February 15, 2022

Article

The past decade has been a pretty good time to be an investor in global equity markets. Only one year in the past 10 years has seen a negative return (2018) and over this period £100 invested in global equities would have turned into £340[1]. Since 1999 we have seen two prolonged, material market falls being the Tech Wreck of 2000-2003 (-48%), when the dot.com stocks crashed, and the Global Financial Crisis in 2007-2009 (-34%). Yet, even from the tops of the market in 2000 and 2007, global markets have still turned £100 in £394 and £373 respectively. Taking a long-term view on equity investments makes good sense but can be hard to do in the noise of day-to-day market movements. As we write, for example, Facebook has fallen 20% overnight!

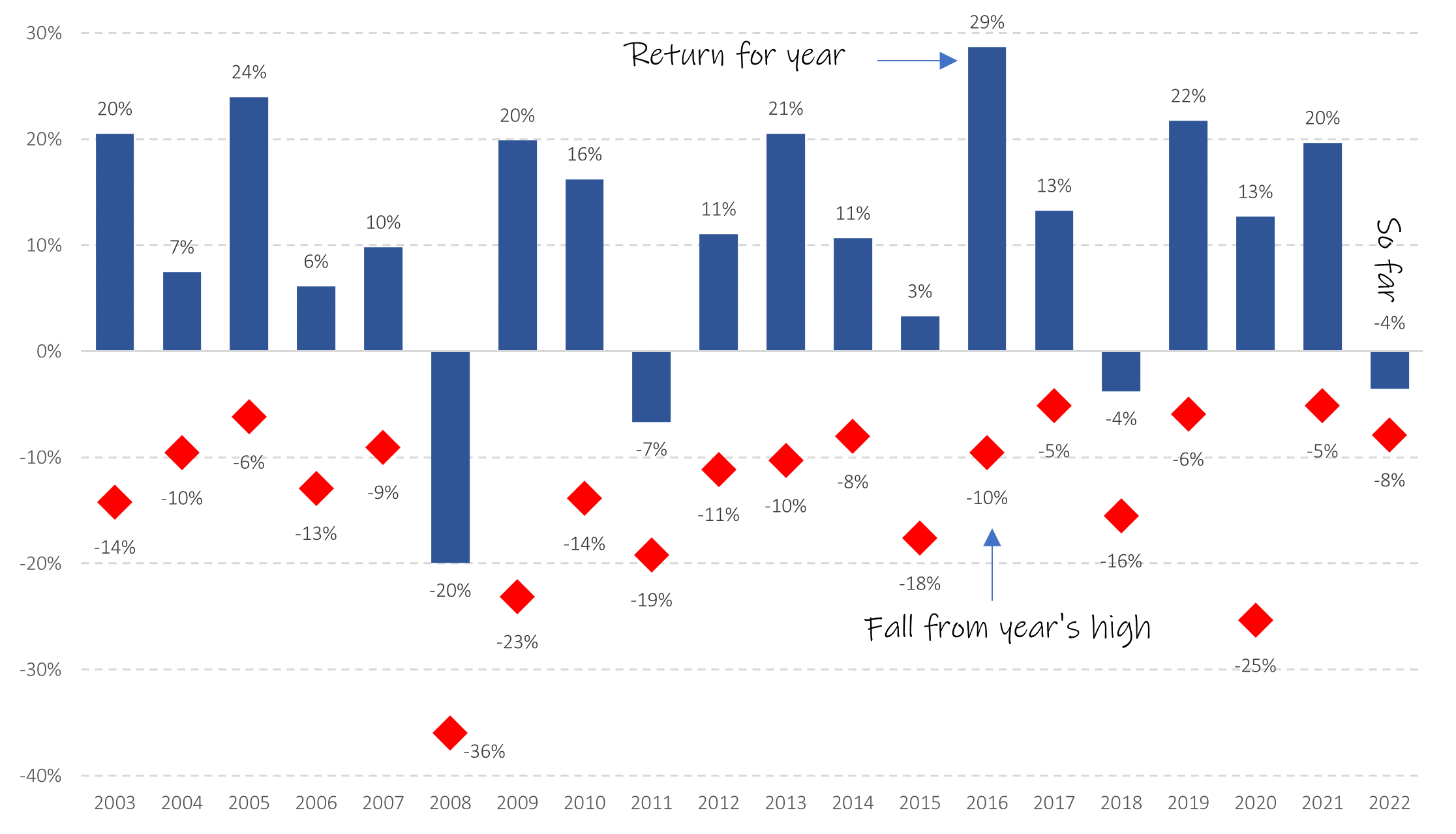

As an investor, your equity allocation is the long-term driver of portfolio returns and needs to be viewed with your true investment horizon in mind. Most of us should be planning to receive a card from the Queen at some point in the future! You do not need this capital now, so you should try to avoid being concerned with shorter-term market movements. You can make up all sorts of stories and ‘what if’ scenarios about where the market might be headed. You may be right, but you may be wrong. Generally, this is an unhelpful process and is best avoided. Remember that market prices reflect all investors views, many of which will be like your own. It is not nice when our portfolios fall in value – as they have done so far in 2022 - but it does not really matter, as our horizons are long (if they weren’t you would not be in equities), and it is this very uncertainty of outcomes from investing in a very broad array of companies that delivers the higher returns that equities eventually bring. Take a look at the chart below. Every year, markets fall from some market high. Long-term investors who get shaken out of markets pay dearly in the long run.

Figure 1: Markets always fall from a market high during the year, sometimes materially

Source: Albion Strategic Consulting. Data: MSCI ACWI Index GR in GBP from Morningstar Direct © All rights reserved.

Yet look how often market returns are positive. This year the markets may go up, down or sideways - nobody knows. Bears will say ‘down’, bulls will say ‘up’, and most people will be entirely uncertain!

The markets have started down in 2022, but that tells us little about the future. Markets do what markets do.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

The value of your investments can go down as well as up, so you could get back less than you invested. Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Use of Morningstar Direct© data

© Morningstar 2022. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted, or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.