September 18, 2019

Article

When building wealth, often the long term goal might be to provide for retirement. It’s only natural that we should consider our pension funds and the level of contributions that we are making.

Here, I look at the income tax savings available for making pension contributions, but why not get in touch with our Financial Planning Team to consider all aspects of pension planning, advice and investment.

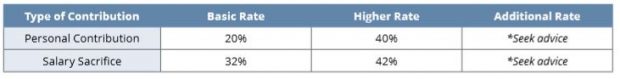

Whilst the one downside of pensions might be that the funds are locked away until retirement, they offer many advantages, particularly if you are thinking long term. The potential tax savings are as follows, showing the savings for personal contributions or those made by salary sacrifice if you are employed:

Personal pension contributions can be used to extend your basic rate tax band to save higher rate tax at 40%. Half of this comes through the grossing up of the contribution when it is paid into your pension fund and, the other half comes from the tax saving on your self assessment tax return.

If you are an employee and are part of a salary sacrifice pension scheme, the saving comes along with a national insurance saving because the pension contribution is excluded from your taxable pay and, is instead paid into your pension fund by your employer. Hence the salary sacrifice term, as you sacrifice some gross pay in exchange for an employer pension contribution.

As part of a wealth building goal, these proportionately large tax savings help significantly boost the funds available in your pension fund, compared with saving cash as part of your net pay, after it has suffered tax and national insurance.

Please get in touch to see if you could benefit from these tax savings based on your personal circumstances.

*If you are an additional rate taxpayer, the amount that you can contribute to a pension fund may be restricted and you will need to consider taking further advice to ensure that you do not suffer a tax charge. Please read my article on pension annual allowance planning.

To view the Prosperity newsletter in full, please click here.