October 30, 2020

Article

Stamp Duty Land Tax Changes - 8 July to 31 March 2021

To support the housing market’s return to good health following lockdown and to encourage buyers to proceed with property purchases, in July, the Chancellor granted a temporary SDLT holiday on the first £500,000 of residential property purchases in England and Northern Ireland, saving buyers up to £15,000. Further, even those purchasing an additional dwelling will benefit from a saving of up to £11,250, paying only 3% on the first £500,000.

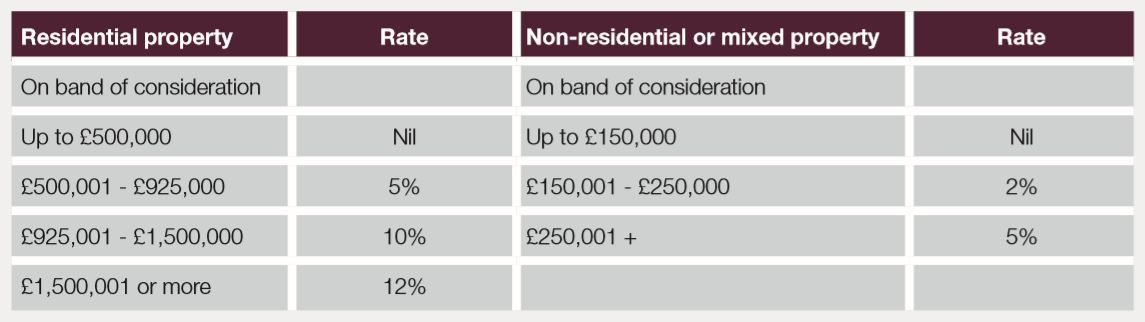

The SDLT rates from 8 July to 31 March 2021 for residential and non-residential or mixed property are:

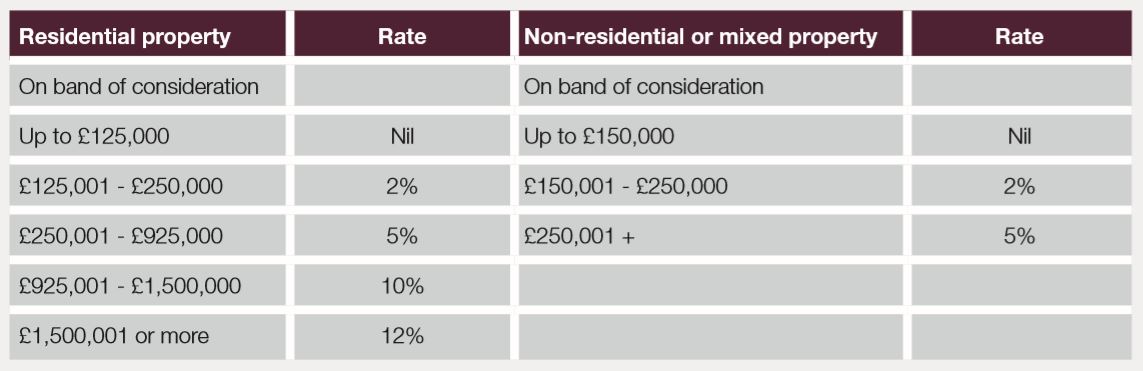

From 1 April 2021 there are changes to Stamp Duty Land Tax rates, these are set to return to:

3 percentage point surcharge

It should not be forgotten that there is a 3 percentage point SDLT surcharge which applies to purchases of additional residential properties including main residences, farm workers cottages, buy to lets and furnished holiday lets.

The net is cast widely so it can catch circumstances where:

- one spouse already owns a property and they both or the other spouse buys a property;

- a buy to let landlord purchases their first home;

- there is a purchase of more than one dwelling which could include annexes and holiday let units;

- a parent helps to buy their child their first home by reason of a joint purchase;

- a purchase of a property by a partner in a farming partnership which has let property.

It is important to remember that you can be taken to “own” property even in circumstances where you are deemed to have only a small share. It is not uncommon for a farming partnership to own property which is let out and as such, if one of the partners purchases their first home in their own name, they may incur the SDLT surcharge.

Non-residential or mixed property

For purchases of non-residential or mixed property the rates may be lower than those applied to purchases of only residential property. For example, where a farm is purchased which includes a farmhouse and land the entire purchase cost could be charged to the lower mixed property rates of SDLT, with no surcharges for additional dwellings. Recently, for example, we have been able to reduce an expected SDLT bill of over £105,000 to less than £25,000. For purchases of six or more dwellings the non-residential rates can apply, with no surcharges.

HMRC are actively raising enquires into the rates of SDLT applied on property transactions. Therefore advice should be taken to ensure the property justifies the application of non-residential SDLT rates.

Multiple dwellings relief

In addition to ensuring the correct rate applies to a transaction consideration should also be given to relief from SDLT. This is particularly important if the purchase involves multiple “dwellings”. Relief in such circumstances can reduce the rates of SDLT applying – even in cases where a mixed property is purchased.

“Dwelling” is not helpfully defined in the legislation so the relief can prove to be difficult to apply in certain cases.

With SDLT payable within 30 days of completing on a purchase it is important to take advice early on. Speaking to your advisor to help understand the SDLT cost could also mean you are more able to secure a farm under tender or at auction, or achieve a better price if you are selling.