October 20, 2025

Article

It feels as though the year has sped away from us once again. With the third quarter drawn to a close, the recurrent themes of this year have reappeared, including global political unrest and lacklustre economic growth closer to home. Portfolio returns have been positive however, so let’s take a brief look at some of the background:

Tightening the Metaphorical Quantitative Belt - UK Debt, Markets and Growth

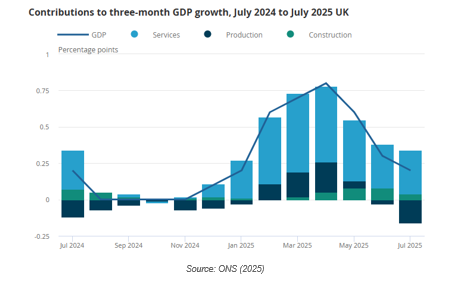

It’s been a quarter of conflicting signals in the UK, with the FTSE 100 reaching an all-time high, while wider reports suggested a struggling UK economy. Three-month GDP growth has remained positive; however, it has slowed for the third consecutive period, pointing to a far from promising economic outlook.

So, why the disparity between the markets and actual UK economic growth? We should remember that market indices are not always reflective of the country in which they are based. Companies are increasingly international, with global revenue streams, and there can be a disconnect between equity movements and the wider economy.

When equity markets are powering ahead and reaching new highs, bond markets can take a bit of a back seat. However, they are important for understanding the wider economic landscape, and UK investors should be keeping a keen eye on the government debt market.

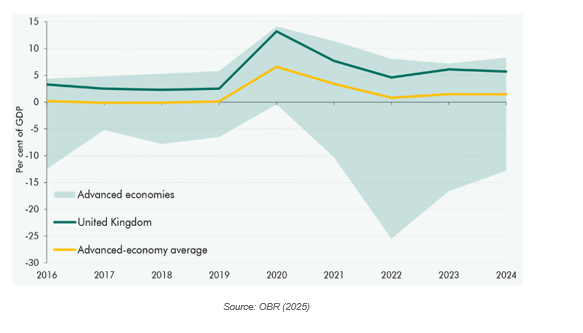

Increased debt costs have been seen across the developed world, not just the UK, with yields on equivalent 30-year German, Dutch, and French bonds all rising over the same period[1]. The US has also experienced climbing debt costs through September. The Bank of England recently announced it was reducing the rate at which it is selling these bonds, which has helped steady markets and slightly ease yields.

While the UK may not have the highest debt-to-GDP ratio, it is certainly above average. Although this can partly be attributed to factors such as Covid-related government spending and the lack of growth since the pandemic, it underlines the increasing pressure on public finances. All of these dynamics are crucial in the lead-up to the Budget on 26 November.

[1] BBC, 2025.

To tax or not to tax, that is the question

The Budget is set for 26 November and as expected, there has been plenty of speculation around whether Reeves will be able to keep her promise not to increase taxes on working people. Currently, the Chancellor faces a myriad of issues, including mounting pressure to balance public finances while improving economic growth within the UK’s stagnating economy, alongside the challenge of servicing expensive public debt. Given this complicated backdrop, the important thing is to stay level-headed and be not to make decisions you could come to regret.

Equities - Broadened Resilience Across Borders

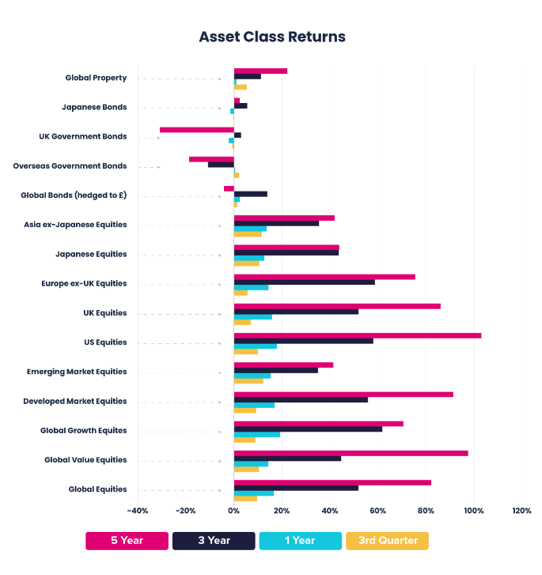

In comparison with the first half of the year, global equities experienced an upward trend during Q3, with major benchmarks reaching or nearing record levels by late September.

More sectors and regions contributed, including greater participation outside the US. Beyond mega-cap technology: healthcare, financials, and industrials, which are tied to capital spending, contributed more steadily, as companies showing solid cash generation were rewarded.

European equity markets delivered modest gains during Q3 2025, along with reliable dividends and buybacks[1] and in the UK, the FTSE 100 closed Q3 at a record high[2].

Overall, emerging markets pushed towards the top of their recent range, though performance remained varied by country.

Japan’s equity market advanced and hovered near record levels into late September, with the Nikkei 225 within about 0.3%[3]of its all-time high and up roughly 11% for the quarter.

[1] Reuters, 2025.

[2] Reuters, 2025.

[3] Investing, 2025

Fixed Income - Divergent Policies

The fixed income market experienced notable shifts in the third quarter as major central banks began implementing different rate policies. Overall, there was elevated volatility and a steepening yield curve, marking the return of higher yields for long-duration bonds. Global bonds held up, with core bond benchmarks rising by roughly 1.1% over the period.

In the UK, the Bank of England (BoE) cut its rate to 4% in August and then held in September, maintaining a cautious stance. Even so, the gilt curve remained prone to steepening, primarily due to the UK government’s sizable funding needs. The 10-year gilt settled around 4.7%, while the 30-year eased to about 5.5%[1] after an earlier peak near 5.7%[2], its highest level since 1998. The BoE provided some technical relief by slowing its quantitative tightening.

[1] Trading Economics, 2025.

[2] Barclays, 2025.

[2] Source: Financial Express Analytics, total returns net of fund charges, but no others.

AG Portfolio Performance

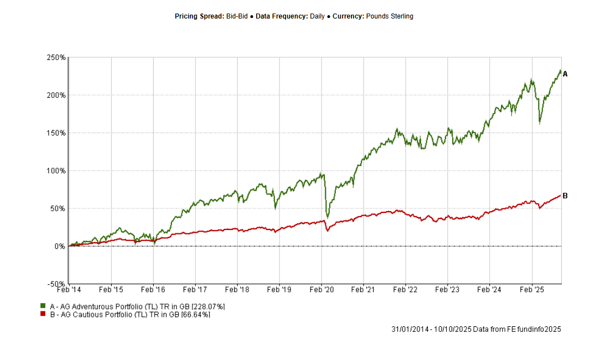

In the third quarter of 2025, all AG Portfolios made a positive return; the AG Adventurous portfolio benefited from the strong equity market conditions and returned 9.04%. Over the same period, the Cautious portfolio, focusing on fixed income investments, returned 4.43%, in line with the stability in the bond market.[1]

Conclusion

This quarter marked positive territory for global equities, with Emerging Markets and Japan leading, and the US, UK, and Europe also in positive territory. The rally extended beyond US mega-cap technology stocks as small caps and cyclical sectors re-engaged. Strong inflows into European and Emerging Markets highlighted a shift towards a more diversified landscape. The quarter’s positive performance was shaped by central bank actions and specific drivers, such as demand for AI, concluding with major benchmarks at elevated levels.

Fixed Income was defined by divergent central bank policies, with the Bank of England and Fed rate cuts causing the U.S. yield curve to steepen. Despite the volatility, core bonds edged higher and credit markets remained well supported, although longer-dated bonds were pressured by heavy sovereign issuance.

Returns have been positive, but doubts remain, and volatility will always persist. We urge investors to remain in markets rather than trying to time any entry or exit.

The team at Albert Goodman Chartered Financial Planners would be delighted to assist with any queries you may have.

'The value of your investments can go down as well as up, so you could get back less than you invested. Past performance is not a reliable indicator of future performance.'

References

- https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/july2025#:~:text=Monthly%20GDP%20is%20estimated%20to,by%200.9%25%20in%20July%202025

- https://www.bbc.co.uk/news/articles/clyry4rg9wyo

- https://www.reuters.com/world/china/global-markets-flows-graphic-2025-09-12/

- https://www.reuters.com/markets/europe/technology-stocks-lead-gains-europe-after-fed-rate-cut-sig-slumps-2025-09-18/

- https://www.investing.com/news/economy-news/morning-bid-stocks-take-a-breather-4254542

- UK 10 year Gilt Bond, chart, prices - FT.com

- A hot summer for UK government bond yields | Barclays Private Bank