May 17, 2022

Article

The 2021 Spring Budget announced an increase to the main rate of corporation tax, to take effect from 1 April 2023 (Financial Year 2023).

Currently, the rate of corporation tax is set at 19% regardless of the level of profits made by a company. This is set to change with the main rate rising to 25%, although some smaller companies will continue to benefit from the lower rate.

The lower rate will be unavailable to close investment-holding companies and those not resident in the UK.

From 1 April 2023, the applicable tax rate will be determined based on the level of a company’s profits, with those over £250,000 paying tax at 25% (on the total), and those with profits below £50,000 continuing to pay at 19%.

Marginal relief will apply to profits between £50,000 and £250,000 to smooth the transition between the small profits rate and the main rate. The tax due is calculated by applying a complex formula and despite the ‘smoothing’, it has the effect of increasing the tax due on profits within this range to a rate above 25%.

Companies may therefore wish to plan and consider reducing profits below the marginal rate limit where this is likely to apply. For example, this could be achieved through the making of employer pension contributions or by bringing forward the purchase of plants and machinery.

Example

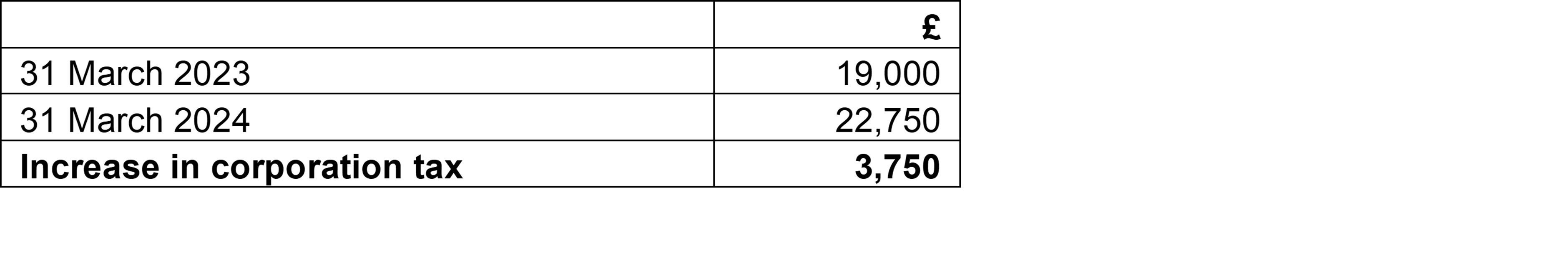

A company has taxable trading profits of £100,000 in each of the two years ended 31 March 2024. It has no associated companies and no other sources of income. The tax liability for each year is summarised in the table below.

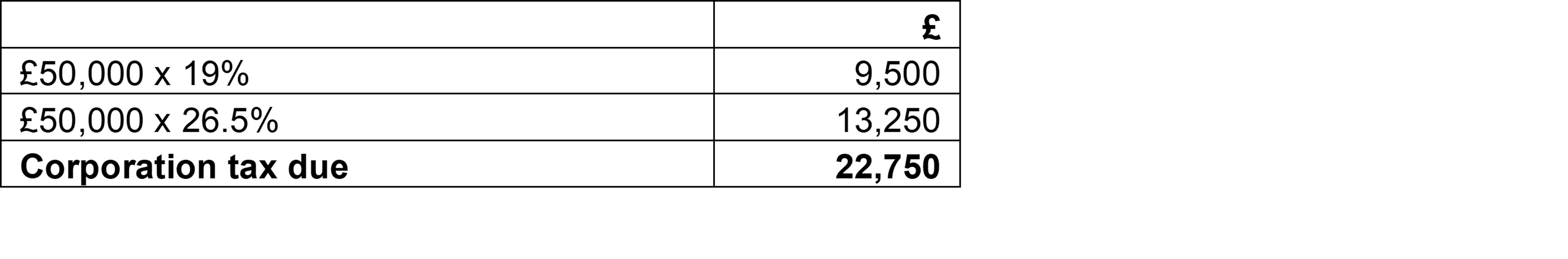

The corporation tax due on 31 March 2024 is calculated by taxing all profits at the upper rate and then applying a reduction for the marginal relief, which in this example is £2,250:

Each additional £1 of profit in the marginal rate band (between £50,000 and £100,000 for this company) is therefore taxed at an effective marginal rate of 26.5% which is more expensive than the main rate of tax, and hence the need for businesses to plan accordingly.

Other points to consider

When calculating the corporation tax due from 1 April 2023, it is important to remember that where a company’s accounting period straddles more than one financial year, the chargeable profits of the accounting period must also be apportioned between the applicable financial years in determining the rate of tax.

The marginal relief calculation makes reference to a company’s ‘augmented profits’ which generally will be a company’s taxable profits plus any exempt distributions from non-group companies (for example dividend receipts from non-group companies).

Care also needs to be taken with the £50,000 lower and £250,000 upper limits as these will be proportionately reduced where:

- an accounting period is less than 12 months, and/or

- there are associated companies.

The way in which associated companies are recognised is also changing from 1 April 2023 from the current test of at least 51% ownership to one of control. This is likely to result in more companies becoming associated.

If you would like to discuss how any of the upcoming changes may affect your business then please get in touch.