June 11, 2024

Article

Since 1 October 2016, large companies and limited liability partnerships (LLPs) have been required to report on their payment practices and policies relating to relevant contracts, and comment on their performance in relation to these. On 21 May 2024, draft reporting amendments on payment practices and performance specifically in relation to construction contracts were laid before parliament.

These amendments include:

- A new schedule 2 which sets out the use of retention clauses and the terms surrounding the holding of retentions in qualifying construction contracts.

- Publishing of retention payment performance statistics

- Publishing of the information set out in Schedule 2 in respect of an entity’s qualifying construction contracts.

The amendments are due to come into force on 1 October 2024 with reporting required by qualifying large companies and LLPs for financial years commencing on or after 1 January 2025.

Why is disclosure considered necessary of general payment practices?

Late payment of invoices can cause detrimental cash flow problems to businesses who do not receive the funds owed to them on time. Mandating publication of payment statistics highlights those businesses who do not pay suppliers promptly, encouraging them to consider the impact that their payment practices may have on their reputation.

What is a large company?

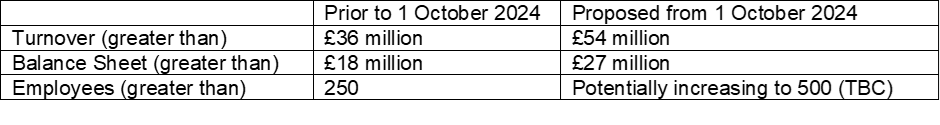

A company is large if it meets two or more of the following size criteria for two or more consecutive years:

What are payment practices and policies?

The following information will make up the company’s practices and policies with regard to payments for relevant contracts: -

- Standard payment terms and whether these are part of the company’s code of conduct or ethics (this links with Modern slavery requirements.)

- Separate payment arrangements which do not fall within the standard payment terms

- Method of processing and paying invoices

- Details of disputes on invoices and how invoice disputes are resolved

- Payments made with regard to interest / penalties for late payment of invoices

What are the reporting requirements?

Large companies are required to publish their payment practices, policies and performance within certain timeframes after the end of the period to which the report relates. The statement must be signed by a director and an update published every six months. Each statement should then remain on the company’s website for three years so that comparisons of practice and performance can be made. Further information can be found here and here.

What format should the report take?

An example Report on Payment Practices and Performance has been published by the Business Innovation and Skills department (example report).

For further information, please contact Sarah Milsom or your usual Albert Goodman advisor.