April 10, 2024

Article

Does your entity own interest in residential property?

If so, ATED may apply to your business.

The Annual Tax on Enveloped Dwellings (“ATED”) is a tax charged annually on the ownership, by a non-natural person (NNP), of a ‘chargeable interest’ in residential property in the UK. An NNP can be a company, a partnership with a corporate partner, or a collective investment scheme.

Valuation of Properties

Last year was of particular importance for ATED, as all residential properties were revalued for the purposes of assessing whether a return needed to be made. If an NNP holds an interest in a residential property, where the property is valued at more than £500,000 at 1 April 2022 or, if a property is acquired after this date and costs more than £500,000, then a return is needed whether or not any tax is due. If you think that this applies to you, then please contact us.

Property Interest

The NNP has to hold all or part of the beneficial interest in the property, which may be a freehold or leasehold interest. The charge payable by the NNP is based on the entire residential property’s value, not just the percentage interest held by the NNP.

For example, an NNP owning 50% of a freehold property valued at £1.5m is liable to ATED based on a 100% interest, so would fall into the £1m - £2m band and not the £500,000 - £1m band.

Chargeable Periods and Valuations

Chargeable periods for ATED run from 1 April to 31 March, so the next return due will be for the year ended 31 March 2025. However, the main return is made in advance, so has to be filed by 30 April 2024, only 30 days after the start of the chargeable period. Any ATED charges must be paid at the same time as the returns are filed.

If you acquire a property during the chargeable period, you have 30 days to file the return following completion. For new builds or conversions, you have 90 days from when the property is registered for Council Tax or from the date of first occupation (for new builds) or completion (for conversions).

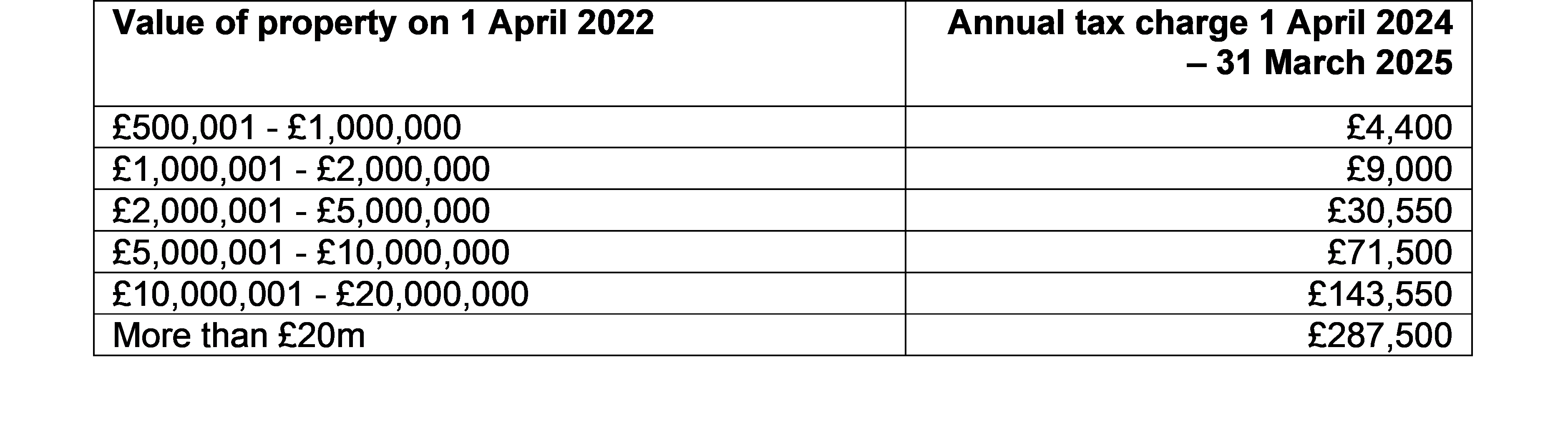

The charge will depend on where the valuation/cost sits within prescribed bandings, as set out below.

Available Reliefs

There are many reliefs available which may reduce the charge to nil, however the relief rules are complex. The most common reliefs include the following:

- The property is used in a commercially run property letting business or is held as part of the trading stock by a property development, or property trading business.

- Qualifying properties open to the general public in certain circumstances.

- Properties occupied by certain employees/partners.

- Farmhouses/cottages occupied by qualifying farm workers.

- Providers of social housing.

If an NNP wants to claim one of the reliefs, it has to file a return to do so.

Be aware that most reliefs are not available when there is, or has been, a “non-qualifying individual” (“NQI”) in occupation, which is broadly anyone connected with the NNP. If this occurs, there will most likely be an ATED charge, which can get very expensive, very quickly and in many cases will mean that a prior relief will have to be withdrawn or prevented for a period going forwards.

Penalties

We have seen a lot of cases recently where HMRC have been very strict on penalties and interest, resulting in these quickly mounting up.

Failure to file correctly or on time, or to pay on time, will lead to penalties and interest charges, even where there is no tax due. For example, if a return should have been filed by 30 April 2024 and is not filed until 1 May 2025, a penalty of up to £1,600 could be charged, even if there was no tax to pay.

Action Required

The rules are complex and, if incorrectly applied, can easily result in interest and penalty charges being levied.

If you are concerned that your company (NNP) may be subject to the ATED regime and would like more information, then please contact us.