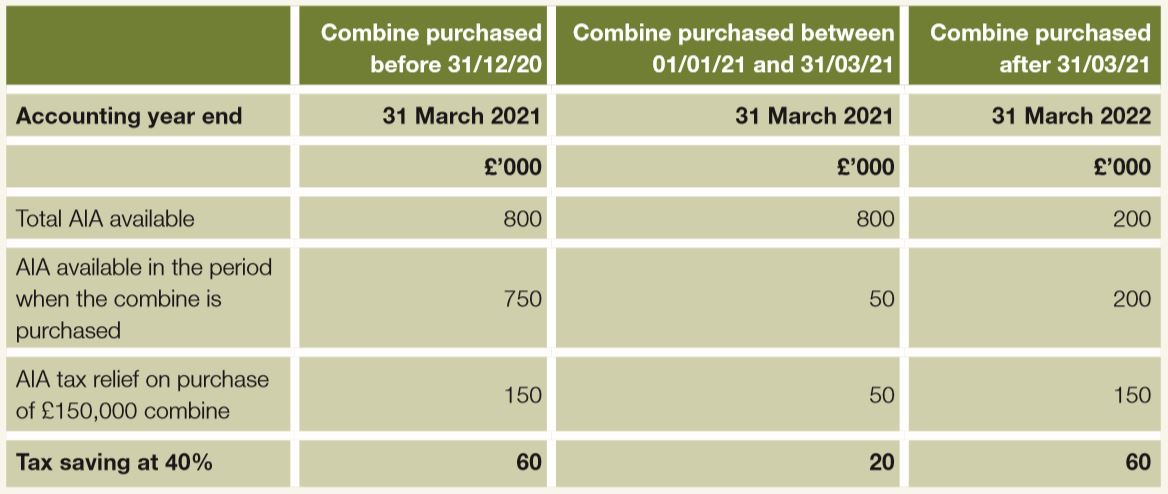

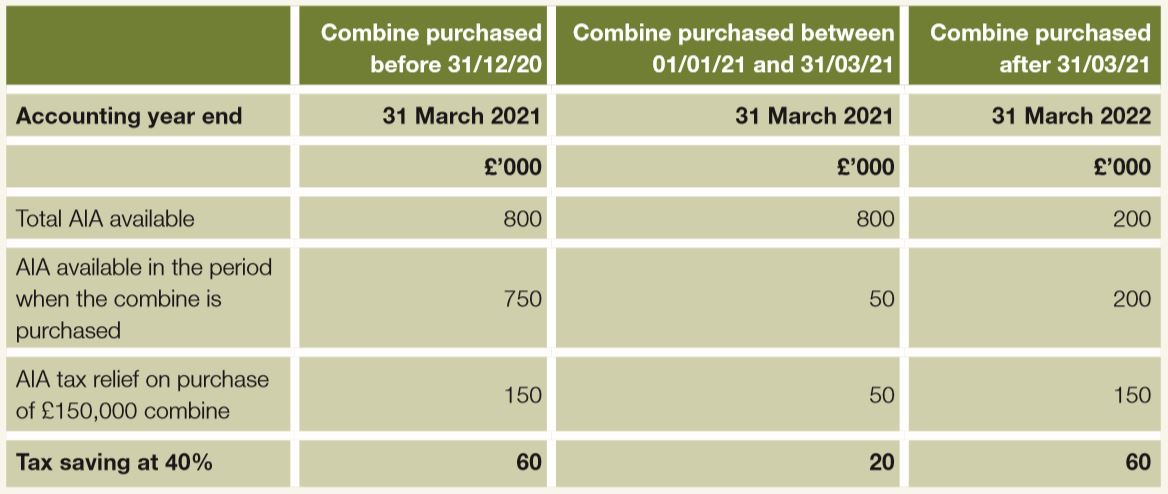

The table below sets out the tax relief available on the combine purchase and the tax relief available under three

scenarios:

As you can see purchasing the combine between 1 January and 31 March 2021 results in a much lower level of upfront tax relief on the machinery purchase.

Farm businesses hoping for a tax efficient investment in the purchase of plant and machinery should consider this tax change and how this may affect their plans. In particular, expensive changes in plant and machinery early in 2021 should be thought through for the best tax relief to be achieved.

For more information contact

Iain McVicar.

As you can see purchasing the combine between 1 January and 31 March 2021 results in a much lower level of upfront tax relief on the machinery purchase.

Farm businesses hoping for a tax efficient investment in the purchase of plant and machinery should consider this tax change and how this may affect their plans. In particular, expensive changes in plant and machinery early in 2021 should be thought through for the best tax relief to be achieved.

For more information contact Iain McVicar.

As you can see purchasing the combine between 1 January and 31 March 2021 results in a much lower level of upfront tax relief on the machinery purchase.

Farm businesses hoping for a tax efficient investment in the purchase of plant and machinery should consider this tax change and how this may affect their plans. In particular, expensive changes in plant and machinery early in 2021 should be thought through for the best tax relief to be achieved.

For more information contact Iain McVicar.