October 02, 2023

Article

UPDATE

Following feedback, the FRC have delayed the proposed effective date by a minimum of 12months, taking it to 1 January 2026 at the earliest. There no other major updates other than confirmation that, the FRC have listened to the feedback produced by the periodic review and are now building in further proportionality and additional developments to IFRS for SMEs.

The update can be seen here.

The FRC released the Financial Reporting Exposure Draft 82, in December. The main drive is to better align UK accounting standards to International Financial Reporting Standards (IFRS).

The consultation period closed on 30 April 2023 so we are now waiting for the final version of the standard to be released ahead of the proposed effective date of 1 January 2025. So how might the proposed changes impact your business?

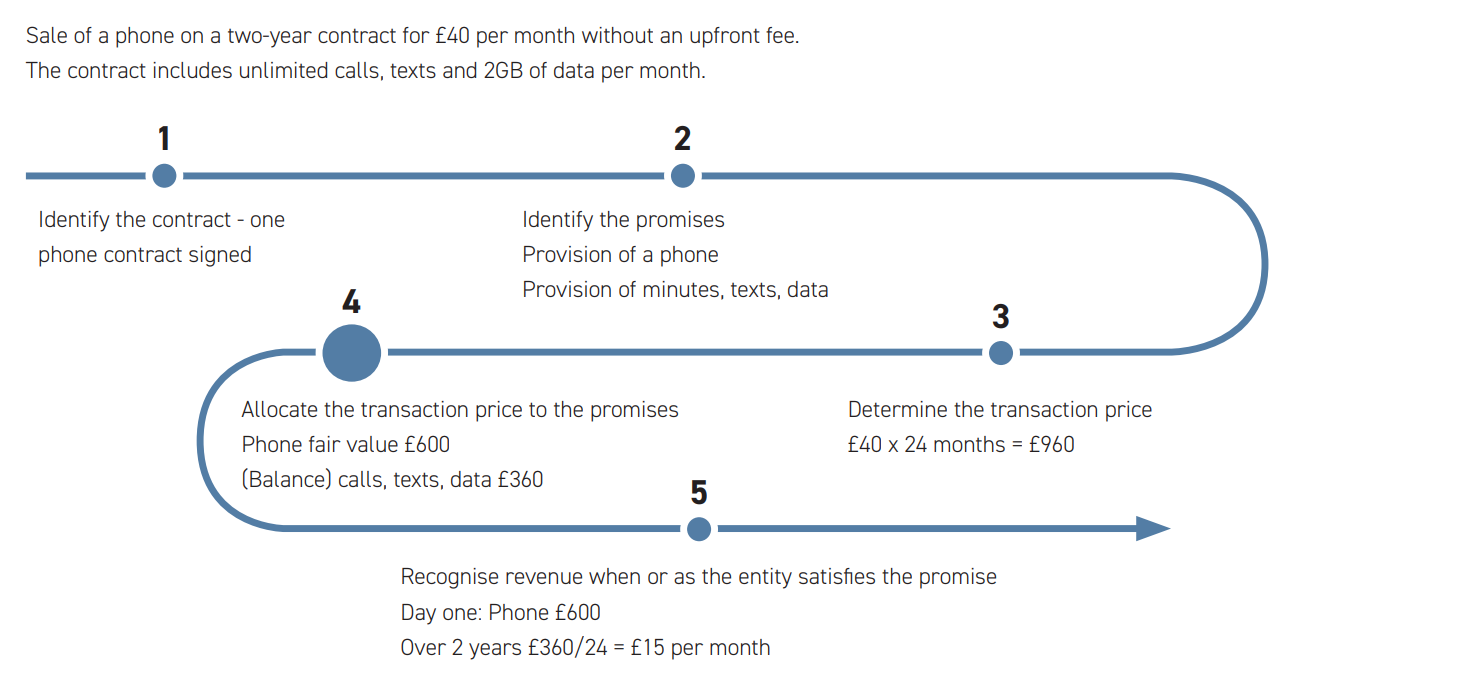

1. Revenue recognition changes for any size of business

A new Revenue Recognition model is proposed based upon IFRS 15. A 5 step recognition process is likely to be introduced:

- Identification of a contract

- Identification of promises

- Allocation of a transaction price

- Matching of the transaction price to the promises

- Recognition of revenue based on fulfilment of promises

This may result in businesses that have contracts falling into the following categories having their income recognised over an extended or shortened time frame, which could impact on your accounting profits:

- Products and services sold within the same contract/transaction

- Contract lengths not matching the period over which the service is provided

- Service provided is unevenly weighted over the delivery period

A SIMPLE EXAMPLE WOULD BE:

Under current UK GAAP the contract above would be recognised in revenue at £40 per month. The 5 point recognition process speeds this up.

On first time adoption, retrospective application will be required for any contracts which are not complete at the implementation date. The impact of the 5 step model should be considered on any new contracts which will span the 2025 year.

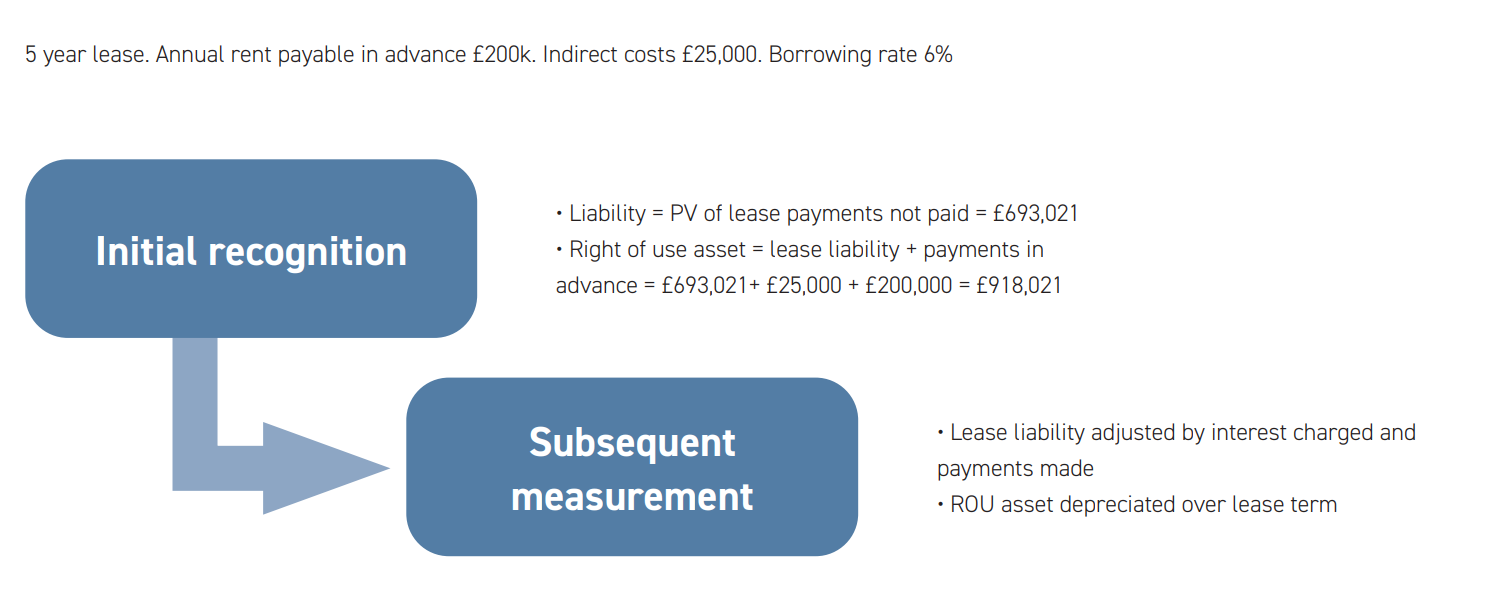

2. On balance sheet lease recognition for non-micro entities

A new method of presenting leases based on IFRS 16, is proposed for small, medium and large entities but not for micro entities. The proposal requires recognition on the balance sheet of a right of use asset and a corresponding lease liability. This will have little impact on the lessor but will be a major change to lessees.

For lessees a right of use asset will need to be calculated as the lease liability, plus payments made at or before commencement of the lease, direct costs, rectification costs and less any lease incentives. The asset is then held at cost less depreciation / impairment or at revaluation.

The corresponding lease liability is then recognised at the present value of the future lease payments, discounted using one of the following rates: the rate implicit in the lease, an incremental borrowing rate, an obtainable borrowing rate or the guilt rate.

FOR EXAMPLE:

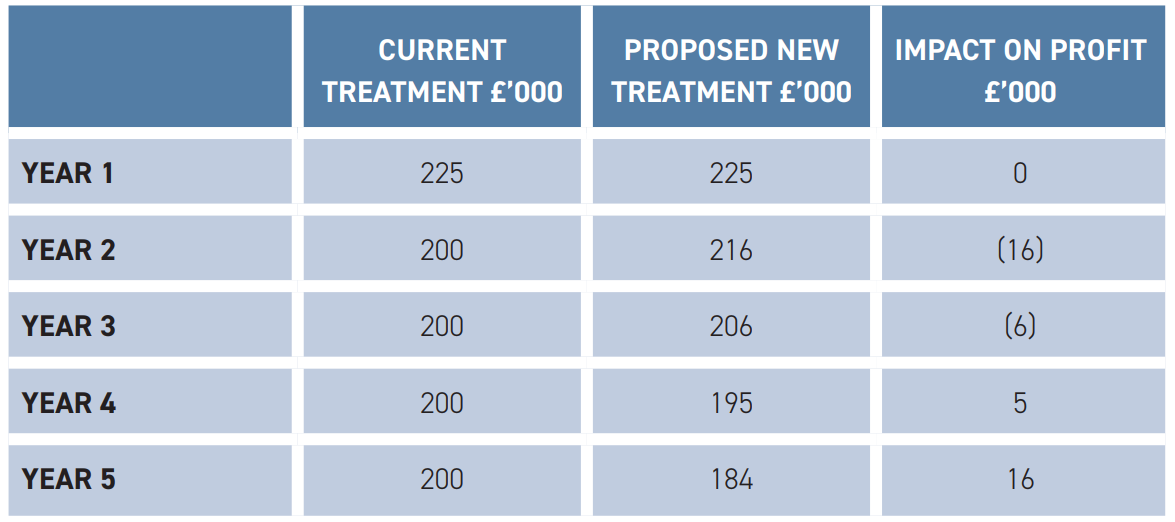

The impact on the profit and loss would be:

On first time adoption entities are permitted to keep comparatives as they are. The lease liabilities can be added at the PV of remaining lease payments and the asset included at the same value. There is also the option for group entities who are included in consolidated IFRS financial statements to use the amounts currently recognised under IFRS 16.

When entering into new lease contracts, and when reviewing current lease contracts it would be worth considering the impact on the balance sheet, particularly net current assets, of the new lease model.

3. Enhanced disclosures for small entities

A number of previously encouraged disclosures are likely to become mandated resulting in more information being available at Companies House. The most significant of those are:

- Going concern disclosure

- Dividends

There are also additional disclosures required relating to revenue recognition, lease arrangements and off balance sheet items as a result of the changes above. On top of this share based payments disclosures will be required along with an enhancement to the deferred tax disclosures.