October 28, 2021

Article

As well as talking through the profit and loss account of each farming client, we also focus on the cash flow statement.

Cashflow management is important for most farming businesses, due to the amount of capital invested in stock, machinery, and land.

Given the day to day investment required, most farming businesses have a significant amount of loans, working overdrafts and/or hire purchase arrangements.

The latter is often a less well-managed source of finance. Hire purchases arrangements are a useful and essential source of finance for machinery and tractor purchases. We do also see them used to purchase livestock and fund short-term cash requirements when other financial providers will not.

In recent years we have seen a vast increase in the cost of machinery and tractors and therefore an increase in the hire purchase liability and the monthly payments due. This, coupled with the demand for having new machinery, has resulted in some farming business having substantial monthly repayments to make.

I recently reviewed the historic “UK Farming accounts”. This showed that from 2000 to 2018 the total amount of hire purchase debt in agriculture had increased by over £1bn and to over £1.5bn. It is therefore key for businesses to review their current arrangements to see whether they can firstly manage with the current commitments and whether they can afford new ones.

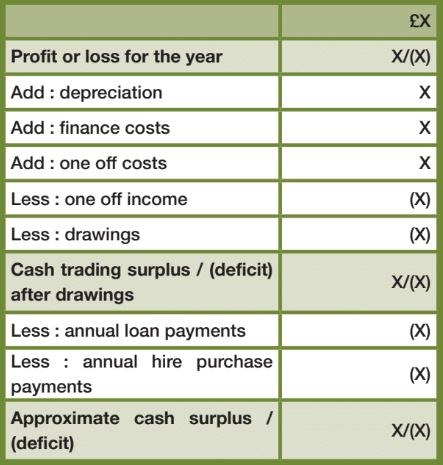

A simple way of looking at this for any business is to open your last set of accounts and complete the following formula: