September 19, 2019

Article

When building wealth, we often do it to provide for our retirement, but another reason might be to pass that wealth onto our children or grandchildren.

Inheritance tax (IHT) is the tax charged on the estate of a deceased person. It is also payable by the donee on gifts that they have received if the donor dies within 7 years of the gift. IHT may also due when assets are gifted into trust, subject to certain reliefs. This will be paid by either the donor or the trustees. Gifts can include property, money and possessions, and is charged at 40%. IHT is due on death where the estates value exceeds the nil rate band of £325,000.

Estates can benefit from an additional nil rate band when a residence is passed on death to a direct descendant. For the 2019/20 tax year the residence nil rate band (RNRB) is £150,000. However, estates with a value of more than £2 million will suffer from a tapered RNRB. This will be withdrawn by £1 for every £2 over the £2 million threshold. Where possible, it is beneficial to minimise the size of your estate to reduce the IHT payable on death.

Gifting is an effective way to reduce the size of your estate. Everyone has gift annual exemption (AE) of £3,000, and the previous year’s AE can also be used if it wasn’t used in the previous year. It is also possible to make use of the small gifts exemption of up to £250 to any individual. These gifts have the benefit of falling immediately outside your estate for IHT purposes.

There is also an additional exemption for wedding gifts of up to £1,000 to any individual. This increases to £2,500 for the wedding of a grandchild and £5,000 for a child. As with the AE and small gifts, these also fall immediately outside your estate for IHT.

It is also possible to make gifts out of excess income (gross income, less tax and all living expenses) if you do not spend all of your income. Gifts out of excess income also fall immediately outside the estate for IHT. In order to qualify as gifts out of excess income, the gifts need to be regular, rather than one offs. For example, gifts that are being made monthly.

Gifts of any size have the ability to be exempt from IHT. These are known as Potentially Exempt Transfers (PETs) and are not subject to IHT as long as you survive the gift by 7 years.

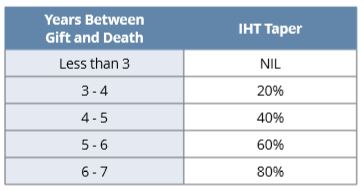

If the gift was made between 3 and 7 years before your death, the IHT due will be tapered, as detailed in the table below.

IHT can also be paid at a reduced rate of 36% if at least 10% of your net estate is left to charity.

Careful IHT planning can be very effective at reducing the IHT paid by an estate, often because the numbers involved are so much larger.

If your estate is worth more than the limits mentioned in this article, or you would like more information or assistance with inheritance tax planning, please get in touch.