February 15, 2022

Article

Following the release of the guidance on the BPS lump sum, we have a confirmed guide for how the lump sum will be calculated.

The lump sum payment will be calculated at 2.35 times of the average BPS payment in 2019, 2020 and 2021. It will however be capped at £99,875, so for farms bigger than around 450 acres they will be capped at the £99,875 level.

The rules to qualify for the lump sum are that the farmer is required to retire from farming, surrender their BPS entitlements and either sell, gift, or lease their farmland on a minimum five year FBT.

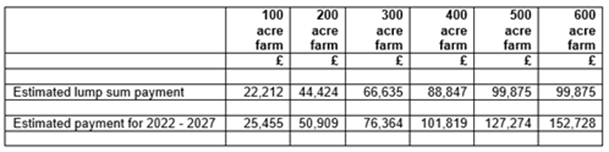

Based on the proposals we can compare the estimated lump sum to the entitlements that might be paid until 2027, depending on the size of the farm as follows:

As you can see above, for the larger farms the scheme looks like a no go, unless there is a need for upfront cash now. However, for those smaller farms with little or no succession then the prospect of receiving a lump sum could be an attractive retirement bonus.

The government intend to introduce legislation to provide clarity that the Lump Sum Exit Scheme payments will be treated as capital in nature and will be subject to capital gains tax, or corporation tax in the case of incorporated entities. The existing capital gains reliefs will be available where the qualifying criteria are met.

This adjustment to the tax could provide some added incentive to the scheme as it is likely that a cessation in farming would mean that the claimant could claim business asset disposal relief and therefore the tax due on the lump sum would be 10% not 20-42%.