April 08, 2024

Article

In March 2024, the then UK Government announced proposed increases to the company size thresholds, to provide more streamlined and simplified reporting. This will make requirements more proportionate to the size of the company.

It is estimated that these changes will bring approximately 132,000 firms into a lower entity size category for reporting, resulting in reduced compliance and disclosures.

UPDATE - These changes were initially planned to take effect from 1 October 2024, but were put on hold due to the general election. The new government confirmed in October that it does intend to lay this proposal before parliament by the end of 2024, with the intention to come into force from April 2025.

What are the new size limits?

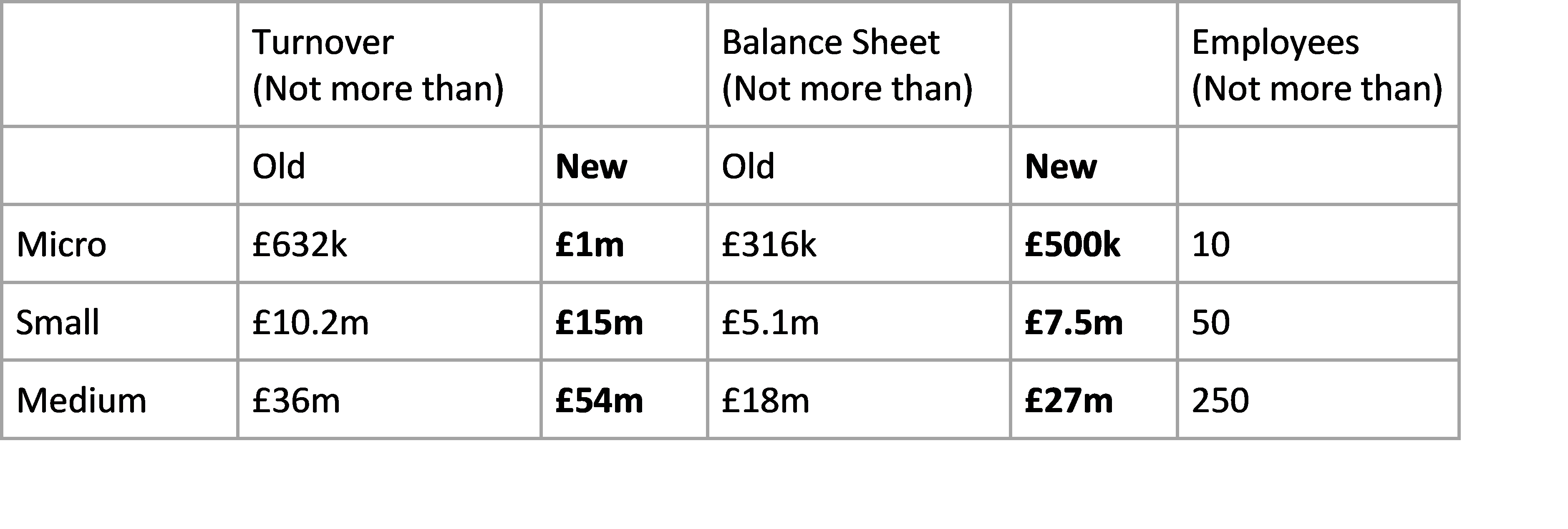

Companies must meet at least 2 of the 3 criteria in either their first financial year or two consecutive financial years to be able to qualify for a particular regime.

Turnover amounts have also been rounded for simplicity, with balance sheet thresholds remaining at 50% of turnover.

What does this mean for my business?

The proposed changes affect both the preparers and users of financial statements. It is estimated that 5,000 large companies will be reclassified as medium, 13,000 medium companies reclassified as small and 113,000 small companies reclassified as micro.

Simpler reporting requirements may result in the annual financial statements being quicker and simpler to prepare, as there will be fewer disclosure requirements. Users may also find the financial statements easier to read and understand as less information is provided.

This could have the opposite impact if other stakeholders were using the information disclosed for wider purposes. It is therefore worth considering what information is required by other stakeholders and ensuring this can still be provided.

These changes will also remove some requirements from the Directors' report, Directors' Remuneration Report & Policy, and fix some audit regulatory technical issues.

Are there any other changes being considered?

Other initial proposals to make changes to medium sized entities will not be proceeding but the government have announced they will be launching a detailed consultation on the future of UK financial reporting next year. The aim of this is to better meet investor and business needs.

For further information, please contact Sarah Milsom or your usual Albert Goodman advisor.