August 09, 2023

Article

Increasing relief using capital allowances, certainly for companies, has featured heavily in the last few Budgets. Most recently the 130% super-deduction, introduced in 2021 by then chancellor Rishi Sunak, has been replaced with what is known as full expensing for companies on certain qualifying new plant and machinery purchases from 1 April 2023 until 31 March 2026.

This means that 100% of expenditure can be set against income in the year of spend, with no limit.

The £1m annual investment allowance (AIA) for all businesses has also been made permanent – this is important as it includes used equipment, which full expensing does not.

While the above is welcome for farming businesses, particularly those operating as a company, the complexity of the capital allowance system continues to increase. This means taxpayers should be careful when planning machinery purchases, property improvements and new agricultural buildings.

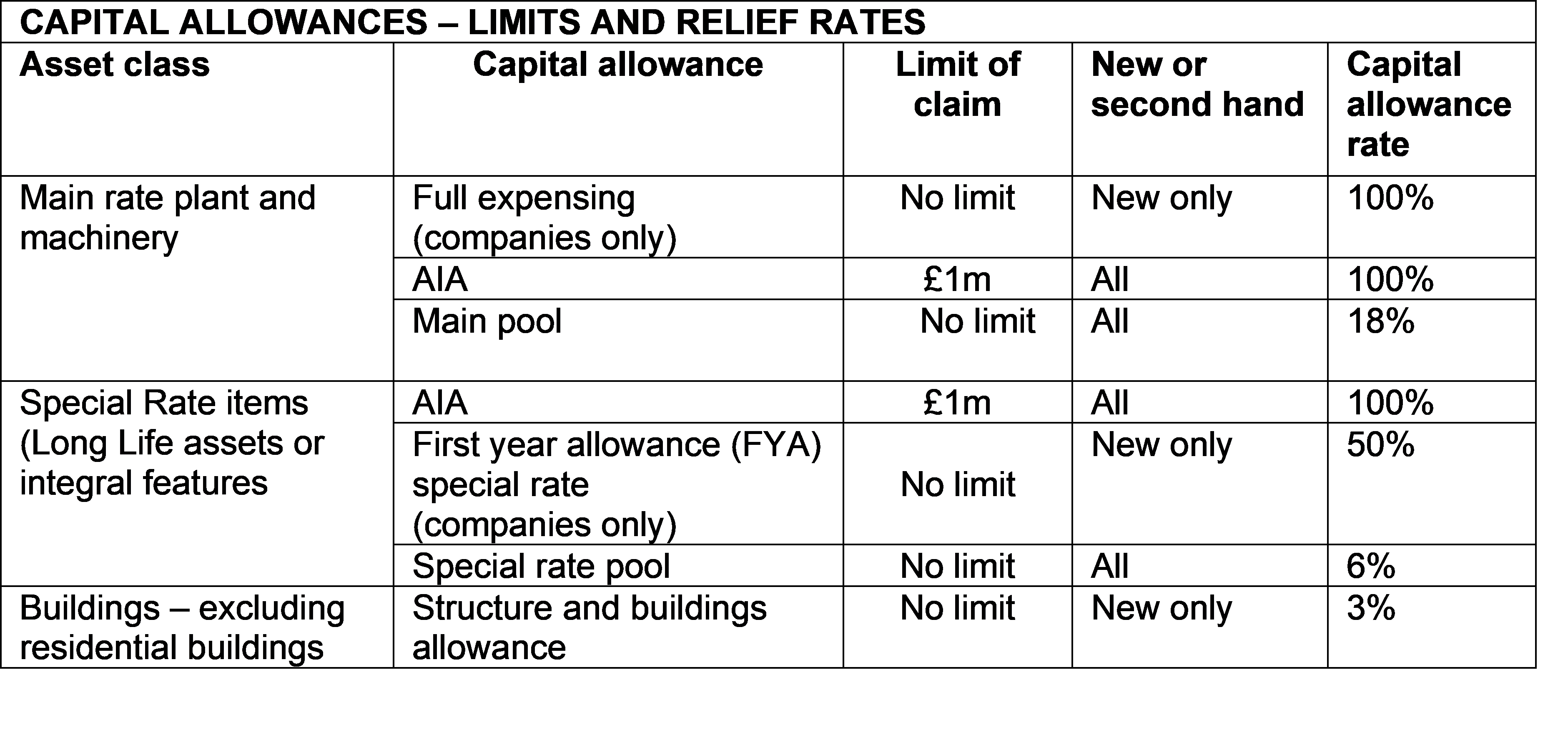

There are now many capital allowance rates, each with their own limits and conditions. The benefit for corporate businesses is that full expensing and the 50% first year allowance (FYA) on what are termed special rate assets have no annual limit, unlike the AIA - see table. Special rate assets include integral features which perform a function in a building for example, electrics, heating, ventilation, and plumbing. Solar panels also qualify.4

Full expensing - what is not included?

As with the super-deduction, the following do not attract full expensing:

- used plant and machinery.

- special rate items such as solar panels – this is often misunderstood.

- cars (except for the purposes of the FYA for electric and zero-emission cars).

- expenditure incurred in the accounting period in which the qualifying activity is permanently discontinued.

- expenditure on the provision of plant or machinery that is to be leased.

Corporation tax rates

The timing of the commencement of full expensing coincides with the increase to the main rate of corporation tax.

From 1 April 2023, the corporation tax rate for each business will be based on the level of a company’s profits, with those over £250,000 paying tax at 25% (on the total), and those with profits below £50,000 continuing to pay at 19%.

What is known as marginal relief will apply to profits between £50,000 and £250,000. The tax due in this bracket is calculated by applying a complex formula which has the effect of increasing the tax due in this range to a rate over 25%.

Care also needs to be taken with the £50,000 lower and £250,000 upper limits as these will be proportionately reduced where:

- an accounting period is less than 12 months, and/or

- there are associated companies.

Any potential large capital expenditure should therefore be planned well in advance to ensure that both the correct timing and structure is in place to attract the best relief.