November 04, 2020

Article

State Pension forms an important part of most client’s retirement income planning and is based on your National Insurance Record, however, many of us are unaware what level of income we will receive from state pension, and when we are able to claim it. Obtaining this information sooner, rather than later, will allow you to plan for any missing years that you may have within your records.

This short guide is a basic summary of how to generate your specific State Pension forecast:

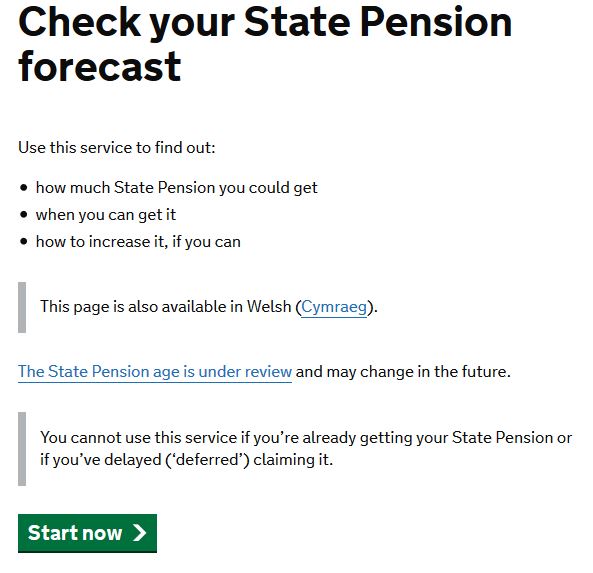

Step 1 – Navigate to the Gov.uk website for state pension details: https://www.gov.uk/check-state-pension

It is important to make sure you are on the official government website as there can be many other websites that claim to be able to forecast this for you. The best way to ensure you are in the correct place is to follow the exact wording on the link above.

Step 2 – Click on the ‘Start now’ button

Step 3 – Sign in using a Government Gateway ID or GOV.UK Verification ID. If you do not have either of these IDs, you will need to register a new account.

Please note that you will require information from following documents to register:

- National Insurance Number

- UK Address

- Recent payslip or P60

Step 4 – Once registered, continue to through the relevant pages and input the personal details requested.

Step 5 – Once all the personal details have been completed, you will be provided details of your current and forecasted state pension.

Step 6 – Generate a summary of your State Pension that you can either print or save.

Please get in touch with our financial planning team should you require further advice and guidance.

*Albert Goodman Chartered Financial Planners is the trading style of Albert Goodman Financial Planning Ltd, which is authorised and regulated by the Financial Conduct Authority. The Financial Conduct Authority does not regulate inheritance tax planning.