October 29, 2024

Article

In August, we had the long-awaited news that the Bank of England (BoE) cut the base rate which was welcome news to most

across the country. Whilst small, the cut from 5.25% to 5% was a signal that (fingers crossed) more rate cuts are to come.

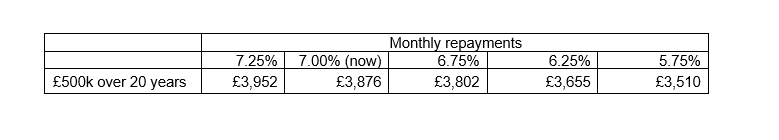

For those with variable rate debt, they will see a reduction in their monthly repayments with every rate cut. Illustrated below is the

impact on monthly repayments for a farming business with a £500,000 variable rate loan over 20 years at 2% plus BoE base rate.

As you can see above, if we have a reduction in the BoE rate to 3.75% then a business with the above debt would save £366

a month.

The questions on the minds of many business owners taking out new debt now are:

- What is the new normal base rate; and

- Should we consider fixing our debt?

On the question of the new normal, many high street banks are suggesting a rate between 3.5% - 4% before the end of 2025.

For those businesses taking out new debt, they have two options.

- Choose a variable rate loan, hoping that interest rates will come down.

- Fix the loans now at the rates quoted.

It is important to review both the variable and fixed rate options available to you. This is because often the markets have priced in the rate cuts in their fixed rate offer. This could mean that the margin between the fixed and variable is quite small and, in some cases, the fixed could be cheaper.

Of course, which option is best for you depends on your attitude to risk and business cashflow. It is also important to remember there are often repayment penalties for fixed rate loans when they are repaid early. This can be costly if you are in the fortunate position to be able to repay the loan early in the future.

On a side note, it is also worth noting that base rate cuts also decrease the governments’ interest payments on government held debt. Reductions in the base rate could help alleviate some of the blackhole mentioned by Rachel Reeves.