February 03, 2022

Article

Given the recent rise in the base rate made by the Bank of England. It is important to revisit how changes in interest rates will affect your business.

To put the current market into context 33 years ago, the Bank of England base rate was 13.875%. 30 years before that the base rate was 4% not too different to 14 years ago.

Ultimately, the global economy works in a cycle. I would not be surprised if within my working lifetime I see interest rates of 10% or above.

Every business is exposed to interest rates changes differently. It is therefore important to consider the cash flow impact of any change to rates and how it affects your ability to repay your debts.

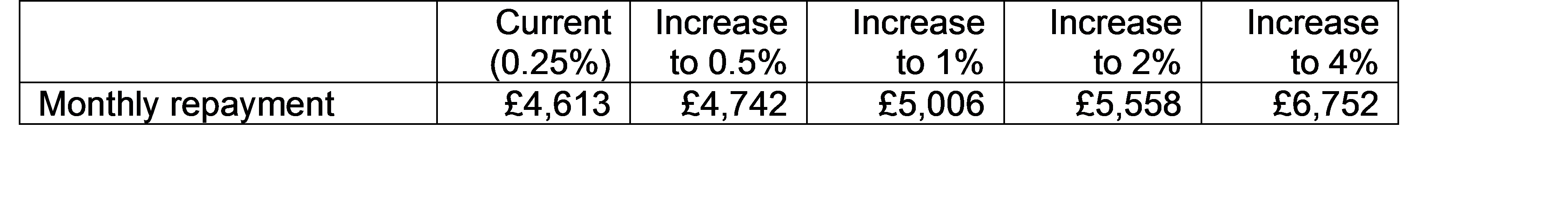

To consider a practical example, if a business has £1m of borrowing over 25 years on a variable basis at 2.5% + base, then the impact of base rates increasing are shown below:

At an increase of 4%, the monthly cost of the loan would increase by just over £2,100 a month (£25.6k a year). For every business the financial impact of this change is different. For some businesses this could mean the end and for others it could mean no sunny holiday.

It is important that you understand how changes affect your business and whether it is worth mitigating your risk by fixing some or all your loans.