June 05, 2020

Article

Flexible Furlough Scheme

The Job Retention Scheme (JRS) ends on 30 June 2020 and will be replaced by the Flexible Furlough Scheme (FFS). The Flexible Furlough Scheme will enable previously furloughed staff to work on a reduced hour basis from 1 July, helping businesses to slowly return staff to the workplace. Employers will also start to contribute towards the furlough payments from 1 August for the time not worked, despite employees continuing to receive a guaranteed amount of 80% of their normal pay, capped at £2,500, until the scheme finally ends on 31 October 2020.

Whilst we are still dealing with queries on the operation of the JRS, we were all slowly coming to terms with its complexities, the ever changing guidance and the differences between it and the two Directions, holiday and notice pay issues, working out whether someone should be a fixed or variable rate worker, whether their overtime and commissions were discretionary or non-discretionary, what to do with car allowances, how to apportion pay when going on furlough or returning, how to deal with claim errors, concerns over employment law issues, whether businesses were correct to claim, worries about getting claims wrong and how HMRC would then deal with this ……the list goes on!

However, in short, we were coping: and then the Chancellor announced the introduction of the FFS!

There is little information on the Flexible Furlough Scheme and, although we did expect the detail to be released by the end of May, this will not be issued until 12 June – no doubt in the evening (it is a Friday, after all), following the pattern for all major JRS updates thus far. There is no doubt that the Government are to be congratulated, despite there being winners and losers, on getting the JRS off the ground from nothing, in so little time, and that it’s helped millions of businesses and employees (£15.6 billion claimed by 1 million employers for 8.4 million workers at 24 May), but the Flexible Furlough Scheme looks set to make the operation of the JRS look like a walk in the park and the additional complexities and added cost burden for employers will inevitably force businesses into considering redundancies far sooner than they thought they might have to.

Flexible Furlough Scheme – the key points

Whilst the detail on the Flexible Furlough Scheme will be released on 12 June, the key points announced so far are:

- From 1 July, previously furloughed employees will be able to work reduced hours, depending on the business needs, and be furloughed for their remaining ‘usual hours’.

- They will be paid their normal contracted rate, which has to be at least the new NMW rate introduced from 1 April, for any hours worked, as well as prorated furlough pay for any of their ‘usual hours’ not worked, based on the current rate of 80% of their reference pay, capped at £2,500.

- The government will reimburse the furlough payments, employer’s NIC and pension contributions on the furlough payments, as it does under the JRS, until the end of July.

- From 1 August, employers will have to cover all NIC and pension amounts, which are estimated to be about 5% of the furlough cost, in addition to having to pay for any hours worked by the employees.

- From 1 September, in addition to the NIC/pension costs on the furlough pay and costs for all hours worked, employers will also effectively pay 10% of the furloughed wages as the contribution from the Government will reduce to 70% of the reference pay, pro rated for hours not worked, capped at £2,187.50 per month.

- From 1 October, the employer’s contribution to the furlough pay will effectively be 20%, as the Government’s contribution will reduce to 60%, pro rated for hours not worked, capped at £1,875 per month.

- The Flexible Furlough Scheme will end on 31 October.

In terms of making a claim under the Flexible Furlough Scheme:

- Claims can be submitted from 1 July and HMRC will need to update its online calculator to be able to deal with the revised claim calculations. Further details are due on 12 June.

- Employers will have to submit details of hours worked and usual hours that would be worked, as part of the claim process, presumably to enable HMRC to start checking that claims are not being overstated.

- Claims have to cover a minimum of one week and no claim can overlap the end of any month, in order to help with the checking process.

- Claims for any pay period will be capped by the maximum number of employees claimed in any one claim period under the JRS.

- No new employees, not previously furloughed under the JRS, can be included under the Flexible Furlough Scheme.

- No employers may make a claim under the Flexible Furlough Scheme if they have not already made a claim under the JRS.

Urgent actions needed under the JRS

The last two points mean urgent action is needed by employers under the JRS.

The JRS will close to new claimants on 30 June. Many employers have been paying furloughed staff but have not yet submitted any claims. If this is you, you need to make certain you file at least one claim under the JRS by 30 June, otherwise you will miss out on the JRS and the FFS, as it’s a condition of the FFS that you have previously made a claim under the JRS.

If you have already made claims under the JRS, you will have until 31 July to complete all your claims to 30 June. If you have any pay periods that straddle the end of June, you will need to split the period between the JRS and Flexible Furlough Scheme and make two claims for that period. It is not clear if the ability to amend prior JRS claims will be available by 31 July (the portal still lacks this functionality) or whether it would be better to make any adjustments in subsequent claims prior to 30 June, despite this being contrary to HMRC’s guidance, in case the opportunity to claim any additional JRS amounts is lost post 31 July.

The FFS can only be used for employees who have been furloughed under the JRS and have at least three weeks of JRS furlough under their belts by 30 June. Therefore, if you are planning to reduce anyone’s hours from July, who has not already been furloughed, the last date you will be able to furlough them from is 10 June, with their furlough period lasting until at least 30 June.

Finally, it appears as though for claims submitted, 40% of employers have not been claiming for their employer’s NIC or pension contributions, and so claims for these should be made by 31 July under the JRS, otherwise it looks as though this entitlement may be lost.

Flexible working

Employers will be able to agree a reduced working pattern with employees who have previously been furloughed under the JRS from 1 July. This will need to be agreed and confirmed in writing. Any hours worked will have to be paid at normal rates and so if you want to pay lower than this, perhaps because your business is still struggling, you will need to seek employment law advice and agree the reduced pay with your staff.

The Flexible Furlough Scheme provides that any hours out of ‘usual hours’ that are not worked will continue to be paid for under the furlough scheme. We are waiting for guidance on what ‘usual hours’ are, but this might tie in with however you are calculating the reference pay. For example, if this is fixed on the pay in February, the usual hours may be the hours worked in February. If the worker was instead treated as a variable hour worker, you may need to work out the hours worked in the previous year’s comparative period and compare this with the average hours worked per week since 6 April 2019, as you do for reference pay purposes, and then compare the higher with the hours actually worked in the current period. This would then pro rate the entitlement to furlough pay.

This is of course speculation only, but does hint at how complicated this could become.

Returning to work and previously furloughed

It is our understanding that any worker previously furloughed under the JRS will be able to have their hours reduced under the Flexible Furlough Scheme, should this be needed by the business. Therefore, even if you have returned some staff to the workplace, you may still be able to reduce their hours under the new scheme, if there is a business need to do so.

Whilst the published details refer to employers ‘bringing back’ employees, it does go on to refer to ‘previously furloughed employees’ as well, and so it is our understanding that it will be possible for employers to claim under the Flexible Furlough Scheme for anyone who has been furloughed for at least three weeks, at any time, under the JRS. We have seen this confirmed on the HMRC Twitter online helpdesk and, although this is not a source of law(!), we would hope that the advice being given is correct.

It should not therefore be necessary to have all staff that you wish to work reduced hours on furlough at 30 June, in order to be able to make a claim under the Flexible Furlough Scheme, but to just ensure that any have already met their minimum three week furlough requirement by 30 June, although of course this will remain subject to the finer detail on 12 June.

We also understand that employers should still be able to rotate employees, with some being in the work place and then changing with others who are on furlough. However, you may need to watch the staff capping numbers here. For example, if you have 10 employees and you have previously furloughed in two groups, rotating each team of five, you may only have had five employees on any one JRS claim. The cap will mean that you will then only be able to claim for five under any one claim of the Flexible Furlough Scheme. Again, details on how this might work will hopefully be released on 12 June, as you might well have included all 10 on one claim anyway, if they were paid monthly, for example and each were only off for the minimum three weeks.

There will not be any minimum working time requirements under the new scheme, so you could return someone for one hour and pay them for this, before returning them to furlough. However, we don’t know if there will be a minimum furlough period required, as there is now under the three week rule, although common sense says there should not be, given the converse to no minimum working period would be no minimum furlough period.

How may businesses and employees be impacted?

There is little doubt that the calculations will be more difficult and costly to work out. Risks remain for employers in getting the reference pay wrong, and what payments to include in the furlough calculations, and not over claiming and risk seeing this clawed back at a later date by HMRC, together with the risk of an employee bringing a claim against the employer for not having claimed for all the right elements and paying it to them.

Costs payable by employers will gradually increase, with employment and redundancy rights continuing to accrue. We may see a fall in productivity, which is not what’s intended as the Government moves to bring businesses back on line, as more employees that might not otherwise have been put on furlough are furloughed in June, in order to give employers the option of reducing their working hours from July and making a claim under the FFS, should trading become more difficult.

Some employers were topping up employees’ pay whilst on furlough, but many have already stopped this as trading conditions have become more difficult. It’s likely many more top ups will cease as employers have to contribute to the furloughed pay from 1 August.

Although the Government’s contribution towards staff costs will reduce, employers will need to make a commercial decision on whether or not staff should be brought back rather than relying on making FFS claims to subsidise the business, and if costs need to be cut further, employers are likely to have to bring forward any redundancies to July and August, rather than perhaps waiting until the end of October, which may mean hardship for many families.

Practical issues

It’s already been confirmed that all records should be retained until 30 June 2025 and it’s likely this will now be extended to 31 October 2025. HMRC’s calculator will need further revisions and these might not be ready in time for 1 July, making it more difficult for payroll teams already struggling with complex calculations. A monitoring system will be needed to accurately record hours worked, compared with ‘usual hours’.

Fresh furlough agreements will be needed for all those who will be required to reduce their hours from 1 July as current agreements will refer to the requirement ‘not to work’ during any furlough period, and employment advice may be needed, as well as advice on possible redundancies and the correct procedures to follow.

Any holiday whilst on furlough has to be paid at normal rates, taking into account the holiday pay calculation changes under the Working Time Regulations from April 2020 – these rates may not be the same as the pay rates for working, which will further complicate matters.

Scheme abuse and enquiries into claims

The details released on 29 May again encouraged parties to whistle blow on businesses who might be abusing the scheme, whether this is perhaps because claims are being made and not passed to employees, or where employees are being forced to work whilst on furlough. HMRC are already understood to be looking into more than 2,000 claims which are potentially abusive.

A consultation is also under way on how HMRC might enquire into claims at a later date and claw back amounts that they do not agree were due to the business, with the solution being to tax such claims at 100%, bringing the review process within the normal enquiry process. This will be useful as existing legislation for handling enquiries, time limits for enquiring, assessing and appealing should apply, as will how penalties will be charged. However, how will businesses know if they have dealt with the scheme correctly?

Guidance has been issued and constantly updated, yet many aspects of the JRS remain unclear and it’s likely that aspects of the Flexible Furlough Scheme will be unclear as well. The Direction states that no claims may be made if abusive or contrary to the exceptional purposes of the JRS, being to cover employment costs for furloughed staff arising from the health, social and economic emergency arising from Covid-19, but how will this be measured?

For example:

- If a business is still making profits, should they stop using the scheme and should any earlier claims be repaid?

- Should a business claim if it has a substantial cash reserve balance? What is substantial and what if the cash is earmarked for something else?

- Should business owners not take any funds out of the business for their own use whilst claiming?

- Would it be right to pay bonuses or pay rises while some are on furlough when that cash could have been used to pay the furloughed staff instead?

- What if the wrong elements have been included in the reference pay calculation? There is still a lack of clarity over what overtime should be included, for example.

The uncertainty over potential claim claw backs will impact audits and on business sales and we are already seeing additional warranties and indemnities being added to sale contracts.

As assessment windows and penalties under normal tax enquiries are based on tax payer behaviour, we recommend that you document all furlough procedures, decisions and research material so you have this to hand in the event of an HMRC enquiry some time down the line. Also keep notes on phone calls or emails with advisers where you have tried to clarify your understanding and the dates on which you are researching a particular point, in case further guidance was later issued. Finally, under the proposed measures, employers will have 30 days to notify HMRC from when they become aware of when an over claim has been made.

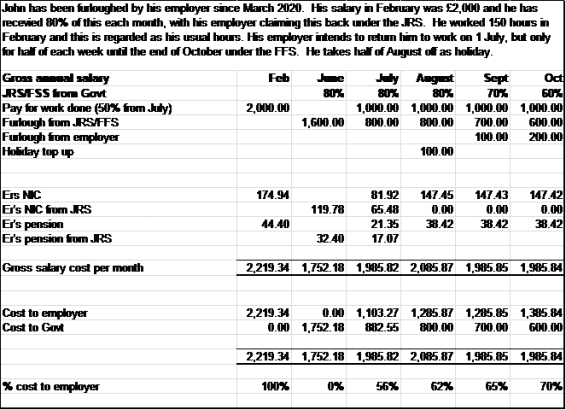

Illustration of how the Flexible Furlough Scheme may operate

We have had a go at looking at what the costs to employers might look like under the new FFS – this is of course subject to the finer detail on 12 June, but it does give an indication of how much more these calculations will become.

Conclusion

The JRS was complex and it looks like the FFS will be even more so, and so please do get in touch if you would like help with your grant applications. We will provide a further update when more details are announced.