April 29, 2021

Article

When you purchase a car in a company it can be very costly if you have any private use on the car. With a green zero emissions car this may not be the case.

To encourage investment in the economy over the next two years, a new 130% ‘super-deduction’ capital allowance has been introduced for purchases of new plant and machinery from 1 April 2021 until 31 March 2023.

The super deduction will only apply to limited companies on purchases of new plant and machinery, not used or second hand.

When the asset is later disposed, the company will have to treat this as a separate pool item and bring 130% of disposal proceeds into account suffering a balancing charge at that point, rather than suffering tax on sale

proceeds over a much longer period of time.

If the disposal takes place after April 2023, when the corporation tax rate is set to rise to 25%, for businesses with profits over £250K, this measure will in fact mean the company may suffer a net cost depending on how the value of the purchase depreciates.

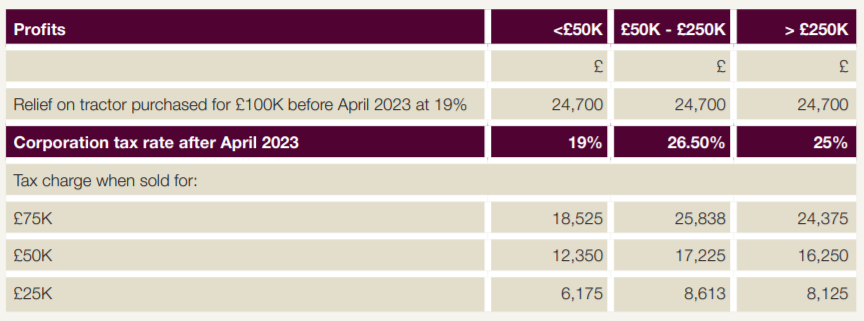

The table below sets out the tax saving when a new tractor is purchased before April 2023 and the tax charge when the tractor is sold after April 2023.

As you can see, for those businesses where profits are over £50K, selling the tractor whilst it is still holds the majority of its value results in a net tax cost of £1,138 or a very small saving for those with profits > £250K.

Farm businesses hoping for a ‘super deduction’ from the investment in the purchase of plant and machinery should consider this situation and how this may affect their plans. For machinery that is traded in regularly, and has potential to hold its value, this relief may need to be viewed as an upfront cash flow saving only.

The annual investment allowance will continue to apply for second hand purchases up to 31 December 2021. The annual investment allowance provides 100% relief for plant and machinery purchases of up to £1,000,000.

As always, the decision to purchase machinery must be a commercial one, and not based on tax.

View the full copy of our spring edition of Rural Intelligence for Farms & Estates here.