April 28, 2021

Article

A lot of has been written in the national and agricultural press on natural capital - assessing and measuring natural capital assets and how this should be calculated based on land use, soil type, habitat and agricultural activities etc. But also, on the opportunities that natural capital assets could provide the agricultural sector.

The UK has legally committed itself to reaching a 100% reduction in net greenhouse gas emissions by 2050. The agricultural sector could play a vital role in this, not by reducing emissions, although the agricultural industry will need to play its part, but by providing a route for carbon offsetting. To achieve a 100% reduction in its carbon account, the UK needs to reduce greenhouse gas emissions, or increase the capture of greenhouse gases, to the tune of an average 15.5 million tonnes per annum over the next 30 years.

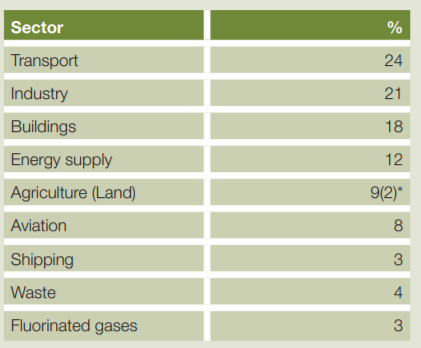

According to the ‘Commission on Climate Change – reducing UK emissions; progress report to Parliament’ (June 2020), emissions by sector the previous year in the UK were split as follows:

*The land sector within agriculture naturally captured 2% of the UK’s 2019 GHG emissions, making the sector’s net contribution 7%.

The government as well as the corporate and private sector are taking more notice of the economic value of natural capital and we are seeing more clients being approached by investors wishing to increase corporate sustainability and offset carbon.

Landowners monetising natural capital assets either through government schemes or through private investment need to consider the tax issues whilst we wait for changes to tax legislation.

As a member of the CLA National Tax Committee I know the CLA are working hard lobbying government for changes to ensure tax is not a barrier - DEFRA and the Treasury are now actively working on this.

For now, the issues are the tax treatment of the payment(s) received and the long term impact to the taxation of the land for capital gains tax (CGT) and inheritance tax (IHT) purposes.

Income received

The payments received for allowing land to be planted for trees or set aside for meadows, marshes or phosphate lakes, for example, will depend on the nature and terms of the agreement. Without specific legislation to deal with these situations the tax treatment of a one-off payment or annual payments over a period of time will depend on the wording of the contracts. The contract may be a lease to a third party or an alternative arrangement.

With a lease the payments received could be deemed to be rental income so potentially non-trading/farming income. If there is an upfront premium, depending on the length of the lease, part of the premium could be charged to CGT and a large proportion to income tax in a single year, which could result in a substantial tax liability charged at higher income tax rates.

For other contracts the payment received could be treated as a capital payment on the basis the land has been devalued and so chargeable to CGT. Alternatively, if a devaluation of the land cannot be argued, the payment could be charged, as farming income, to income tax. This would be on the basis the payment is to compensate for loss of income that could have been generated had the land remained in agricultural use. With the latter you would then wish to argue the spreading of the taxation of the payment over the term of the contract to avoid a large higher rate tax liability in one year. As farming income it could also continue to qualify for farmers averaging.

Whether the income is deemed to be trading or not will depend on whether the income is deemed to be farming, and if not, whether there is enough activity involved to secure the income. Otherwise, the income could be treated as income from holding land, i.e. like rent.

Capital tax position

Land farmed in hand and occupied for the purposes of agriculture qualifies for a multitude of CGT and IHT reliefs.

For CGT purposes the land should qualify for rollover relief, holdover relief and business asset disposal relief. For IHT purposes the land should qualify for agricultural property relief (APR) and business property relief (BPR).

Even if the land is rented to a third party, and in agricultural occupation, the land can qualify for CGT holdover relief and IHT APR.

If the land is no longer occupied for the purposes of agriculture many of these reliefs could be lost going forwards. There is specific legislation to allow APR on land within old set-aside and habitat schemes but these schemes closed in 2000 and the legislation has not since been updated to cover new schemes or ELMs.

If the land is not deemed to be in agricultural occupation and the activities involved on the land to secure the income are minimal then the land is unlikely to qualify for reliefs for CGT or IHT purposes.

For woodland to qualify for BPR it needs to be managed commercially. If it only has amenity use or biodiversity relief it will not qualify.

Conclusion

Whilst there is likely to be huge opportunities for landowners, until we have specific legislation, to protect the CGT and IHT reliefs currently secured on the land, tax is likely to be a barrier for some to enter the schemes. As always, tax should not be considered in isolation and commercially these deals often make sense. The wording of the contracts and the amount of activity required on the land to secure the income, will be crucial to protecting the existing reliefs. Ensuring a relevant business plan, to support this, is in place will be helpful. Take advice early on regarding how best to structure the arrangement.

Also consider the impact of the potential opportunity on the ‘Balfour’ status of the business. If the land is unlikely to qualify as a trading activity, where the income from it should be received and how the land should be owned going forward should be considered in advance, protecting BPR on the balance of the business.

In the meantime, the CLA are continuing to lobby for the Rural Business Unit (arguing that the farm and estate business should be treated as a single business rather than that of farming or property) as well as protecting CGT and IHT reliefs by extending the reliefs to these schemes. They successfully agreed a broader definition of APR recently to include vineyards and orchards, therefore we may see new definitions of agriculture or a new conservation relief in the future. We will keep you posted.

View the full copy of our spring edition of Rural Intelligence for Farms & Estates here.