August 09, 2023

Article

HMRC have released figures showing that receipts from Inheritance Tax (IHT) have exceeded £6bn in the last tax year and are increasing year on year. This trend is likely to continue as property values increase and allowances remain static at £325,000 until at least 5 April 2026.

With HMRC clearly focusing on increasing receipts from IHT, it is key to ensure that the availability of relief is correct to minimise any liabilities. While there are several reliefs from IHT available, this article focuses on Business Property Relief (BPR).

To claim BPR a business must be deemed to be mainly trading. This is determined by looking at the Balfour Test; a complex test which compares the trading and investment elements of the business in terms of capital invested, turnover, profitability, and time spent. In order to pass the Balfour Test the business has to be wholly or mainly trading, and at present, this is considered to be a 50% test. If the business passes then IHT relief is available on the full value of the business.

Where assets are used by a business but are not actually part of the business, the relief is restricted to 50%. As such, once the Balfour Test has been passed, it is important to understand which assets officially form part of your business. With limited companies this is reasonably straightforward as there will be legal paperwork stating the company is the beneficial/legal owner of the property.

Partnership property is more complex and is an area where HMRC frequently makes challenges. Should HMRC successfully argue that property is not partnership property then the relief reduces from 100% to 50% which could lead to significant tax liabilities.

In the case of a partnership between a husband, wife and son or daughter, where the husband owns farmland and buildings used within the partnership, it is frequently assumed that the farm is partnership property. It is however, not that simple, and even if the property has been included on the partnership balance sheet, HMRC have won cases where they have argued that it is not partnership property but rather used by the partnership. As such BPR has been limited to 50%.

Where the open market value (OMV) is the same as the agricultural value, this should not be issue as Agricultural Property Relief (APR) should be available. However, where the OMV exceeds the agricultural value, BPR is required to provide relief for the excess.

Example

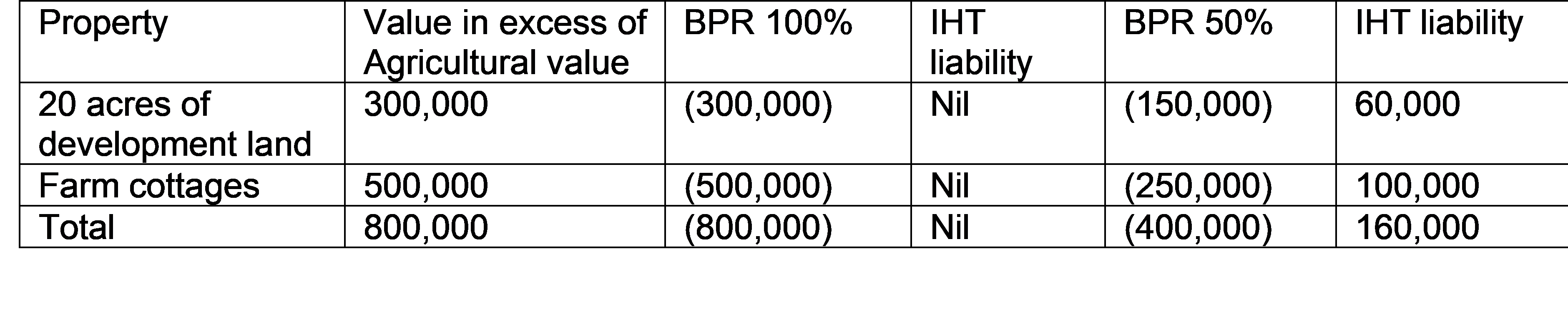

A farm includes 150 acres of land and buildings with no development potential, 20 acres with development potential at a value of £500k (£300k above agricultural value), and two farm worker’s cottages which are rented out and have a value of approximately £250k each.

If the assets are partnership property then BPR would cover the total value and no IHT would be chargeable, assuming the Balfour conditions are met. Should HMRC argue , however, that the property is not partnership property but simply used within the business, then BPR is limited to 50%. This would result in chargeable assets totalling £400k (£800k of property less 50% BPR) which, assuming there is no nil rate band available, leads to an IHT liability of £160k.

Please see the table below:

It is therefore key to ensure that the correct planning is undertaken in advance to minimise large, unexpected IHT liabilities. It would be frustrating if the intention was for assets to be held as partnership property but the paperwork was incorrect and a large IHT liability arose.

If you think that this could affect you, or you would like an IHT review, please do contact us.