May 22, 2019

Article

During the Autumn Budget in 2018 the Chancellor announced a new capital allowance – the Structure and Buildings Allowance (SBA). This was very welcome but is it as good as it sounds?

The SBA is available for all business types including sole traders, partnerships and limited companies on qualifying costs for new commercial buildings such as storage, offices and livestock buildings where a contract for construction is entered into on or after 29 October 2018. If a contract was entered in to before 29th October 2018 but work was not started until after this date, this contract will not qualify for the relief.

The relief is available on both the erection of new commercial buildings and the refurbishment of old commercial buildings. When calculating the cost of the project for relief purposes the cost of demolition or land alteration can be included but not the original cost of the land where the building is situated.

The SBA provides a 2% writing down allowance which effectively gives relief over a 50 year period. The claim for this relief can only be made once the building comes in to use within the business.

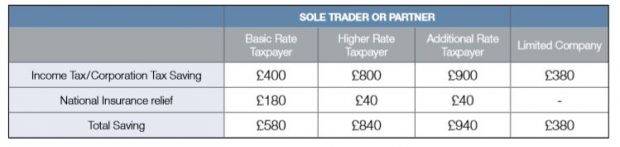

To put this into context, a £100,000 spend on a qualifying building would have the following savings for businesses each year based on current tax rates:

If a property is sold before the end of the 50 year period the remainder of the 50 year allowance will transfer to the new owner of the property. They will then continue to claim the allowance on the

original cost of the new structure or renovation.

This relief was a welcome addition to The Budget as there have been no allowances on buildings since the Industrial Buildings Allowance was abolished in 2011. However, while any tax relief is

welcome, these amounts are unlikely to make any credible difference to the commercial decision to invest in to a new building or renovation.

If you are planning on investing or refurbishing any commercial buildings and would like further details on the potential reliefs and interaction with other capital allowances, please contact one of our team.