February 03, 2022

Article

A hot topic within any agriculture conversation includes the rocketing prices we have experienced for key input costs within all farming sectors. The main costs which have been impacted are feed, fertiliser, fuel and labour. Like most things, once one cost increases, this has a knock-on effect on others. The increase in fertiliser cost pushes up the cost of feed prices, which then, as time goes on, puts pressure on buyers to increase commodity prices. (We hope!)

For the dairy industry feed and forage input is by far the largest cost. Therefore, any change in feed price will impact the bottom line with some significance. Undoubtedly, over the last 12 months farmers have suffered numerous price rises with feed and fertiliser being at the forefront. This has been softened slightly by the numerous milk price increases currently being seen in the sector.

But we are still left questioning where this will leave our margin?

Therefore, comparing your increase in milk price, to your increased input costs should be at the forefront of understanding your current profitability. This will then help you understand if your margin is being squeezed, stable or even improved.

An averaged benchmarked dairy farm producing 8,000 litres per head would have a concentrate cost of 8.3 pence per litre (based on £255 per tonne @ 2.6 tonnes per head per year). If we then increase the concentrate cost by 1.0 pence, to 9.3 pence per litre, the price per tonne would need to increase by 12%. Therefore every £31 per tonne increase in concentrate cost would need to see a 1.0 pence per litre (ppl) milk price increase to balance the margin.

AHDB reported the average feed price from September 2020 to September 2021 has increased by £29 from £237, an increase of 12%.

Although concentrates are one factor that will push up feed costs, fertiliser and fuel will also push up the cost of forage. The fertiliser and fuel increase for 2022 has been estimated at 1.5-2 pence per litre. This does not include any increase in labour cost which will inevitably increase with the national living wage set to go up in April by 6.6%.

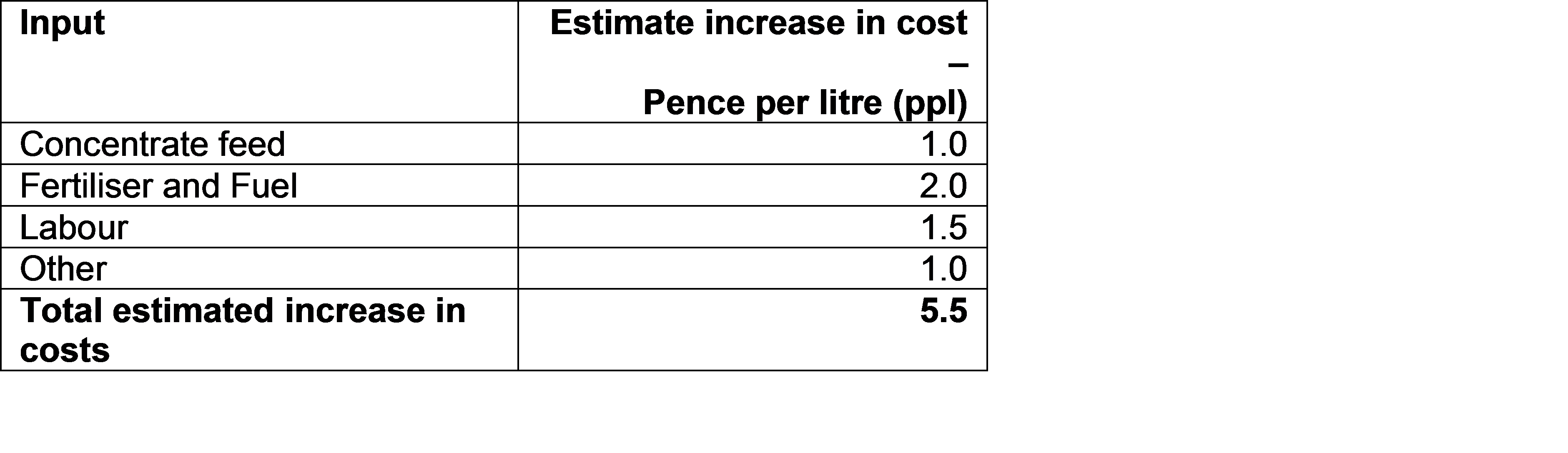

The below table is an estimate of how a dairy farm's costs could look over the next 12 months:

The Milk for Cheese Value Equivalent (MCVE) in November 2021 was 39.2ppl which compares to 31.6ppl in the 12 months prior, an increase of 7.6 pence per litre.

Our estimated total dairy farm costs have increased by 5.5 pence per litre. Assuming that the MCVE price increase is passed onto farmers, which it appears to be, then the milk price increase should be enough to cover the extra costs incurred.

It will be interesting to see the actual financial figures once the 2022 year end accounts start to land with us in April/May. We will then start to understand the actual impact on the sector and how margins compare to the previous year, with a clearer idea of what the next 12 months may bring.