November 22, 2022

Article

When selling your farm or farmland there are several tax planning options available to mitigate the capital gains tax (CGT) liability. These include Rollover Relief and Business Asset Disposal Relief (BADR) formerly known as Entrepreneurs Relief. With the lifetime allowance reducing from £10million to £1million, the decision regarding whether to claim BADR and pay your tax liability upfront or rollover the gain is harder than in previous years.

Business asset disposal relief (BADR)

BADR is available for individuals and trustees (not companies) disposing of all or part of a business, the assets of a business after it has stopped trading or shares in a company.

Each person has a maximum lifetime limit of £1million total gains on which BADR can be claimed. This £1million gain is charged at a reduced tax rate of 10% rather than the usual CGT rate of 20%. With rumours that CGT rates may align with income tax rates in the future, BADR enables you to lock in your CGT liability now.

Rollover Relief

Rollover Relief can be claimed when trading assets are disposed of and the proceeds are reinvested in new trading assets. Rollover is available to both individuals and companies.

The capital gain on the disposal can be deferred by rolling it into the cost of another business asset. The cost of the new asset is reduced by the gain and when the replacement asset is sold the gain becomes chargeable. Assets which qualify for Rollover Relief have a life of over 60 years, ie. land, buildings, fixed plant and machinery and potentially Furnished Holiday Lets.

The new asset must be purchased 12 months before the disposal or 36 months after the disposal takes place. By reinvesting all proceeds, you can reduce your capital gain to nil.

Partial Rollover Relief

Where proceeds are not fully reinvested within 36 months of disposal, relief is available only where the amount reinvested exceeds the allowable expenditure, i.e. the base cost. Any amount not reinvested becomes chargeable to CGT.

If non-farming assets are purchased with the proceeds, then it may be possible to claim both Rollover Relief and the full £1million of BADR.

Examples

The below examples assume that a farm with a base cost of £1million is sold by an individual (not a company) for £5million. There are no disposal costs, and the individual has no annual exemption available.

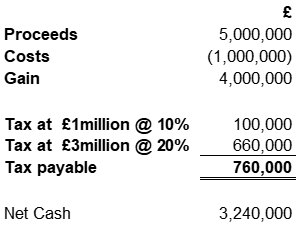

Example 1: Business Asset Disposal Relief

The farm is sold and the trade ceases. BADR is claimed and no other reliefs are applied.

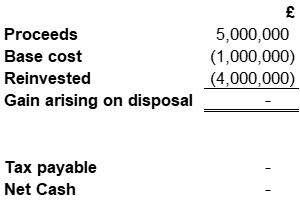

Example 2: Rollover Relief

The farm is sold and the full £4million gain is reinvested in trading assets within 36 months of disposal. This results in no CGT being paid at this time. The new asset cost £5million therefore the base cost is £1million (£5million less the £4million gain).

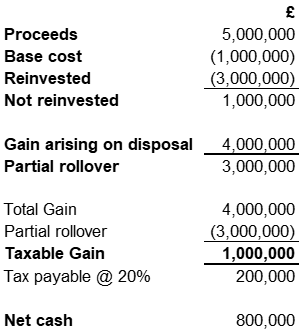

Example 3: Partial Rollover Relief

The farm is sold but the trade does not cease. £3million is reinvested in a new farm or land, however as the trade has not ceased BADR is not available. The £3million reinvested exceeds the initial base cost of £1million therefore £1million becomes chargeable.

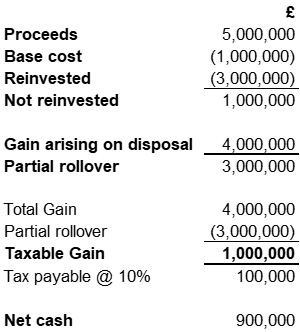

Example 4: Partial Rollover Relief & BADR

The farm is sold and the trade ceases. £3million is reinvested in trading assets such as Furnished Holiday Lets. Similarly, to the above example, £3million of the £4million is reinvested, however the trade has ceased, and BADR can be claimed meaning that the gain is taxed at 10% rather than 20%.

Another way to reduce your CGT liability is by using the Enterprise Investment Scheme (EIS), allowing you to defer the gain using Rollover Relief and investing in qualifying shares. For more information on EIS please contact our Financial Planning team for a free of charge initial meeting.