November 15, 2023

Article

On 26 October 2023, the Economic Crime and Corporate Transparency Bill received Royal Assent, and the Act was published.

The purpose of the act is to increase the powers for tackling money laundering, illicit activity and reforming Companies

House operations and powers. There is no timetable at present for these changes to be implemented. The Bill was first introduced to the House of Commons back in September 2022 and has evolved since then with the key provisions which have made their way to final stages being:

- Changes to the financial statement filing requirements for smaller companies

- Small entities to file both P&L and directors report at Companies House**

- Micro entities to file P&L only at Companies House**

- Increased accountability required for audit exemption

- Identification of audit exemption being taken and confirmation of eligibility for the exemption where appropriate

- Mandating the method of delivery of documents to Companies House

- Increased movement towards electric methods

- Request the filings of >1 document to be filed together

- Enhanced companies house powers for verifying the integrity of information provided

- Inconsistent, incomplete or incorrect information will be rejected (and treated as not delivered)

- Introducing identity verification for registered company directors, people with significant control and those who file on behalf of companies

- Providing Companies House with more enhanced investigation and enforcement powers, and introducing cross-checking of data with other bodies

- Enhancing the protection of personal information provided to Companies House

- Reforms to prevent abuse of partnerships

- Enhancement of regulations surrounding limited partnerships

- Additional powers to seize and recover suspected criminal crypto assets

The filing of a profit and loss account at Companies House will ensure this information is available on the public register. Filleted abridged accounts will no longer be filed. It was felt that minimal disclosures were concealing fraudulent activity, including money laundering, and the new rules would improve the reliability of information for all.

The introduction of a director’s report for small entities is designed to provide explicit verification from directors to aid in the reduction of misuse around minimal disclosures and also reduce the abuse of the dormant accounts’ rules.

A new corporate offence is also being introduced for large organisations, being the failure to prevent fraud. Defence is possible where appropriate safeguard procedures have been implemented. There is also a new regulation applicable to all corporate entities or partnerships, enabling liability to be the entity for economic crime offences, where a senior manager, acting within the scope of their authority, commits or attempts to commit a “relevant offence”. This latter provision will come in to force on 26 December 2023 whereas all further regulations will be implemented at a date to be appointed by the regulators.

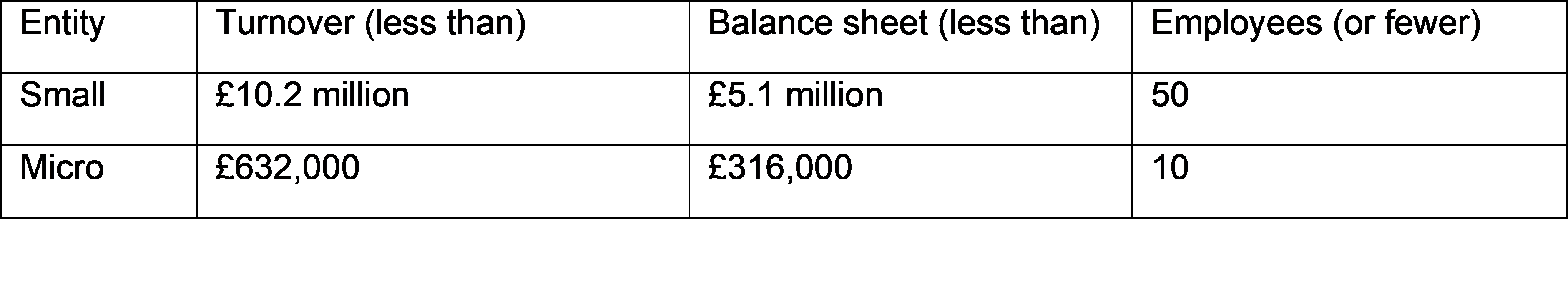

** Classification of small and micro entities