April 30, 2019

Article

PRIVATE MILEAGE IN BUSINESS CARS

Fuel Scale Charges are used to account for VAT on the private use of cars.

The rates for VAT returns beginning on or after 1 May 2019 and the figures for the VAT due and net values for monthly, quarterly returns and annual returns are shown below.

BUSINESS MILEAGE IN PRIVATE CARS

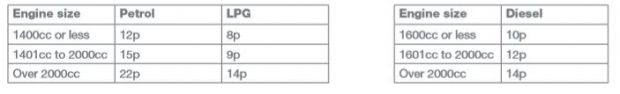

Where employees are reimbursed for business mileage in their private cars input VAT can be reclaimed on the fuel element included in the mileage rate.

The rates reflect fluctuations in fuel prices and are now to be reviewed quarterly on 1 March, 1 June, 1 September and 1 December.

Care is needed here as there are different engine size bandings for diesel engines.

The current rates, applicable from 1 June 2019 are:

Hybrid cars are treated as either petrol or diesel cars for this purpose.

A claim is based on business miles x the appropriate rate x the VAT fraction currently in force.

e.g. for a business journey undertaken on 2 June 2019:

100 business miles in a 2.3 petrol engine car would give a calculation of:

100 x 22p x 1/6 = a VAT claim of £3.66 (Based on the 20% standard rate of VAT)

Please note that receipts (less detailed or full tax invoices) must be retained to support the VAT claimed.

CONTRACT HIRE AGREEMENTS

VAT claims on lease hire charges are subject to a 50% restriction when the car is used for both business and private purposes. The VAT incurred on optional maintenance contracts is fully recoverable when these are separately described in the hire agreement and are genuinely optional.

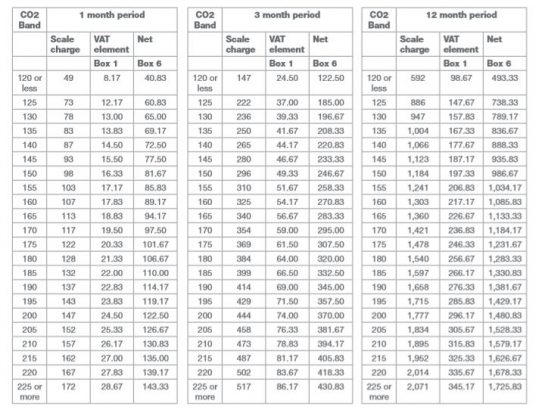

VAT FUEL SCALE CHARGES

For VAT accounting periods beginning on or after 1 May 2019

The scale charge for a particular vehicle is determined by its CO2 emissions figure.

Where the CO2 emissions figure of a vehicle is not a multiple of five, the figure is rounded down to the next multiple of five to determine the level of charge.

For a bi-fuel vehicle which has two CO2 emissions figures, the lower of the two figures should be used.

For cars which are too old to have a CO2 emissions figure, you should identify the CO2 band based on engine size as follows:

- If its cylinder capacity is 1400cc or less, use CO2 band 140;

- If its cylinder capacity exceeds 1400cc but does not exceed 2,000cc, use CO2 band 175;

- If its cylinder capacity exceeds 2,000cc, use CO2 band 225 or above.

The advisory electricity rate for fully electric cars is 4 pence per mile. Electricity is not a fuel for car fuel benefit purposes.

FURTHER ASSISTANCE

If you need assistance with any of the above, or any other VAT issue please contact Andy Branson or your usual Albert Goodman contact.