February 03, 2022

Article

Whether you are looking to invest in a new combine, tele handler or other machinery, a key issue is figuring out how best to finance. You may be fortunate enough to have the cash to purchase the asset outright, but if not, you are likely to reach for a hire purchase or lease.

Leases

There are two main types of leases that you could enter: operating leases or finance leases.

Operating leases:

If you enter an operating lease, you will effectively be renting the asset over an agreed period. The lease payments are tax deductible and any VAT on each payment is reclaimable. In many cases the finance company will be responsible for insuring and repairing the asset. The downside is this type of lease is likely to be more expensive in the long run as the monthly repayments are generally higher than a finance lease or hire purchase.

Finance leases:

A key difference is a finance leased asset will be recognised on the balance sheet as well as the lease liability. The additional benefit of this is that the depreciation charged on the asset recognised is allowable for tax purposes. The finance payments are also tax deductible and any VAT attached to these are reclaimed on each payment. The business will however be liable for insuring and maintaining the asset themselves.

At the end of the lease agreement the business will not own the asset but could still use the asset going forward at reduced monthly payments. Otherwise the asset will need returning to the finance company. No capital allowances can be claimed for assets on finance leases.

Hire Purchase (HP)

With a HP, the business will own the asset at the end of agreement. There is normally a small option to purchase fee at the end of the repayment period but then the asset is completely owned by the business.

The repayments are not tax deductible and won’t be shown in the profit and loss account. Like a finance lease it will be the business’ responsibility to maintain and ensure the asset. The depreciation of the asset is not tax allowable either, but it isn’t all doom and gloom as, in the year of the asset being purchased it is likely to qualify for capital allowances. This does mean that if the business manages to sell the asset later the proceeds will be taxable income too. This shows tax relief is received earlier with a lease.

At the initial purchase date all the VAT for the asset on hire purchase is immediately reclaimable rather than having to claw this back month by month over a finance lease so this can have an additional cash flow benefit.

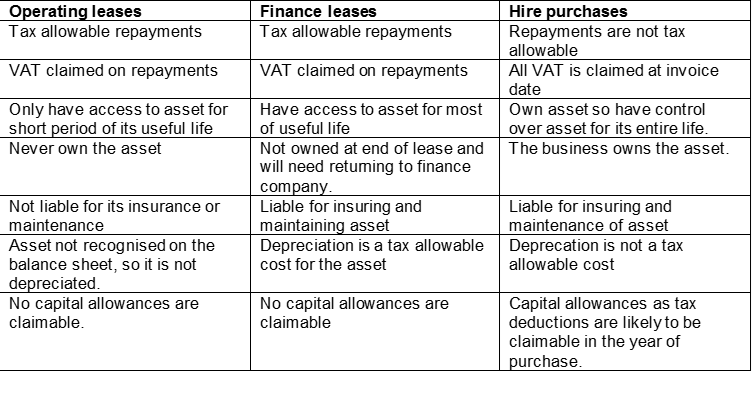

Summary of differences between leases-

To be help you decide the type of agreement which is right for the business you should focus on what the long-term benefits of owning the asset are against the cash flow effect and the tax relief. To do this you should obtain all the deals from the supplier, consider how long you will keep the item and what it might be worth when you sell it. We can then calculate the cost of each financing option for you as well as the cash flow impact.