February 03, 2022

Article

FROM THE 1ST OF APRIL 2023 THE MAIN RATE OF CORPORATION TAX WILL BE INCREASING FROM 19% TO 25% ON TAXABLE PROFITS.

However, a small profits rate (SPR) will be introduced for companies with a taxable of profits of under £50k. These companies will continue to pay Corporation Tax at the current rate of 19%.

Companies with profits between £50k & £250k will pay tax at the main rate of 25% reduced by a marginal relief. The first £50k of these profits will continue to be charged at 19%, any profits between £50k and £250k will effectively be charged at a rate of 26.5%.

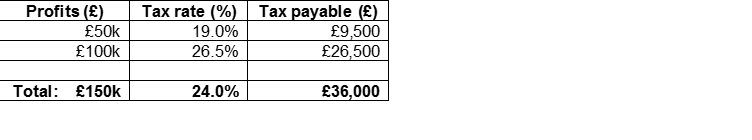

For example, if a company has profits £150k, this would result in tax payable of £36k, an effective rate of 24%, as demonstrated by the table below. This compared to a tax liability of £28.5k using the current rules (19%).

For companies whose profits exceed £250k, all these profits will be charged at 25% with no marginal relief.

If your accounting period spans the 1st April 2023 new rate start date, profits before this date will continue to be charged at 19% and any profits after this date will then be charged under the new rules. The limits will also be prorated if the accounting period is shorter than the usual 12 months.

Depending on your profit levels it may be beneficial to look at your year end tax planning. For example, if your company profits were between £50k and £250k, and you are paid a national insurance efficient salary from your company it may be worth considering increasing your salary to that of the personal allowance, meaning you are only being charged tax at 12% instead of 26.5%.

Alternatively, if possible you may be able to increase a rental charge from the company to you to maximise your basic rate band, meaning profits would effectively be taxed at 20% not the 26.5%.

Until the 31st March 2023 you will be able to reduce your corporation tax bill by investing in qualifying plant and machinery and special rate assets. Companies will benefit from a 130% first-year capital allowance on plant and machinery and 50% first year allowance on qualifying special rate assets.

The effect on group & associated companies

A company is associated with another company at a particular time if, at that time or at any other time within the preceding 12 months:

- One company has control of the other

- Both companies are under the control of the same person or group of persons.

For example, those with holding companies owning the property and a trading subsidiary company will fall under the first bullet point. A shareholder owning more than 50% of two or more companies will bring their companies under the second bullet point.

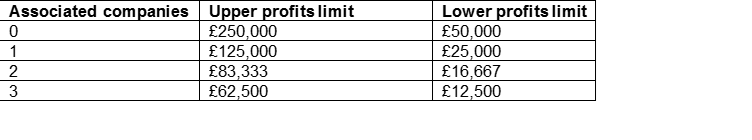

The lower and upper limits will be proportionately reduced where there are associated companies, the limits will be divided equally between each associated company as shown in the table below:

For example, if the company in the previous example had one other associated company, its profit limits would be halved to £125k & £25k. As the profit was £150k, this exceeds the upper limit and all the £150k of profits would be charged at the new main rate of 25% resulting in a Corporation tax charge of £37,500. Therefore, additional corporation tax each year of £1,500 will be payable

If the other associated company had profits below £25k it would be beneficial to move profits from company 1 to company 2 so these profits are charged at 19% not 25%.

As we approach the new rules and higher corporate rates, consideration should be given to year end tax planning and any planning which can be put in place to minimise the impact of the associated company rules.