July 30, 2024

Article

“The Government will reform the tax system by abolishing Class 2 self-employed NICs. From 6 April 2024, no one will be required to pay Class 2 self-employed NICs”. Autumn Statement 2023.

A lot has been said about Class 2 NICs being abolished, but unfortunately it is not that simple and will not be the case for everyone.

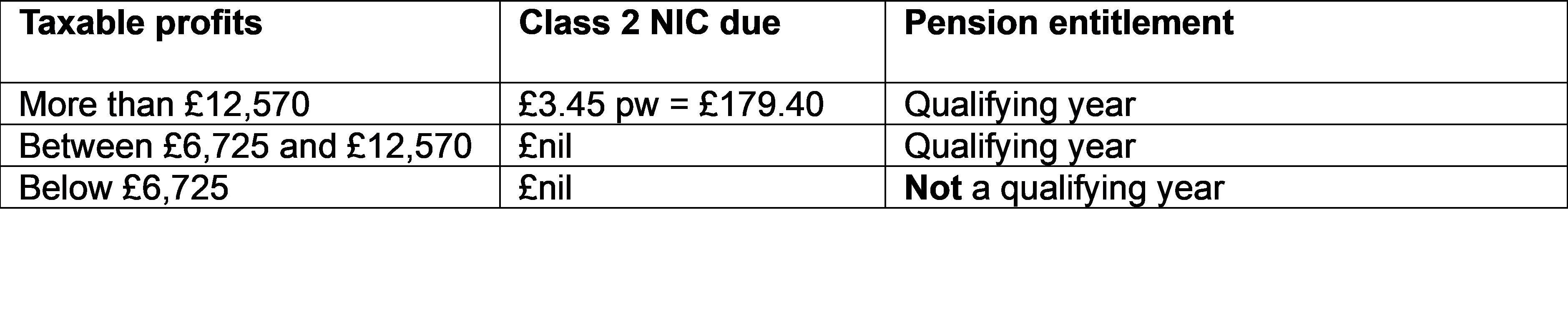

Class 2 NI is paid by the self-employed and provides a contributory year towards the individual’s state pension. The amount payable depends upon the individual’s taxable profits for the year. For 2023/24, this is as follows:

Individuals who are self-employed with profits below £6,725 can voluntarily pay the Class 2 NICs of £179.40 for 2023/24 to gain that qualifying year for state pension purposes.

From April 2024, individuals earning over £12,570 will not be required to pay Class 2 NICs and will still be entitled to a qualifying year for state pension purposes. However, those earning below £6,725 will still need to pay Class 2 NICs if they need a qualifying year for their state pension. Therefore, the tax has not been completely abolished.

This might be particularly relevant for farmers with lower incomes, or in years where purchases of machinery results in capital allowances which reduce taxable profits significantly. Taxable profits can also be impacted by averaging which can change the amount of Class 2 NI due.

If your taxable profits are below £6,725 but you already have sufficient qualifying years for your state pension, then there is no benefit to making further voluntary contributions. If, however, you do need further contributing years then it is recommended that you pay Class 2 NICs as this will be cheaper than paying the alternative Class 3 NICs.

In order to plan for these changes and to ensure that you qualify for the full state pension, it is important to know how many qualifying years you have, how many more you need and how many years you have left to make these qualifying contributions. This information is available on your personal tax account or can be requested either online or by phone from HMRC.