January 30, 2024

Article

WHAT IS CHANGING?

As you may have read from our previous newsletters, basis periods for income tax purposes are being replaced by the "tax year basis”. If you already prepare your accounts to 31 March or 5 April each year, you won’t be affected by these new rules as you are already being taxed on the tax year basis. The new rules will impact unincorporated businesses, partnerships and sole trades with an accounting year end other than that of 31 March or 5 April. The change will first apply in 2023/24 so from 6 April 2023, with transitional rules applying. If you operate with a different year end, you will have to choose to either:

- Change your business year end; or

- Keep your existing business year end and time apportion profits from two accounting periods, to arrive at a tax year basis profit.

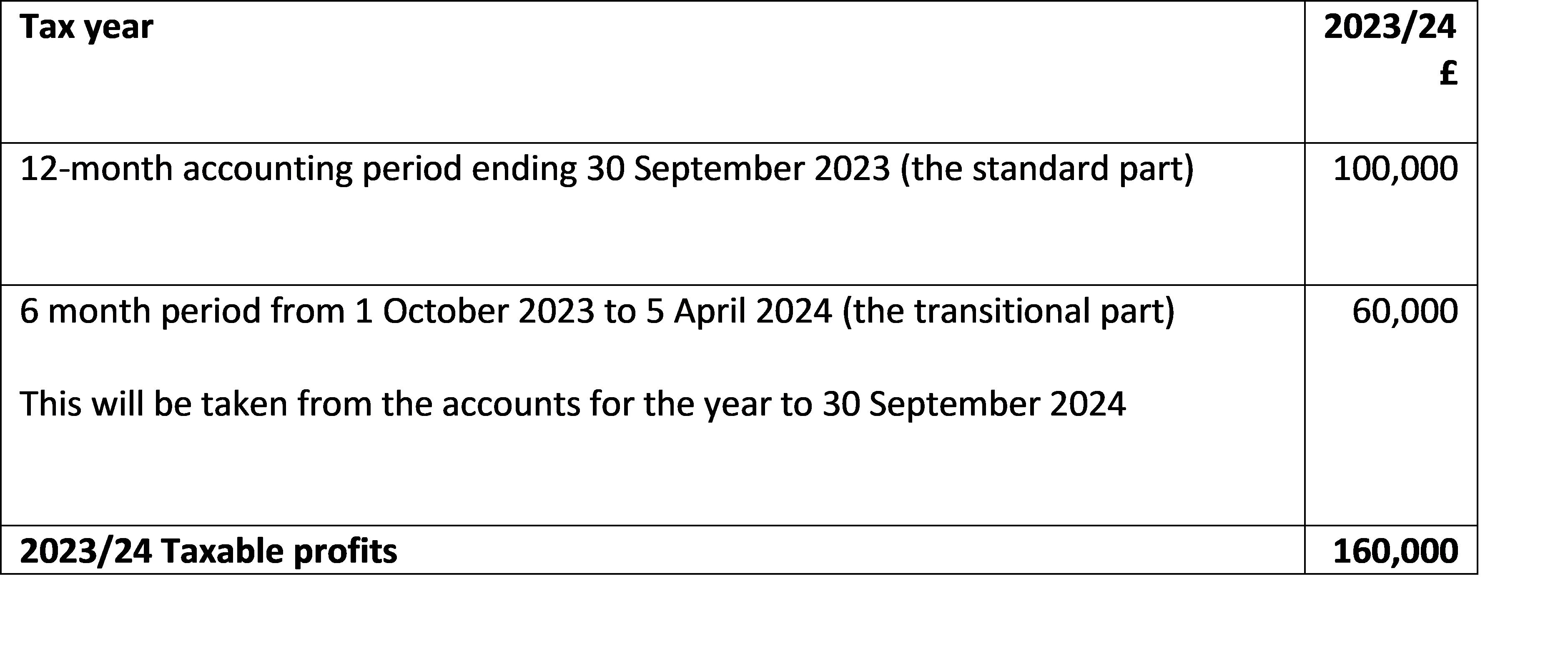

The following is an example of how the transitional rules will work for a business that has a 30 September year end.

As you can see from the table, this will mean 18mths of profits fall into the 2023/24 tax year which will bring the payment of tax closer to the time that the profits are earnt.

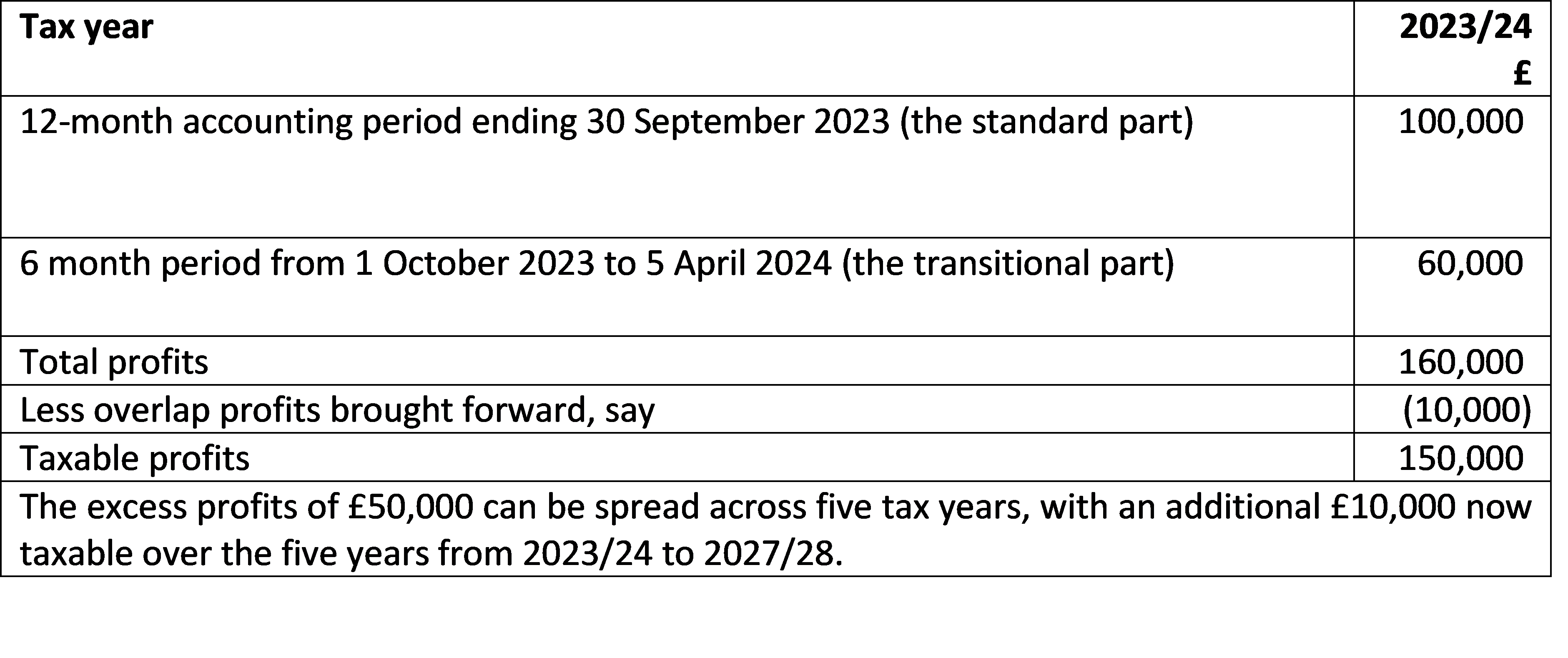

RELIEFS IN THE TRANSITION YEAR – OVERLAP AND SPREADING

During the year of change there is relief in the form of overlap profits. Overlap profits are profits from your first year of trade which were taxed twice and can be relieved when you move your year-end closer to a tax year basis. However, unless you joined a profitable business the overlap profits may be modest or non-existent.

You can also spread the excess profits being taxed in2023/24 over 5 years from 2023/24 to 2027/28. The amount that can be spread are those from the transitional period less any overlap.

These reliefs are shown in the example below.

INTERACTION WITH FARMERS AVERAGING

Farmers five-year averaging may also be available; however, you can only average the normal profits and not the excess profits or the transitional profits which you maybe spreading over the next 5 years. Although restricted averaging is still a useful tool in tax planning.

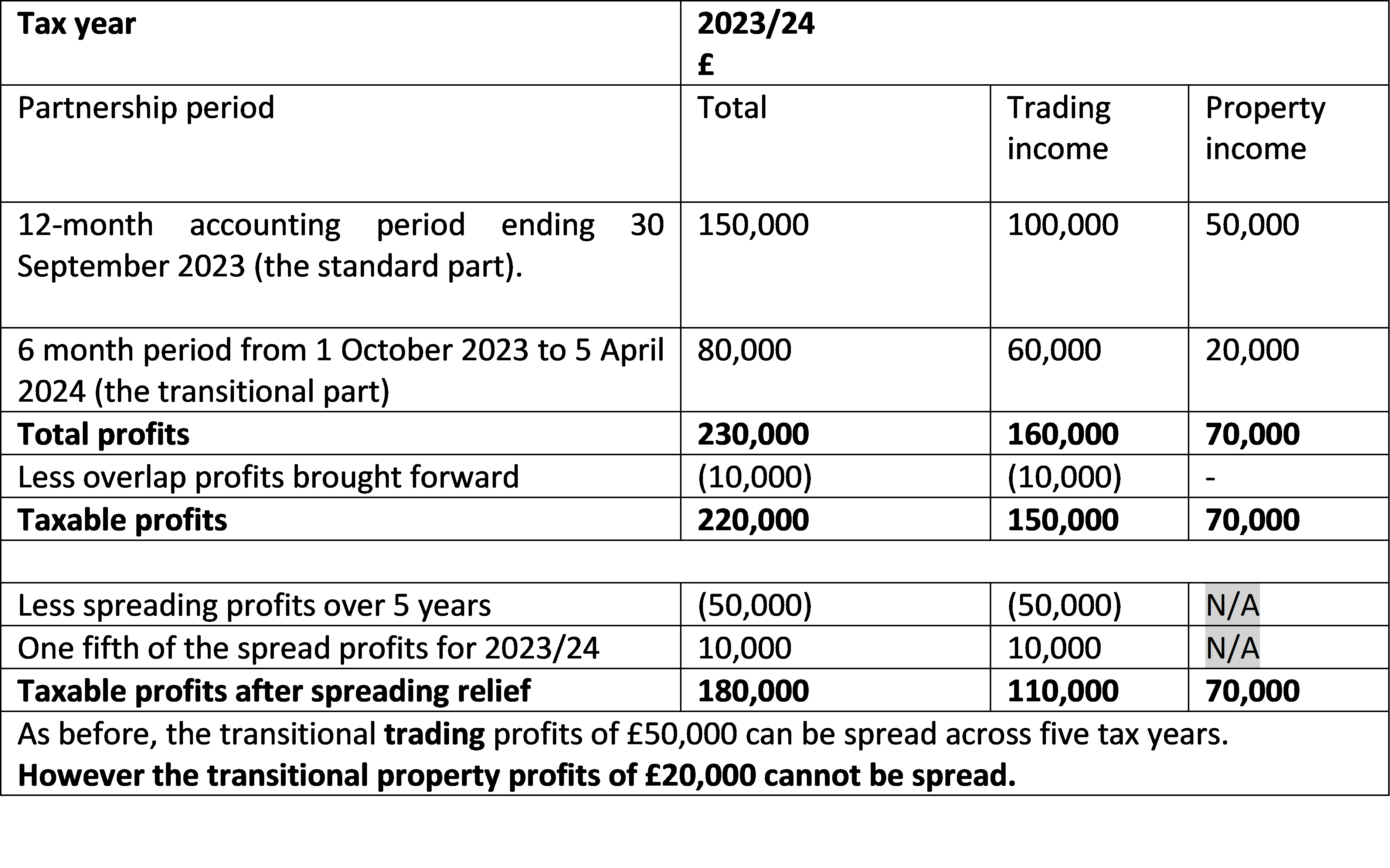

PROPERTY INCOME - COMMERCIAL OR RESIDENTIAL LETTINGS

Many rural businesses have additional sources of income in the form of rental income. A farming partnership may let out property as commercial units or residential properties(excluding their own farm workers).

For a partner in this type of partnership, the basis periods used for rental profits have been the same as that used for the trade. The change in basis periods will also align partnership property income to the same basis.

A major problem for those with property income is that the legislation introduced regarding spreading relief, only refers to ‘trading profits’ and will therefore only apply to your trading partnership income and not income from property, whether that is commercial or residential.

Continuing with the example above but now including property income:

Those operating as a partnership with a year end that is not already aligned to a tax year with income from rental property therefore need to consider whether profits can be mitigated in advance of these changes.

For example, if you have large repairs planned for next year or even the year after, by bringing these forward, to before the 31 March 2024, the additional property profits being taxed due to these changes, could be reduced.

It is also important to remember that there are no capital allowances on capital expenditure on residential property, so, for example, an extension to a residential property would obtain no relief.

There is relief available on capital expenditure for those with commercial lettings. The extension of a commercial unit would result in 3% relief from the cost of the structure itself, however there may be 100% relief (AIA) on integral features such as costs for the lighting, plumbing, heating and of plant such as kitchens and bathrooms if these are installed in the unit.

Partnerships with a year end of 30 April and with property income will be most impacted for 2023/24 as their 2024 tax return will include the period from 1 May 2022 to 31 March2024 - a total of 23 months. These changes therefore make it even more important to plan for your 2023/24 tax liability early.